HOME ABOUT AYA GOVERNANCE CORPORATE GOVERNANCE

Governance Framework

Board Committees

Role of Committees

Code of Ethical Conduct

Leadership Commitment

Effective Corporate Governance is critical to the proper functioning of the Bank and the Economy as a whole. To avoid mismanagement, Good Corporate Governance is vital to enable our business to operate more efficiently, to improve access to capital, mitigate risk and safeguard stakeholders.

Our Board Members and Executive Team lead the Bank to drive responsible growth and deliver maximum profit for our customers, stakeholders, and shareholders. As Chair of the Board, my primary goal is to protect and enhance AYA’s Vision and Mission. We have also clearly defined a Governance Framework that ensures transparency, fairness, and accountability, high ethical conduct in all aspects of our operations. Our dedicated Board members have exercised this responsibility with due diligence and hard work. The team will continue to exercise its fiduciary role at the highest level.

Zaw Zaw

Founder and Chairman

Board of Directors

Board is the highest authority within the structure of the Bank and the Board of directors has ultimate responsibility for the bank’s business strategy and financial soundness, organizational structure, governance framework and practices, risk management and compliance obligations. The Board is chaired by Founder and Chairman of the Bank and comprising nine members including three Independent Non-Executive Directors with diverse backgrounds and expertise. The Board ensures compliance with the regulatory and legal framework, and the existence of an effective and productive relationship with key stakeholders. For dedication and best governance, the Board has appointed numbers of committees for designated areas.

The Board of directors play a critical role in the Bank’s success. In order to make sure every director is on board with the Bank’s goal, and the entire Board is in sync with the Bank’s mission, various training programs including orientation programs are provided. The new director orientation program will bring them up to speed on the Bank, its competitive environment, strategies, and board processes.

Roles and Responsibilities of Board of Directors

In discharging their responsibilities, the Board of Directors must take into account the legitimate interests of depositors, shareholders, and other relevant stakeholders. The responsibilities of the Board of Directors shall include –

-

Keeping up with material changes in the bank’s business and external environment as well as act necessary changes in a timely manner to protect the long-term interests of the bank.

-

Overseeing the development and approval of the bank’s business objectives and strategies and monitoring their implementation.

-

Playing a leading role in establishing the bank’s corporate culture and values

-

Overseeing implementation of the bank’s governance framework and review periodically that it remains appropriate in the light of material changes to the bank’s size, complexity, geographical footprint, business strategy, markets, and regulatory requirements.

-

Establishing along with bank’s officers, the bank’s risk appetite, taking into account the competitive and regulatory landscape in the banking industry and the bank’s long-term interests, risk exposure and ability to manage risk effectively.

-

Approving the policy and overseeing the implementation of key policies and rules pertaining to the bank’s capital adequacy assessment process, capital and liquidity plans, compliance policies and obligations, and the internal control system.

-

Overseeing the integrity, independence and effectiveness of the bank’s policies and procedures for reporting fraud and other illegal activities

-

Overseeing the development of and approving the bank’s policy on transactions with related parties; and overseeing the compliance of the bank with the Financial Institutions Law, regulations and directives issued there under.

Role of Committees

01 Executive Committee

Executive Committee

The Executive Committee is led by an Executive Chairperson of the Bank and serves as steering committee for the rest of the Board. It has the power to facilitate decision-making between board meetings or in urgent and crisis circumstances. The Executive Committee reports to the Board and is responsible for ensuring that the Board’s policies and guidance are implemented in daily operations, and good corporate practices are maintained. In addition to this, the role of the executive committee includes monitoring the ethics policies, human resources, security guidelines, quality management, sound financial management and the Bank’s compliance with regulations.

02 Audit Committee

Audit Committee

The Board Audit Committee is chaired by an Independent Non-Executive Director and comprised of members from various areas such as risk and compliance, legal, finance and audit. The Board Audit Committee has been providing continuous advice to the Board with regards to the effectiveness and independence of the Bank’s internal audit function, the overall risk governance framework and internal control system. Audit Committee is responsible to ensure that senior management is taking necessary corrective actions in a timely manner to address control weaknesses, non-compliance with policies, laws and regulations, and other problems identified by auditors and other control functions.

03 Board Risk and Compliance Committee

Board Risk and Compliance Committee

The Board Risk and Compliance Committee (BRCC) is headed by Vice Chairperson of the AYA Bank. BRCC assists the Board to achieve effective corporate governance and oversight responsibilities in relation to risk and compliance management strategy, framework and risk and compliance management function of the Bank. BRCC oversees the policy of risk and compliance, determines Bank’s risk appetite, and risk tolerance, and ensures that risk assessments are performed regularly and monitor the whole risk and compliance process.

04 Nomination and Remuneration Committee

Nomination and Remuneration Committee

The Nomination and Remuneration Committee is chaired by an Independent Non-Executive Director and the main role of the committee is to set succession and compensation policies in the Bank, identify directors and Senior Management in accordance with the criteria laid down and recommend their appointment to the Board. The committee is responsible for the overall oversight of the compensation system for the entire bank. In addition, the committee shall regularly monitor and reviews outcomes to ensure that the bank-wide remuneration system is operating as intended.

05 Human Resources Committee

Human Resources Committee

The Human Resources committee is chaired by the Vice Chairperson of the Bank and responsible for assisting the Board in fulfilling its oversight responsibilities for human resources related policies and strategies. The committee is responsible for employees’ compensation, benefits, and performance management, and to ensure that the Bank is following government laws, international and local best practices. The committee’s objective is to retain qualified and productive employees, to ensure human resources risks are appropriately identified and mitigated, and to create an attractive environment for existing and prospective employees of AYA Bank.

06 Assets and Liabilities Committee

Assets and Liabilities Committee

The Assets and Liabilities Committee (ALCO), chaired by the Executive Chairperson, is responsible for overseeing the management of the bank’s assets and liabilities. ALCO provides an important oversight for effectively evaluating on-and off-balance-sheet risk for the bank. One of the objectives is to ensure adequate liquidity while managing the spread between the interest income and interest expense. Members also consider investments and operational risk. ALCO members’ responsibilities typically include managing market risk tolerances, establishing appropriate management information systems, and reviewing and approving the bank’s liquidity and funds management policies. This includes developing and maintaining a contingency funding plan, reviewing immediate funding needs and sources, and determining liquidity risk exposures to adverse scenarios with varying probability and severity.

07 Credit Committee

Credit Committee

The Credit Committee is chaired by the Chief Executive Officer of the Bank and is the decision-making body for approval of credit facilities in the Bank. The purpose of the committee is to oversee the credit and lending strategies, objectives of the bank, the credit risk management of the Bank, reviewing the credit policies and the quality of and performance of the entire Bank’s credit portfolio, and regular assessment of the quality of risk assets in the Bank.

08 Product and Business Development Committee

Product and Business Development Committee

The Product and Business Development Committee is led by the Chief Executive Officer of the Bank and is comprised of Head of Business Units and Product Development Department. The committee is responsible for overseeing and managing the process and procedures for product design and development in compliance with the Bank’s strategy and regulatory guidelines. That includes reviewing product performance and competitiveness in the current market for its continued relevance and justification.

09 Purchasing Committee

Purchasing Committee

The Purchasing Committee is managed by the Vice Chairperson of the Bank and is established for independent review and evaluation of purchasing documentation. The committee is obliged to decide the most appropriate supplier or service provider for the Bank and ultimately responsible for the successful outcome of the evaluation process. The committee members must be in no way related to or associated with any of the suppliers being evaluated.

10 IT Steering Committee

IT Steering Committee

The IT Steering Committee is led by the Chief Executive Officer of the Bank. The primary objective is to manage IT resources and implement IT Governance to align with the strategic direction of the Board. This includes building, acquiring, and implementing the required infrastructure, applications, and services for the Bank. The secondary objective is to support IT projects as defined by the committee. The committee is responsible for evaluating and assessing the performance and compliance of all the IT related processes, practices, and activities.

11 Corporate Social Responsibility Committee

Corporate Social Responsibility Committee

The Corporate Social Responsibility Committee is chaired by Independent Non-Executive Director and obliged to define the strategy of the Bank’s corporate social responsibilities to implement effectively and oversee the approach to be in line with the Bank’s CSR pillars. The committee determine from time to time and recommend various aspects of corporate social responsibilities including the Bank’s culture, employment issues, health & safety, human rights, workforce diversity & inclusion, the environment, community & social investment, compliance with ethical trading and business practices and other CSR-related matters.

12 Health and Safety Committee

Health and Safety Committee

The health and safety committee (HSC) is managed by the Chief Executive Officer of the Bank. The committee is formed to address concerns related to occupational health and safety issues that affect employees. This includes addressing hazards in the workplace, responding the health issues in pandemic efficiently, implementing new safety and procedures, reviewing safety training requirements. The purpose is to create communication with employees and management personnel to improve safety and reduce hazards. The committee holds meetings quarterly and discuss health and safety issues, develop plans and procedures to resolve the identified issues, recommend corrective actions and evaluate the reports submitted to the committee.

Code of Ethical Conduct

AYA Bank regards high ethical standards as non-negotiable. This Code of Ethical Conduct is adopted to give effect to our Core Values and to guide our relationships with all our stakeholders and other relevant role-players as well as to outline our commitments to them. All directors, senior management, officers and employees are obliged to comply with our Code of Business Conduct and Ethics. This conduct is required to maintain and enhance the public’s confidence in AYA Bank.

Business Principles

Preserve Confidentiality

AYA Bank assure that all aspects of our communication with individuals, stakeholders regarding their business-related data or personal identities will be held in the strictest confidence. Individuals shall protect the confidentiality of bank detail, business plan, conditions, and customer’s data, to any unauthorized individuals.

Anti- Bribery and Corruption

AYA Bank employees are strictly prohibited on promising, receiving, offering cash or anything of value to any customers, stakeholders, government employees or any individuals for the purpose of improperly influencing decisions or securing benefits for obtaining or retaining business.

Fair Business Dealing

All employees are expected to exercise fair business dealing when conducting all business transaction. Both parties shall work honestly and refrain from any use of deception or unfairness when negotiating the business.

Workplace Principles

Discrimination and Harassment

AYA Bank try its best to make employees feel safe and supported in the workplace, which includes while they are engaged in Bank’s business and at events of the Bank, or at other outside activities with a connection to employment or work, whether during or after normal business hours. Any kind of discrimination or harassment including unwanted verbal or physical harassment based on race, ethnicity, religion, sex, gender, identity, age, or disability will not be tolerated. We have a formal complaint system that acknowledges the victim’s rights to anonymity and security from retaliation.

Human rights

AYA Bank is committed to respecting human rights and demonstrates leadership in responsible workplace practices across our Bank’s Branches and in all regions where we conduct business. We aim to align our Bank’s policies and practices with international standards. Our commitment to fair, ethical, and responsible business practices, as we engage with our employees, clients, vendors, and community, is embodied in our values and Code of Conduct.

Conflict of Interest

Any employee of AYA Bank is obliged to disclose any known or potential conflicts of interest as soon as they arise. This practice is in place to prevent a possible conflict from existing between their own personal interests and the interests of the Bank. As all conflicts of interest will be reviewed on a case-by-case basis, a review may result in disciplinary action. Executive Management has full discretion to deem what disciplinary action is both fitting and necessary, including suspension and/or termination of employment.

Use of Bank’s property for private advantage

Employees are expected to be ensure that all property maintained by Bank is kept in the best possible working condition and is used appropriately for Bank’s business purpose only. Using of Bank’s property for private advantage includes using of supplies, equipment, vehicles, inventory, AYA Bank’s material, products, ideas, or concepts to an outside firm or individual for private advantage.

Monitoring and Enforcement

Having a code of ethical conduct is about creating a healthy working environment. Monitoring and enforcement mechanisms are in place to ensure that all staff adopt and implement the values and rules in our code.

Leadership Accountability

Leaders lead by example and demonstrate a commitment to ethical behavior. They are obliged to monitor the compliance of the people they supervise.

Training and Education

Conduct regular training programs for employees to ensure they understand the code of ethics and conduct.

Clear Policies and Procedures

Establish detailed policies and procedures that align with the code of ethics.

Continuous Improvement

Regular review and update on code of ethical conduct to align with evolving industry standards and societal expectations.

Auditing

Conduct regular internal audits and monitor the operations on regular basis in order to ensure adherence to the code, identify and correct any potential occurrences of noncompliance or barriers to compliance.

Reporting Mechanism

Develop effective lines of communication between the Compliance Team and the Bank’s employees, contractors, agents, directors and members to support the reporting of potential misconduct and unethical behavior or violations. These lines of communication are confidential and easily accessible including hotline, e-mail and online form.

Disciplinary Actions:

Implementing a consistent and fair disciplinary process for addressing violations of the code.

Disclosure Process

Employees are also obliged to disclose the activities of any other employee that falls in direct breach of the AYA Bank’s Code of Ethical Conduct. Employees are given full support and encouragement to disclose any activities or behavior they may view with uncertainty, or that they feel requires clarification. Disclosure may be achieved by speaking to their Head of Department or People Department. Failure to disclosure will be considered an intentional breach of the Code of Ethical Conduct.

Disciplinary Action

Employees found willfully behaving outside any of the above outlined guidelines will be considered to have been in breach of the Code of Ethical Conduct, and to have opposed AYA Bank’s policy of honesty, loyalty, and faithful service. The employee will be subject to disciplinary action up to and including dismissal and all activities undertaken by the employee may be made public knowledge within the AYA community. In order to be a fair process, an “Enquiry Board” comprising of Head of People Department, HOD of accused employee, reporting line Director will access and probe the situation and report its findings and recommendations to Human Resources Committee. Any breach of the Code of Ethical Conduct which is linked with violation of criminal conduct by an employee will also be charged with criminal law.

Governance Framework

Overview of the Governance Framework

Good governance is critical and a foundation attribute to the effective business operations of the Bank. It sets the tone as to how the bank operates and connects to both internally and to the market. It’s crucial to comply with statutory and policy obligations in the financial industry, we fully comprehend that the extensive corporate governance framework will ensure delivering our obligations competently. This will also allow us to utilize as a benchmark for discharging our commitments and maintaining our performance.

AYA Bank's corporate governance framework is directed by a well-defined structure, effective policies, and efficient procedures that ensure the optimal management and direction of the Bank's business operations. This framework provides assurance to our stakeholders that the Bank operates both effectively and efficiently. Its design not only focuses on enhancing efficiency, but also prioritizes increased transparency and accountability towards our shareholders and various stakeholders. This comprehensive concept extends to encompass all relationships, including those with our stakeholders, suppliers, employees, and customers.

The principles of the governance in the framework derived from the Constitution of AYA Bank Public Company Ltd, Myanmar Companies Law, the Directives of Central Bank of Myanmar as well as it is the development over time by the Board of the Directors of the Bank. The purpose is to shape up our efforts to provide a top-notch quality service to our customers. These principles are prescribed as:

- Underpin the Bank’s culture, mindset and ethos which ensures the employees’ behavior with integrity and a strong commitment to ethical values.

- Set the ethical tone for the Bank and the transparency of its conduct.

- Communication with and protecting the rights and interests of shareholders and all other stakeholders.

- Oversight of the Bank's performance and the contribution to corporate success from the Board of Directors in the context of the Bank’s strategic goals and objectives.

- Enhance the effective oversight of risk management, corporate compliance, and the integrated framework of internal controls.

- Define the priorities and outcomes that we aim to achieve sustainable socio-economic benefits and to determine interventions as necessary to maximize the achievement of it.

- Guide us in developing the capacity of the leadership team and its employees.

Read more at Board Charter

Who are on the Committees?

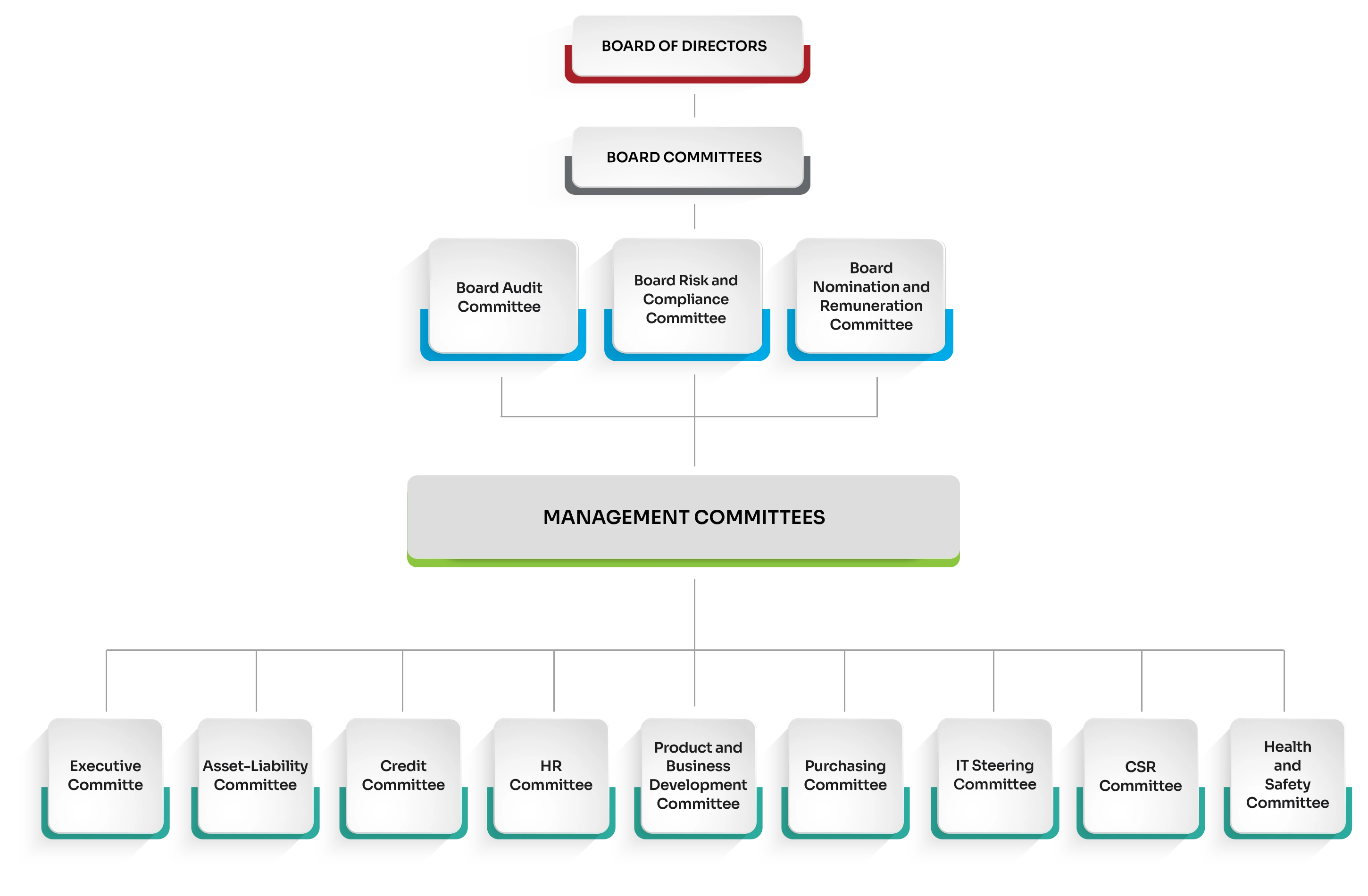

The Board operates through a number of committees covering certain specific matters, illustrated in the chart below:

| Senior Management | Board Committee | Executive Committee | Board Audit Committee | Board Risk and Compliance Committee | Board Nomination and Remuneration Committee | HR Committee | Asset-Liability Committee | Credit Committee | Product and Business Development Committee | Purchasing Committee | Information Technology Steering Committee | CSR Committee | Health and Safety Committee |

| U Zaw Zaw | |||||||||||||

| Daw Khin Saw Oo | |||||||||||||

| Daw Htay Htay Khaing | |||||||||||||

| U Than Zaw | |||||||||||||

| Daw Khin Ma Ma | |||||||||||||

| U Myint Zaw | |||||||||||||

| Daw Jasmine Thazin Aung | |||||||||||||

| Prof Dr Aung Tun Thet | |||||||||||||

| U Min Sein | |||||||||||||

| U Aung Naing Maung Maung | |||||||||||||

| Daw Lwin Lwin Aung | |||||||||||||

| U Ko Ko Oo | |||||||||||||

| U Minn Wint Oo | |||||||||||||

| U Nay Lin Htut | |||||||||||||

| U Tin Maung Htay | |||||||||||||

| U Myat Min Htin Kyaw | |||||||||||||

| U Soe Htaik Aung |

Committees Meeting & Attendance

All board members require compulsory attendance at meetings of the Board of Directors if there is no reasonable cause. Board members are required to attend at least 75% of all regularly scheduled meetings. The Secretariate Section under Corporate Affairs Department organizes the management calendar for the year and schedules the meeting of the Board of Directors at least 10 times a year with the interval between two meetings not to exceed two months. During the financial year 2024-2025, the board held 10 regular scheduled meetings and attended by 75% of the board.

Committee meetings conducted in financial year 2024-2025 were as follows:

| Meeting Title | No. of Meetings |

| Board Committee | 10 |

| Executive Committee | 7 |

| Board Audit Committee | 10 |

| Board Risk And Compliance Committee | 7 |

| Board Nomination and Remuneration Committee | 0 |

| Assets and Liabilities Committee | 12 |

| Credit Committee | 2 |

| HRC Committee | 5 |

| Product and Business Development Committee | 4 |

| Purchasing Committee | 4 |

| Information Technology Steering Committee | 5 |

| Corporate Social Responsibility Committee | 2 |

| Health & Safety Committee | 2 |

The attendance of management at meetings of board committees during the financial year 2024-2025 is shown in the table below.

| Senior Management | Board Committee Meeting | Executive Committee Meeting | Board Audit Committee Meeting | Board Risk and Compliance Committee Meeting | Board Nomination and Remuneration Committee Meeting | HR Committee Meeting | Asset-Liability Committee | Credit Committee Meeting | Product and Business Development Committee Meeting | Purchasing Committee Meeting | Information Technology Steering Committee Meeting | CSR Committee Meeting | Health and Safety Committee Meeting |

| Number of meetings held | 10 | 7 | 10 | 7 | 0 | 12 | 2 | 5 | 4 | 4 | 5 | 2 | 2 |

| U Zaw Zaw | 10 | - | |||||||||||

| Daw Khin Saw Oo | 10 | 7 | - | 2 | |||||||||

| Daw Htay Htay Khaing | 10 | ||||||||||||

| U Than Zaw | 10 | 7 | 10 | 7 | - | 11 | 2 | ||||||

| Daw Khin Ma Ma | 8 | 4 | 10 | 7 | - | 12 | - | 2 | 4 | 3 | 2 | ||

| U Myint Zaw | 10 | 7 | 7 | 2 | 5 | 2 | 2 | ||||||

| Daw Jasmine Thazin Aung | 3 | 7 | 7 | 7 | 11 | 2 | 5 | 4 | 5 | 2 | 2 | ||

| Prof Dr Aung Tun Thet | 7 | - | 9 | 2 | |||||||||

| U Min Sein | 9 | 8 | 7 | ||||||||||

| U Aung Naing Maung Maung | 8 | 10 | |||||||||||

| Daw Lwin Lwin Aung | 7 | 2 | 4 | 3 | |||||||||

| U Ko Ko Oo | 7 | 7 | 12 | 2 | 5 | 4 | 4 | 2 | |||||

| U Minn Wint Oo | 7 | 10 | 2 | 4 | 4 | 4 | 2 | 2 | |||||

| U Nay Lin Htut | 7 | 2 | 4 | 4 | 4 | ||||||||

| U Tin Maung Htay | 6 | 3 | |||||||||||

| U Myat Min Htin Kyaw | 6 | 3 | 4 | ||||||||||

| U Soe Htaik Aung | 6 | 4 | 5 |