HOME DIGITAL SERVICES GUIDELINES FREQUENTLY USED DIGITAL SERVICES IN DAILY LIFE

How To Start

Click on the steps to view screens

-

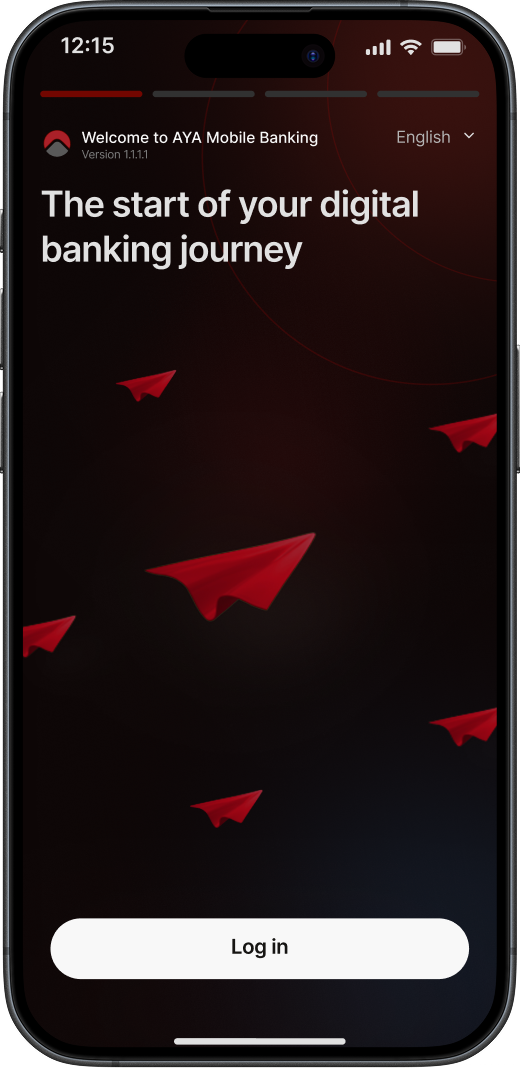

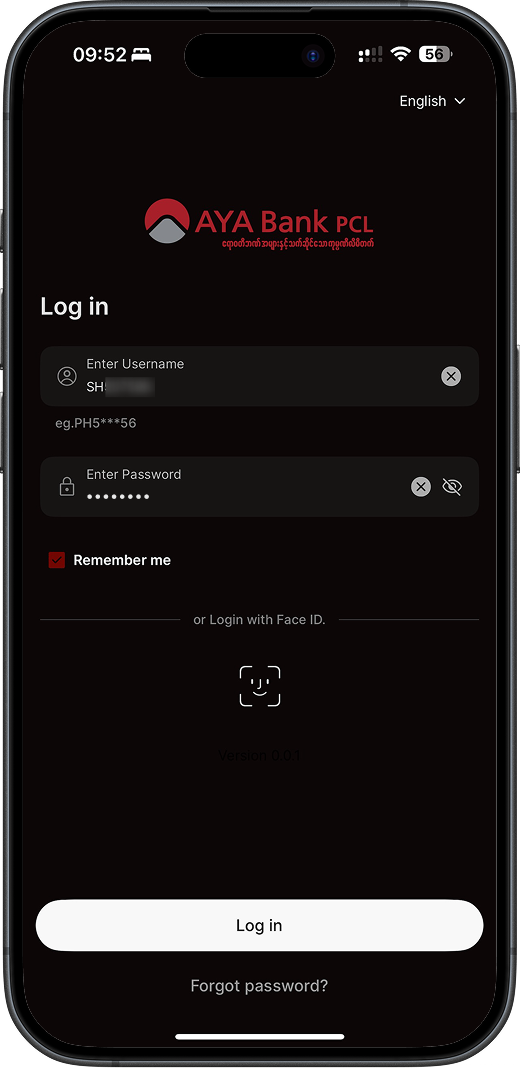

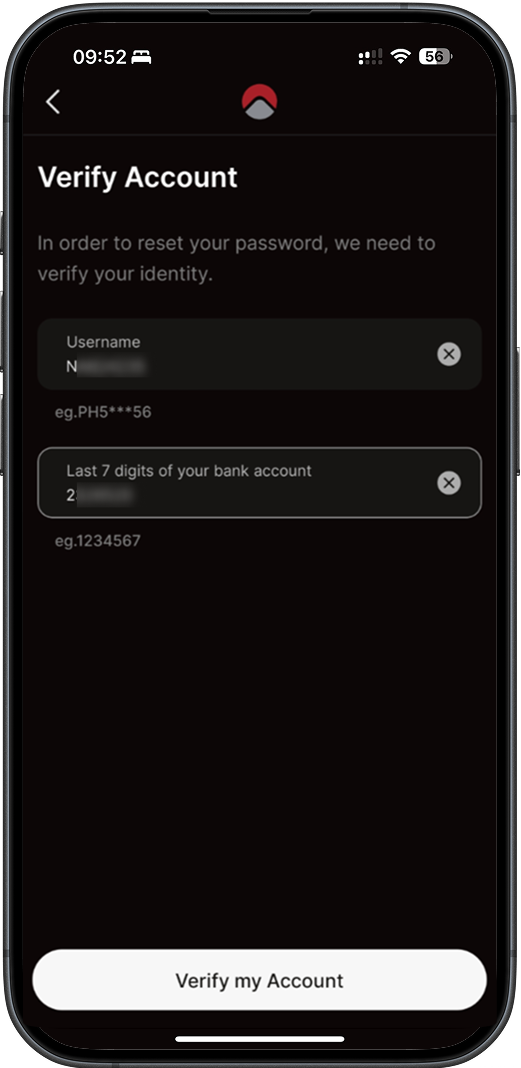

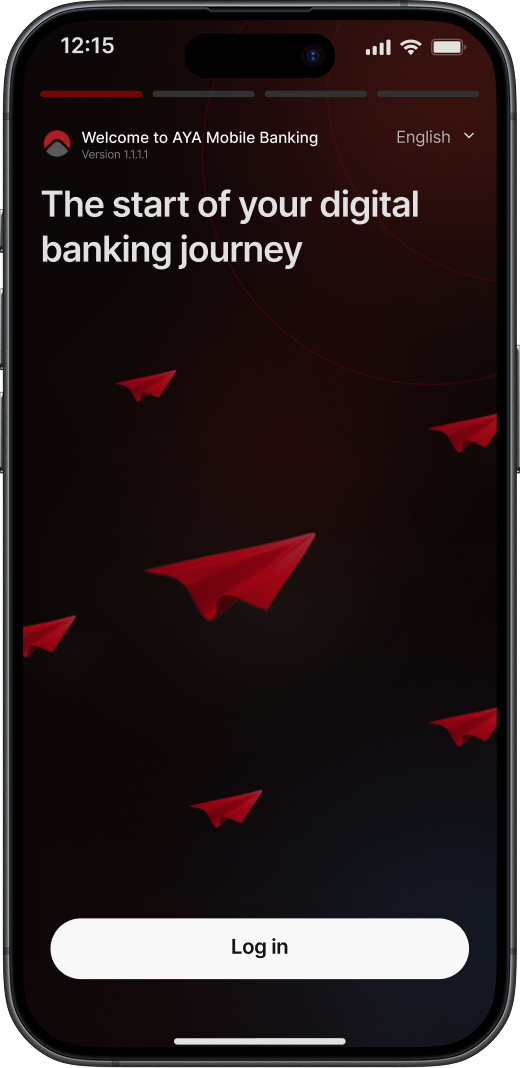

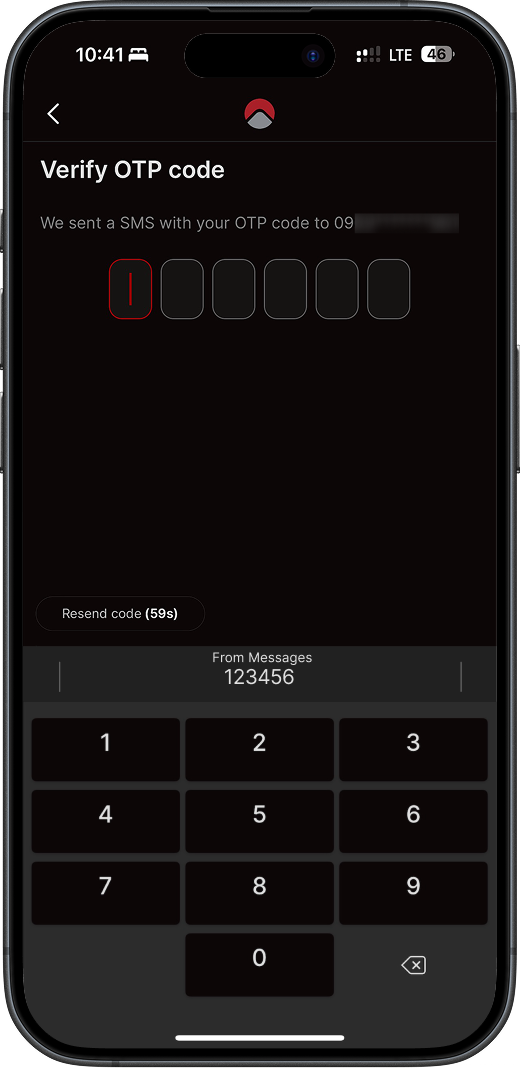

1A

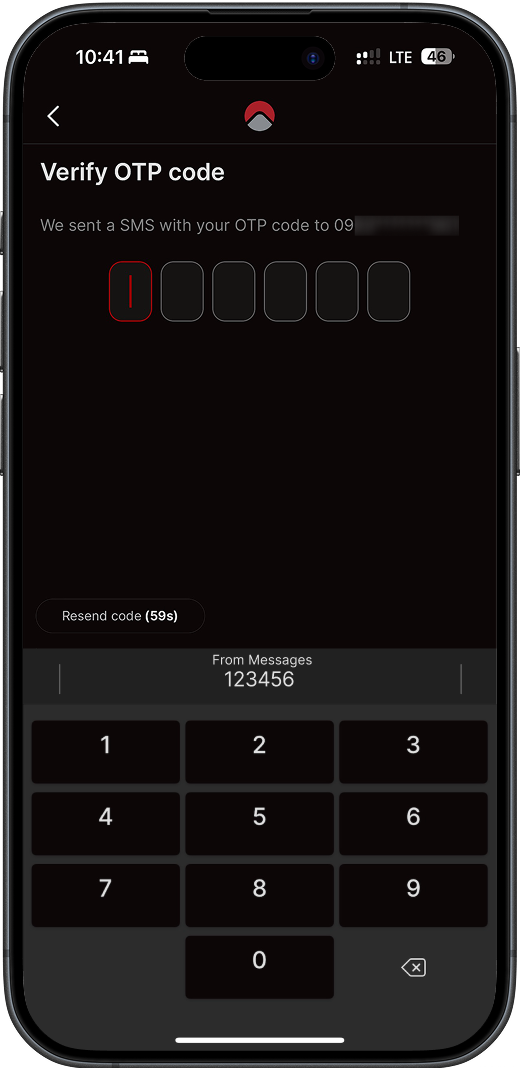

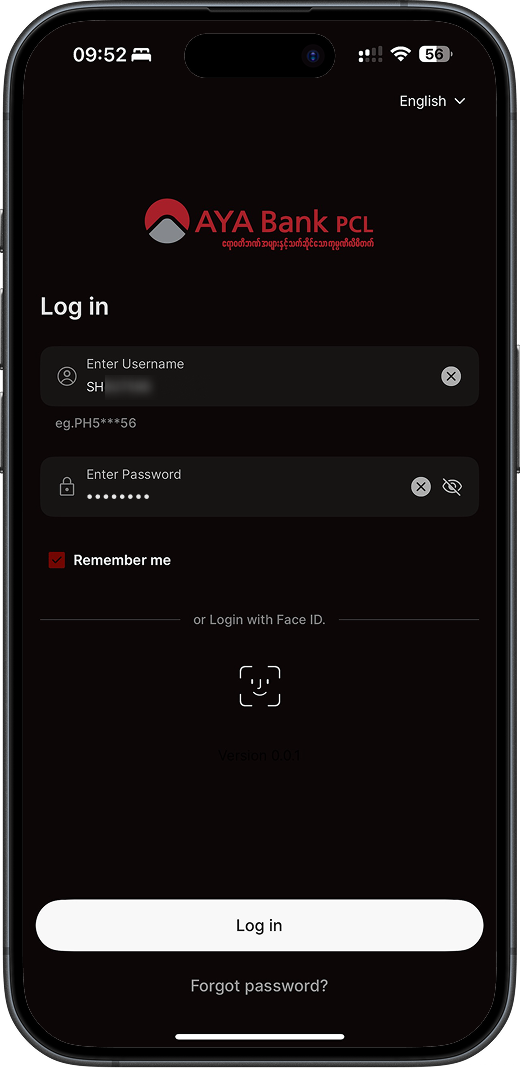

Open the AYA Mobile Banking app and click the Log In button. Then, check your SMS and enter the OTP code sent to the registered phone number.

1B -

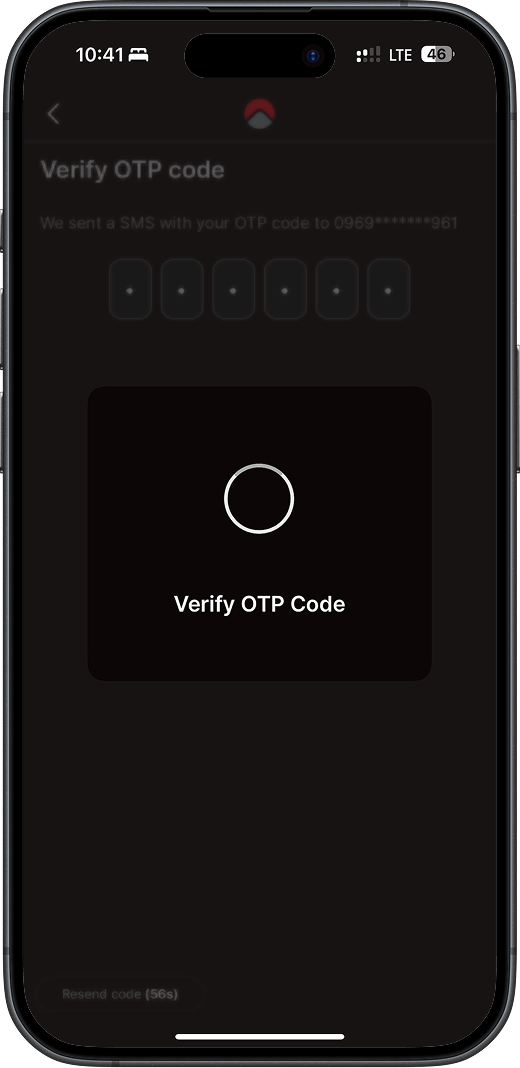

2A

Then, check your SMS and enter the OTP code sent to the registered phone number.

2B -

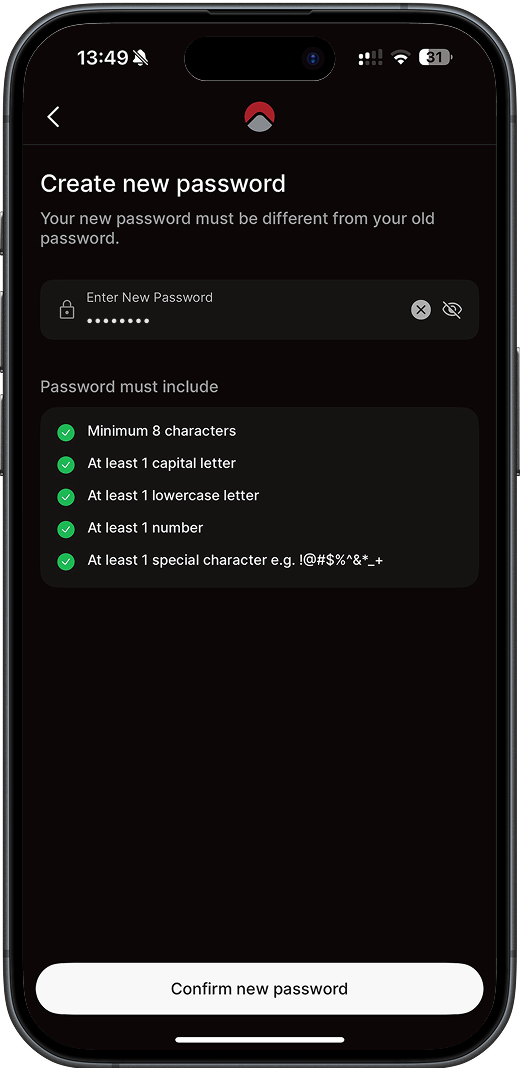

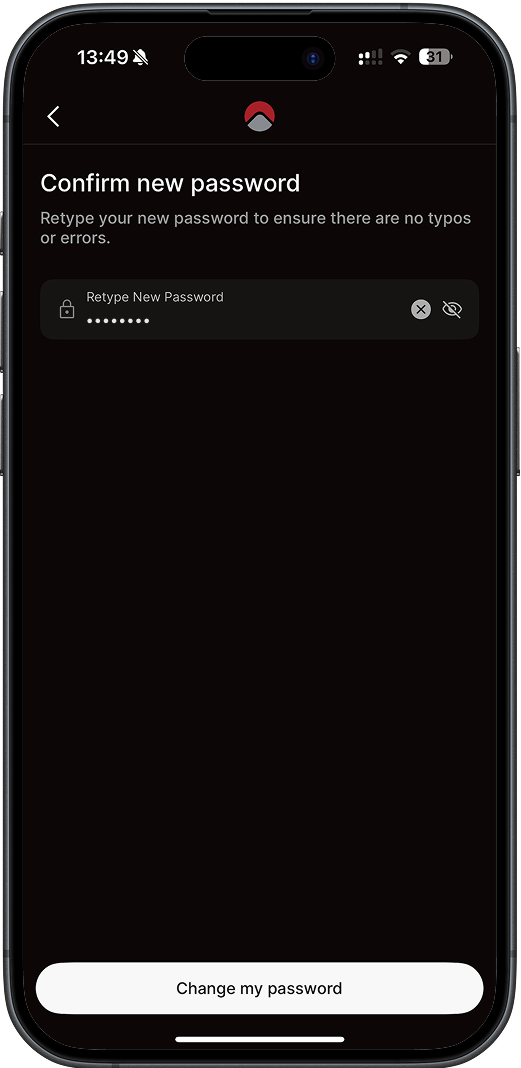

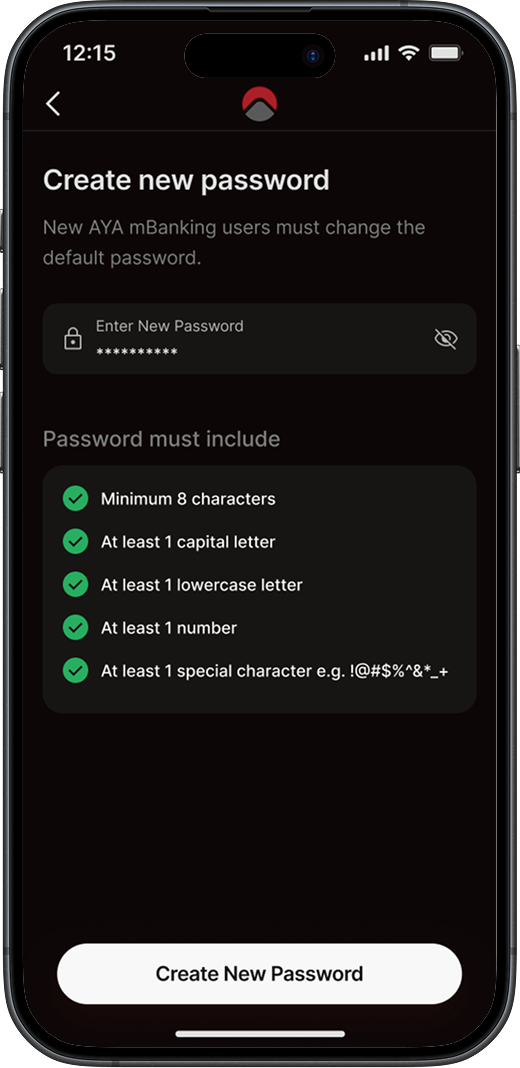

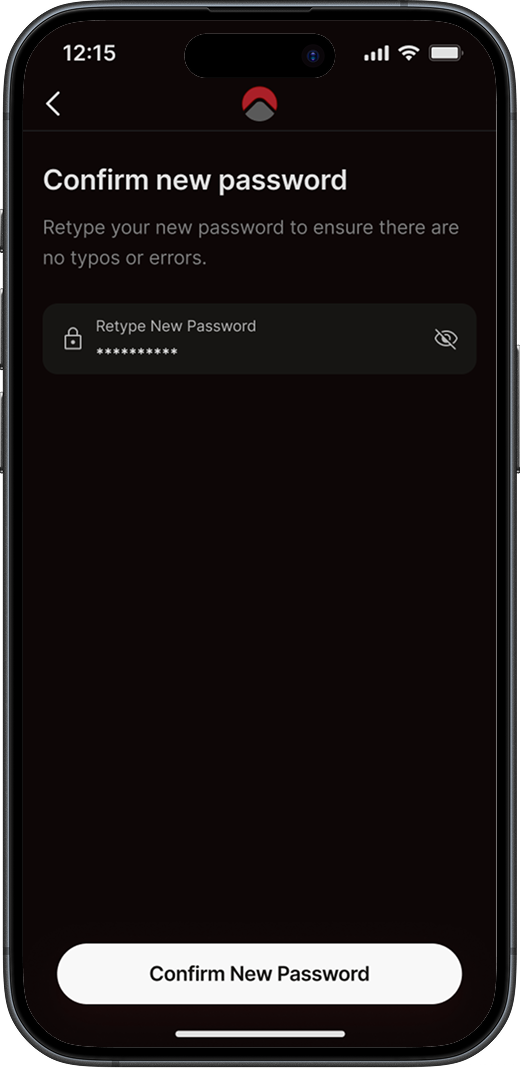

3A

Create a new password and retype it in the next screen. This will be your new AYA Mobile Banking password.

3B -

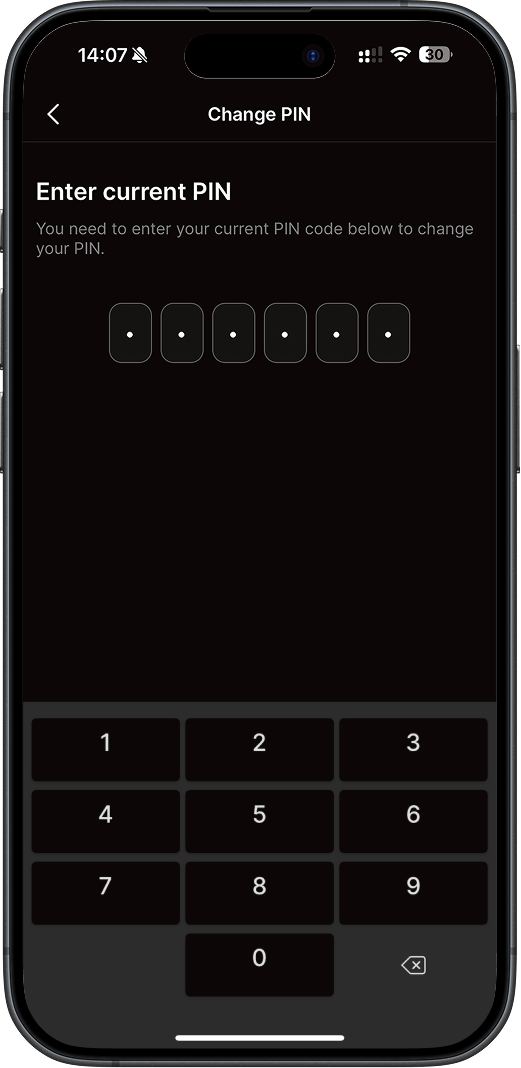

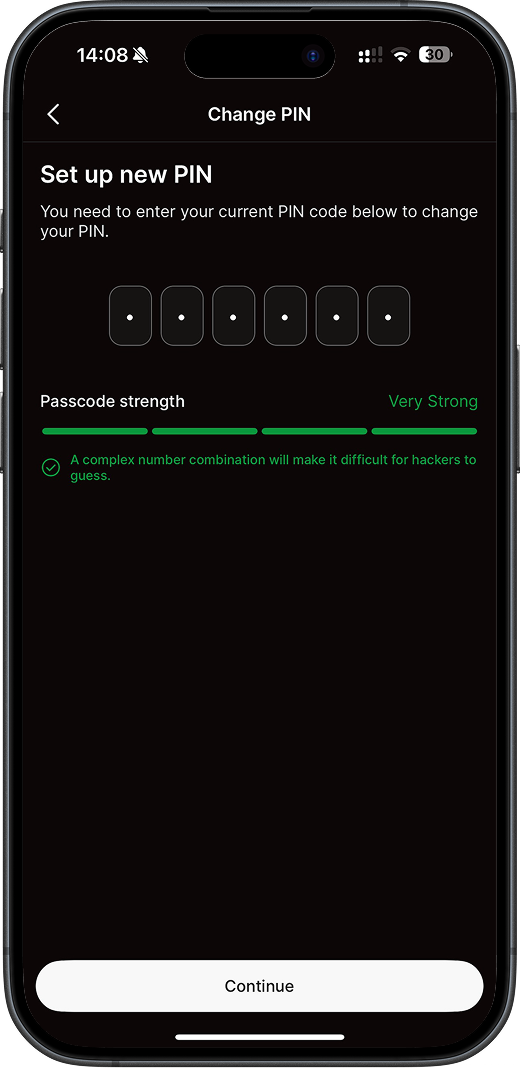

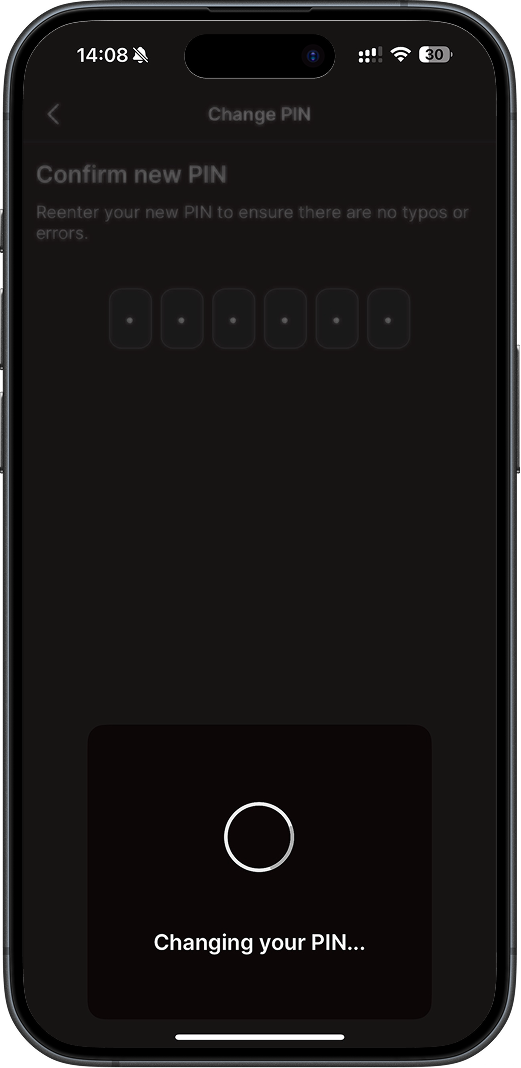

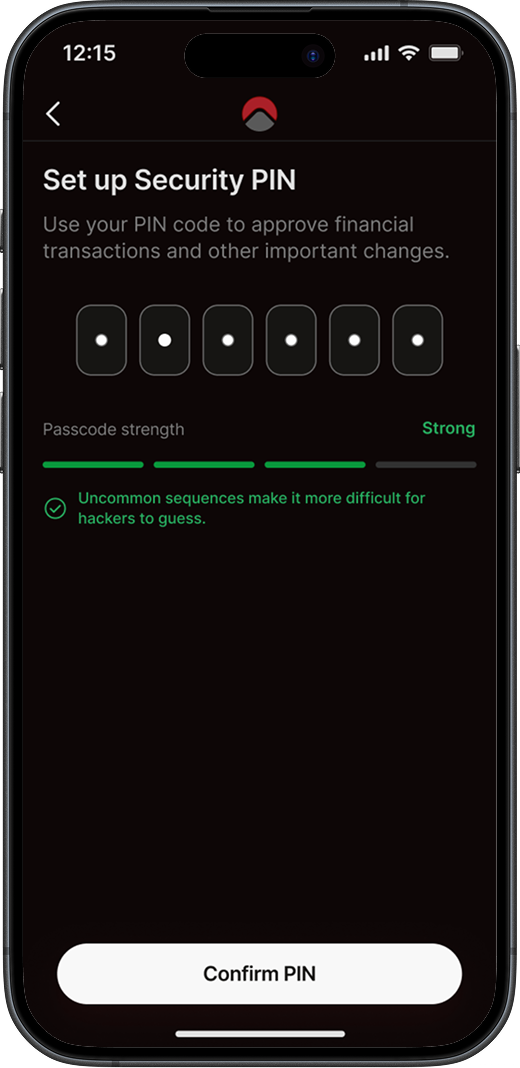

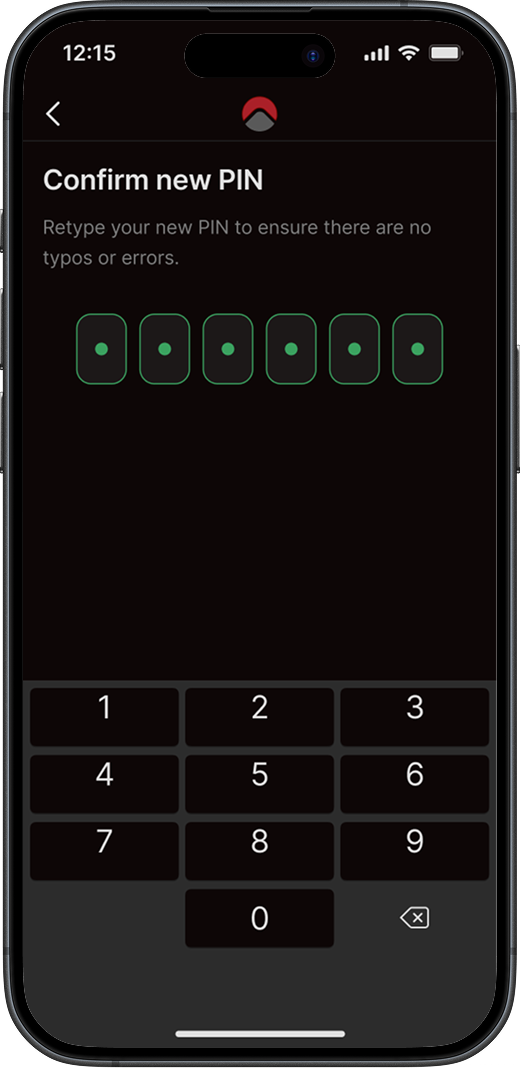

4A

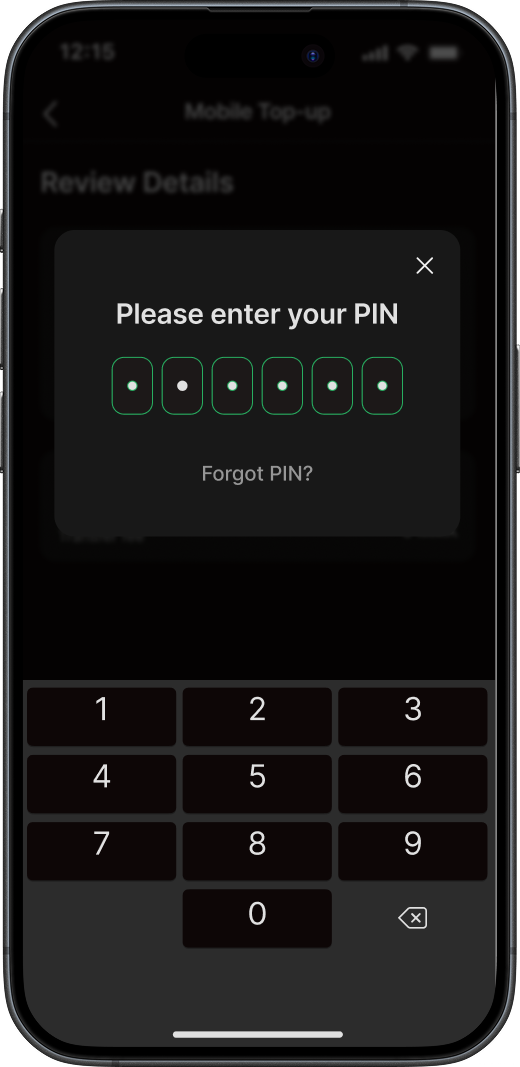

Then, set up a Security PIN and reenter it in the next screen. You will need this to verify your transactions in AYA Mobile Banking.

4B -

5A

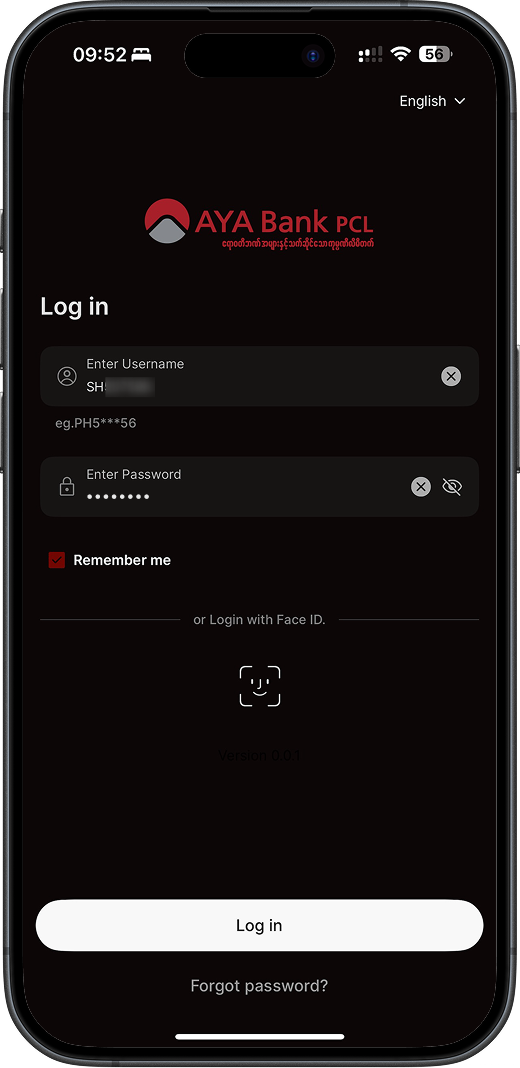

Log in again with your new password.

5B -

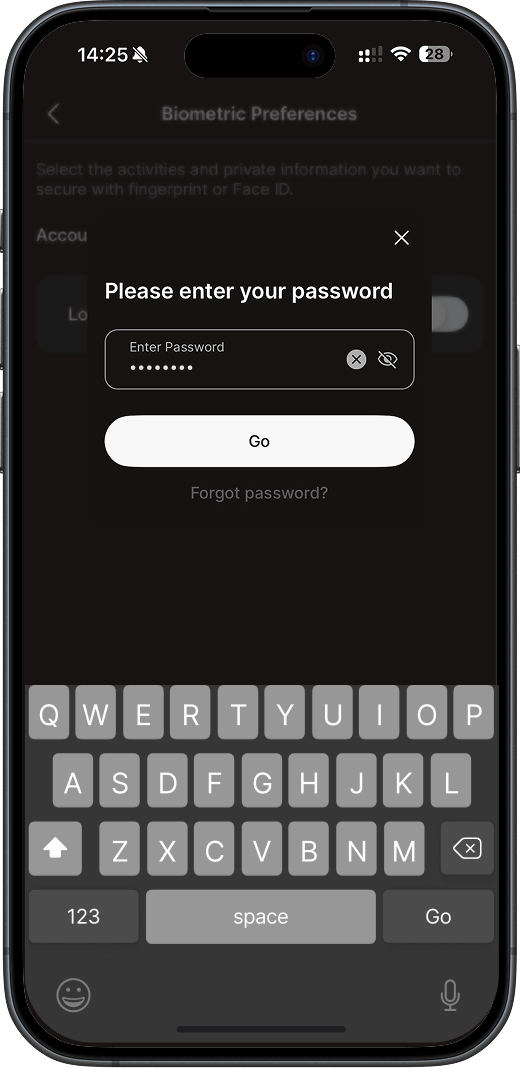

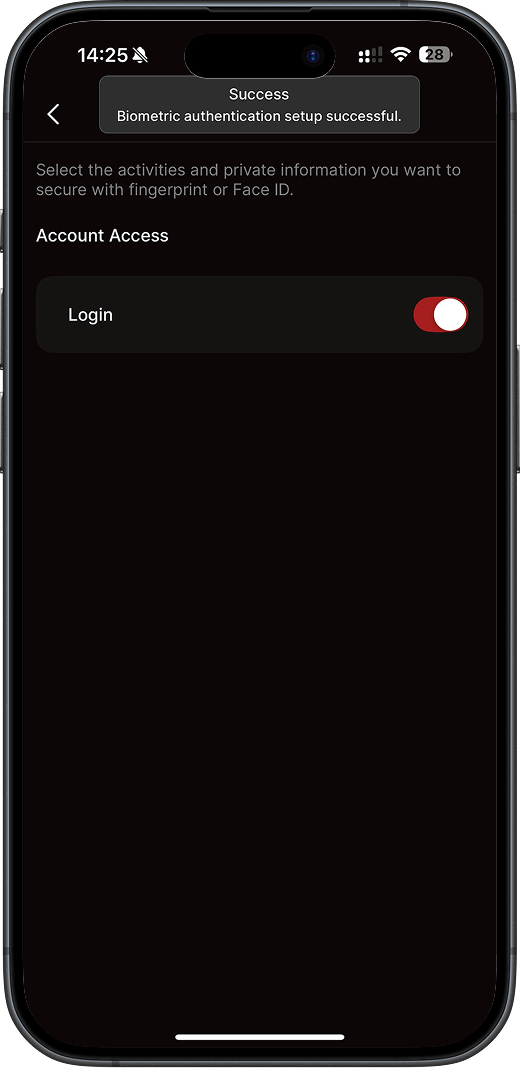

6A

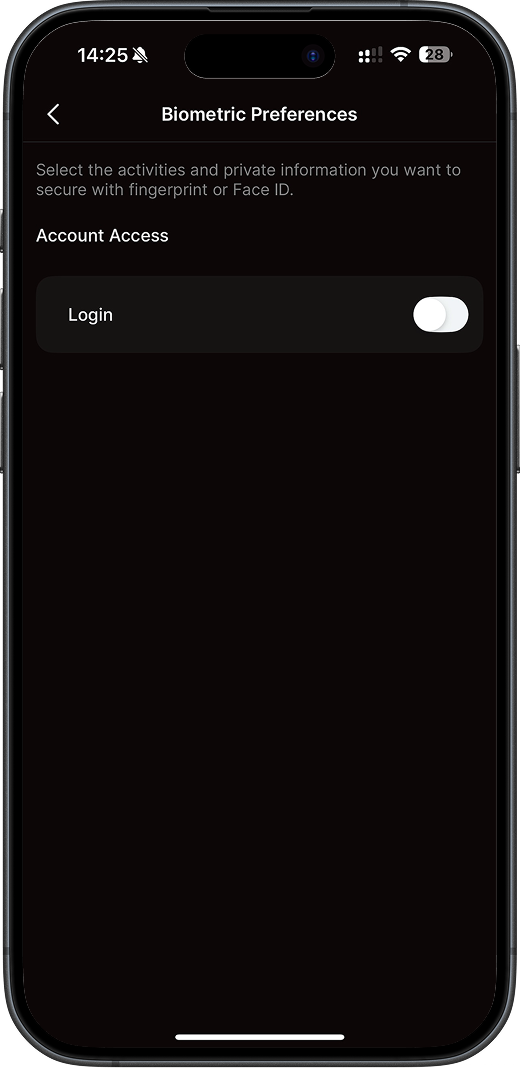

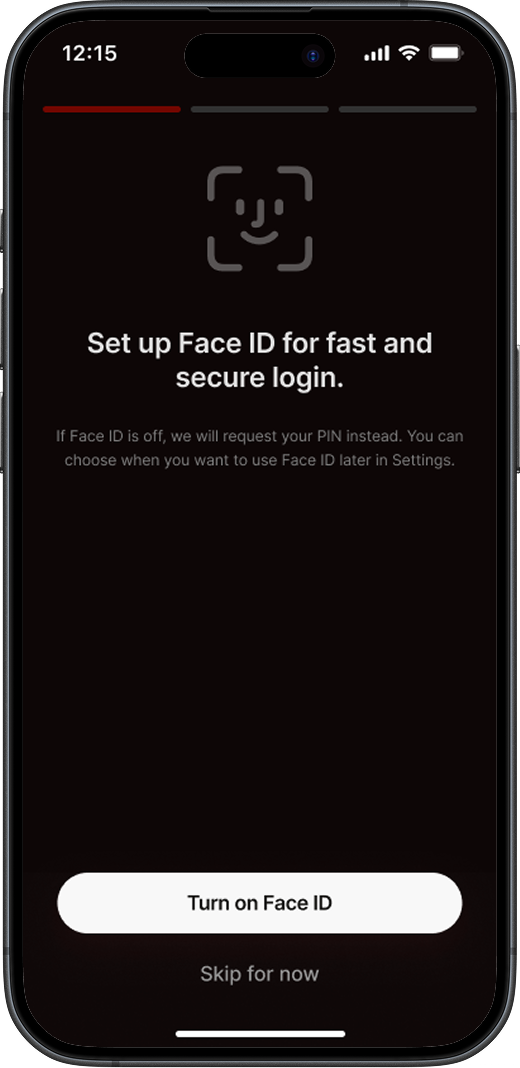

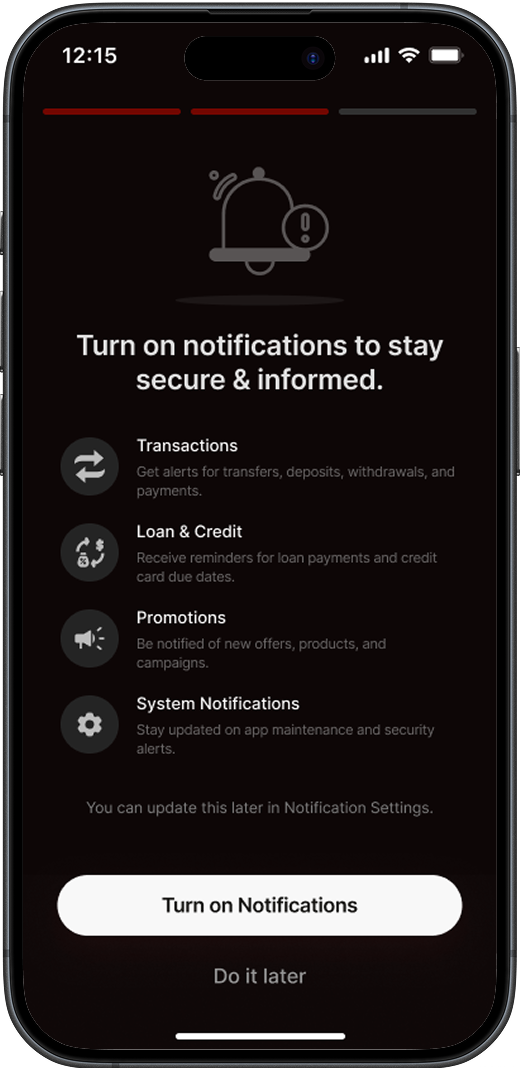

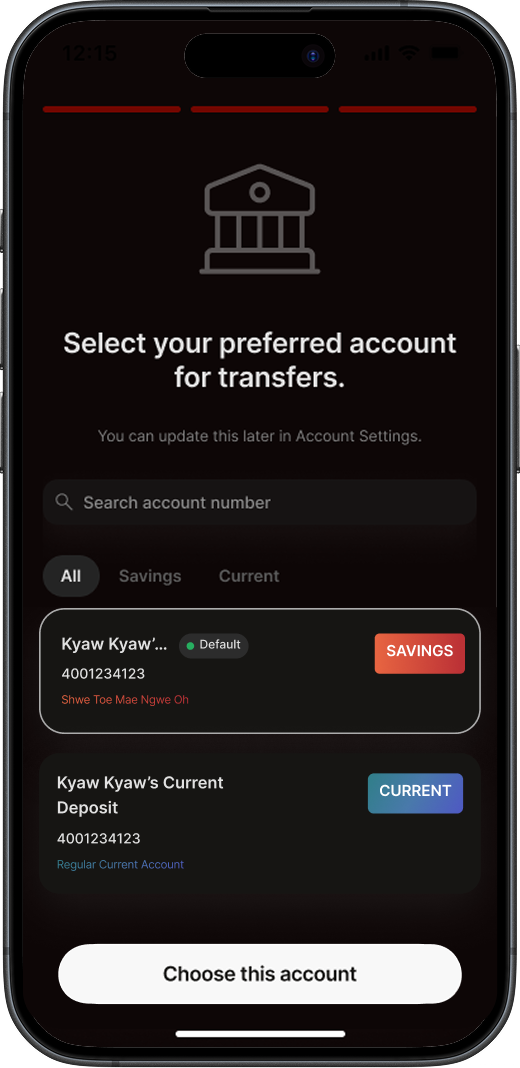

Then, set up Face ID or Fingerprint login, turn on notifications, and select your preferred account for transfers and payments.

6B -

7A

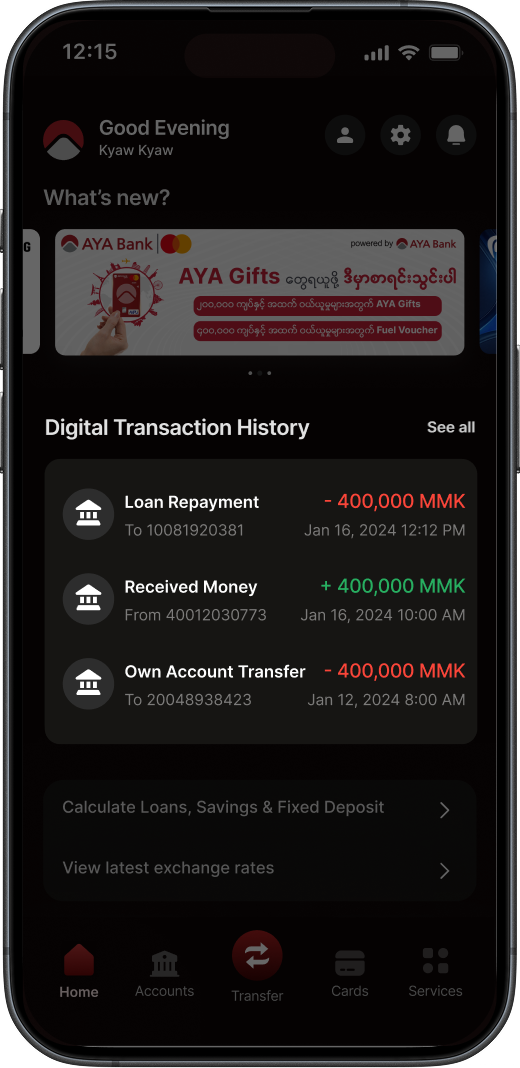

When you’re done with these steps, we’ll take you straight to the Home page.

7B

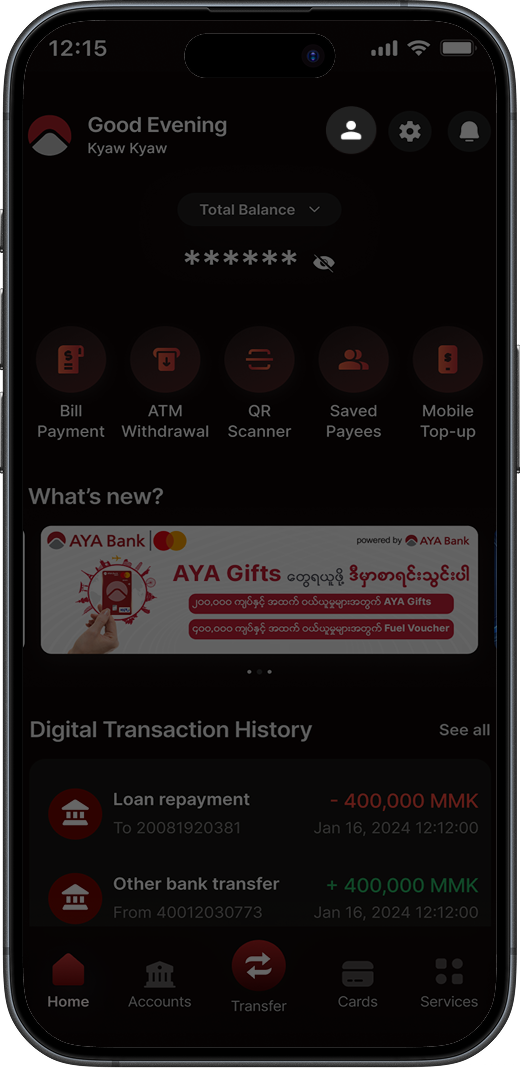

How To Manage Home Page

Click on the steps to view screens

-

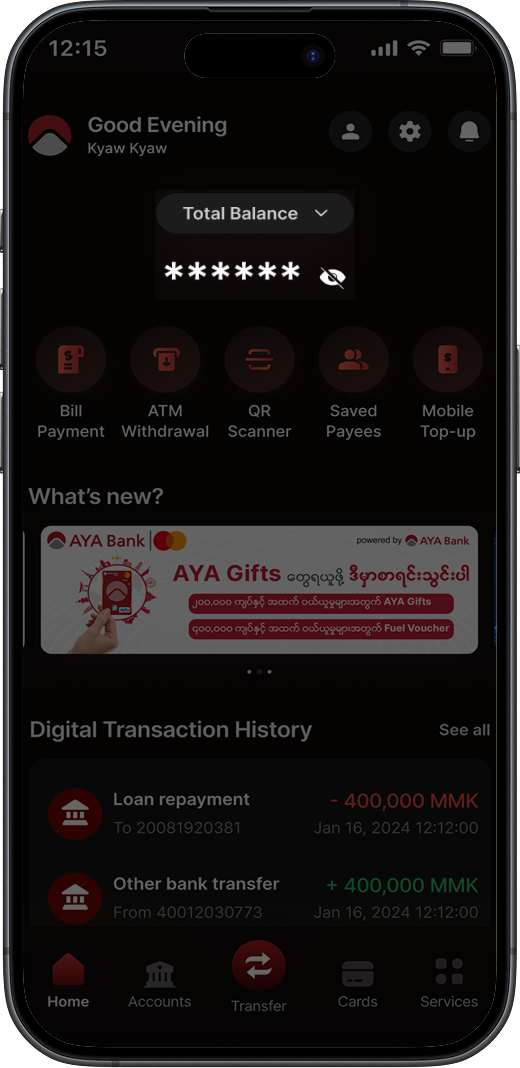

1

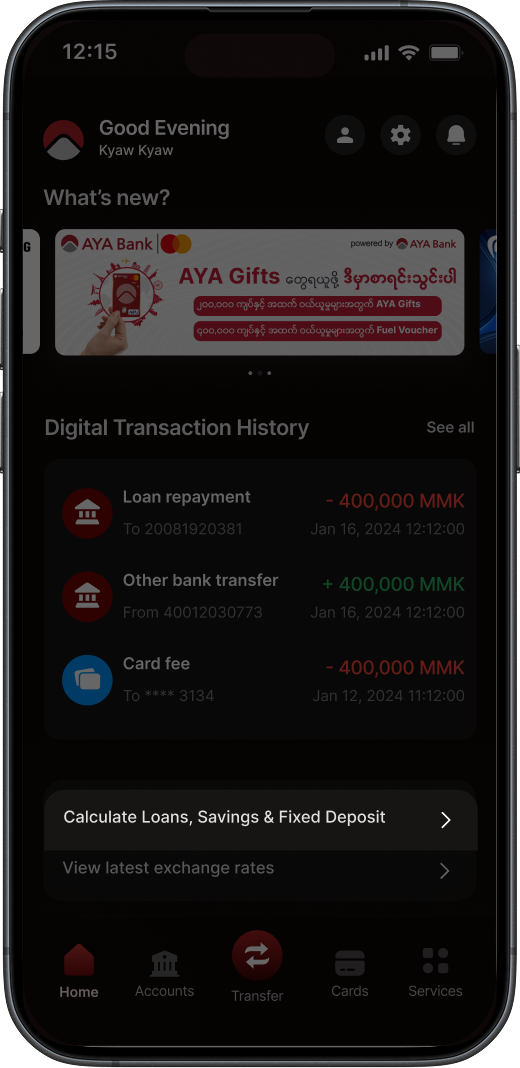

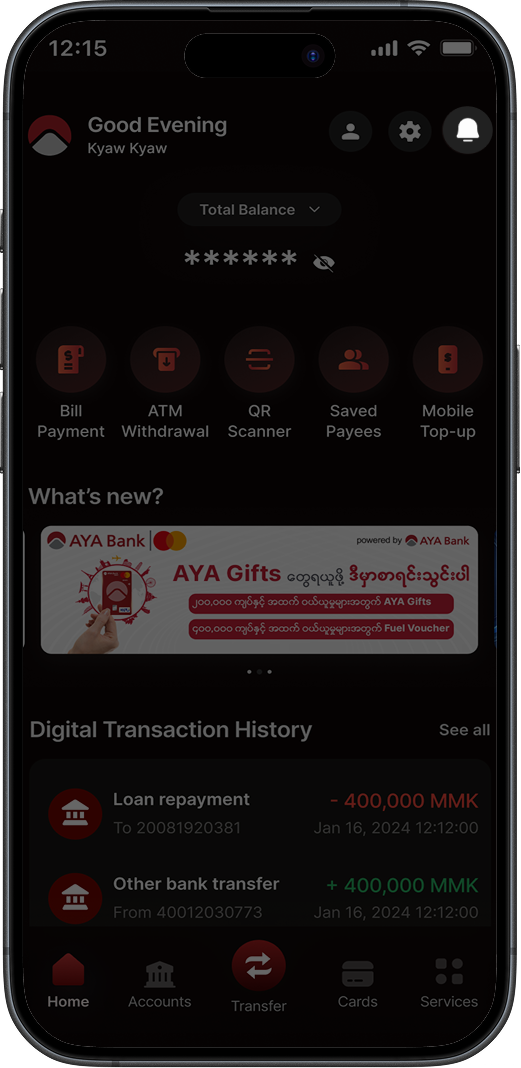

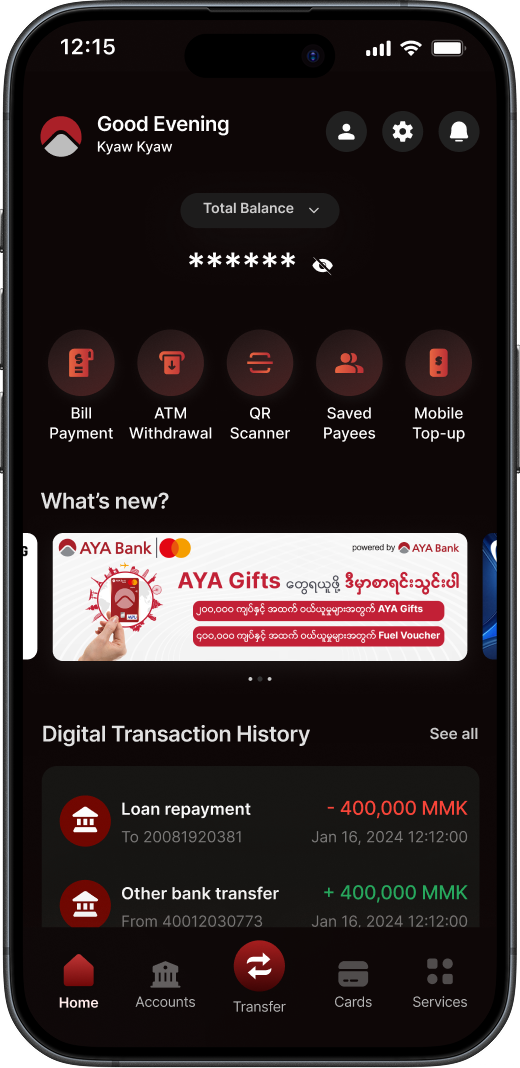

Your total balance is displayed at the top of your Home page by default.

-

2

Click on the eye icon to hide or view your balance.

-

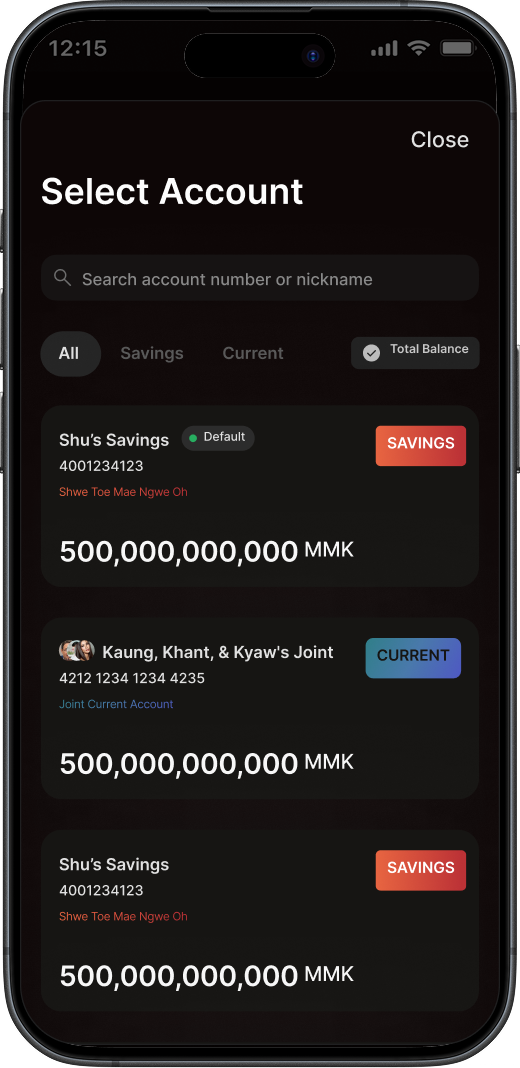

3

You can choose a specific account to show its balance in the Home page. Just tap Total Balance and select the account you want to see.

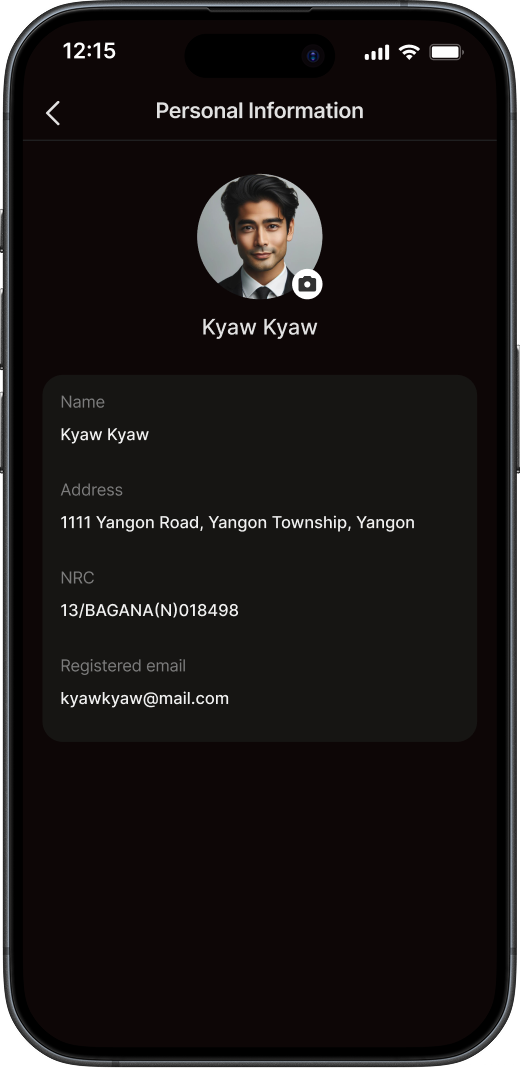

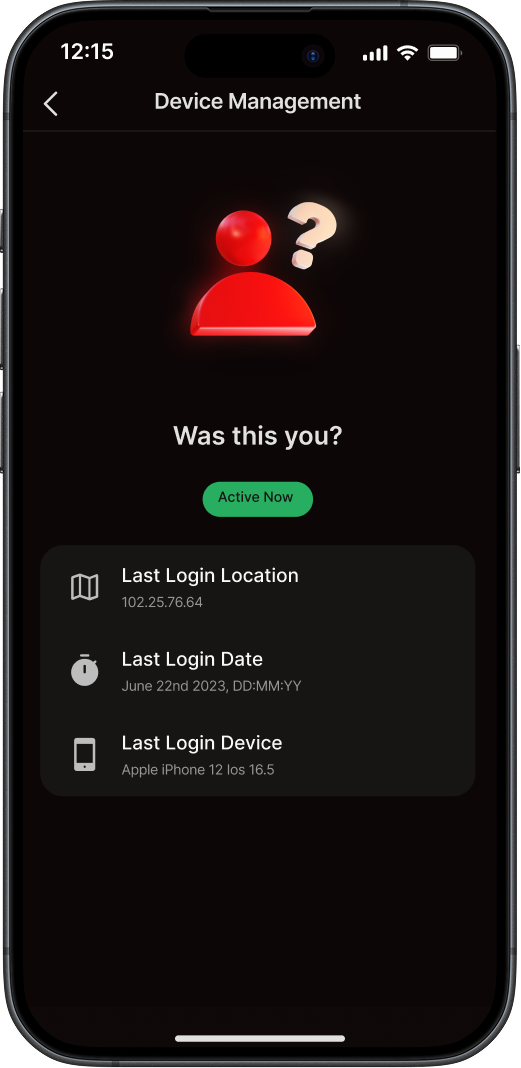

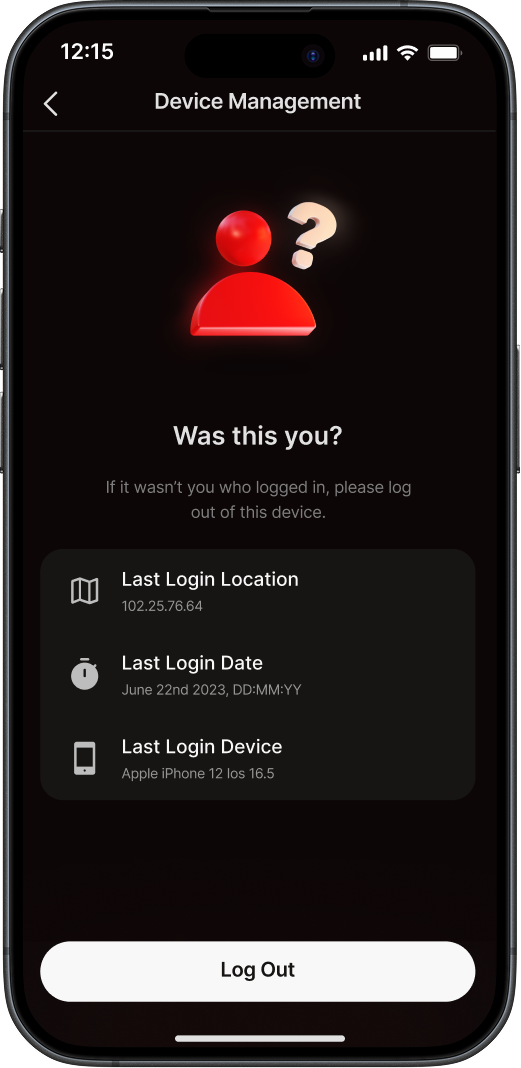

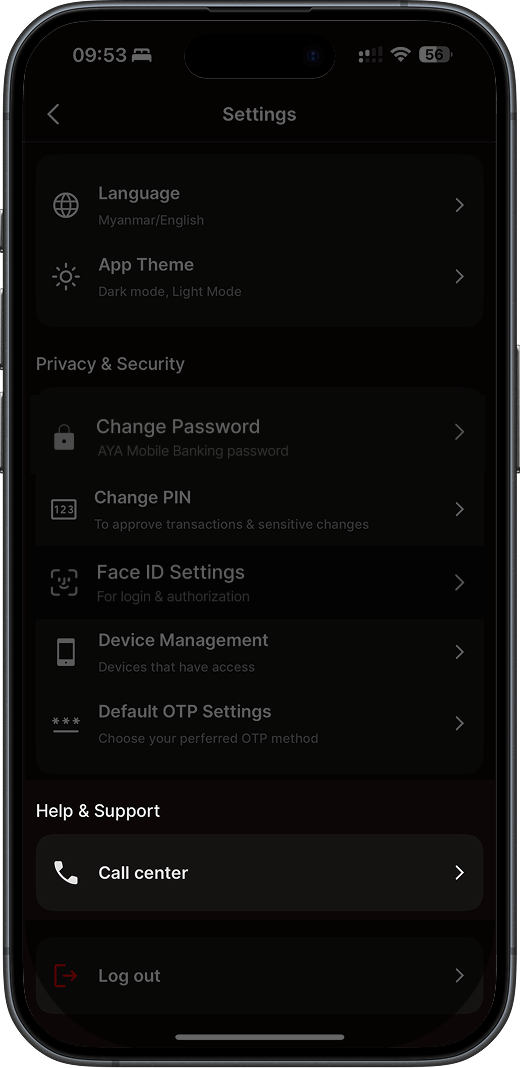

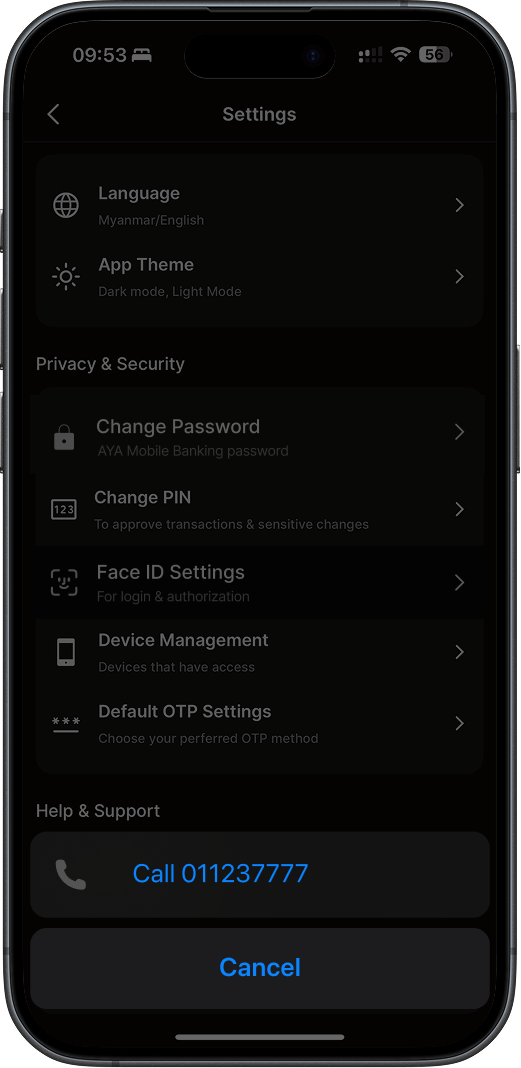

How To Manage Settings

Click on the steps to view screens

-

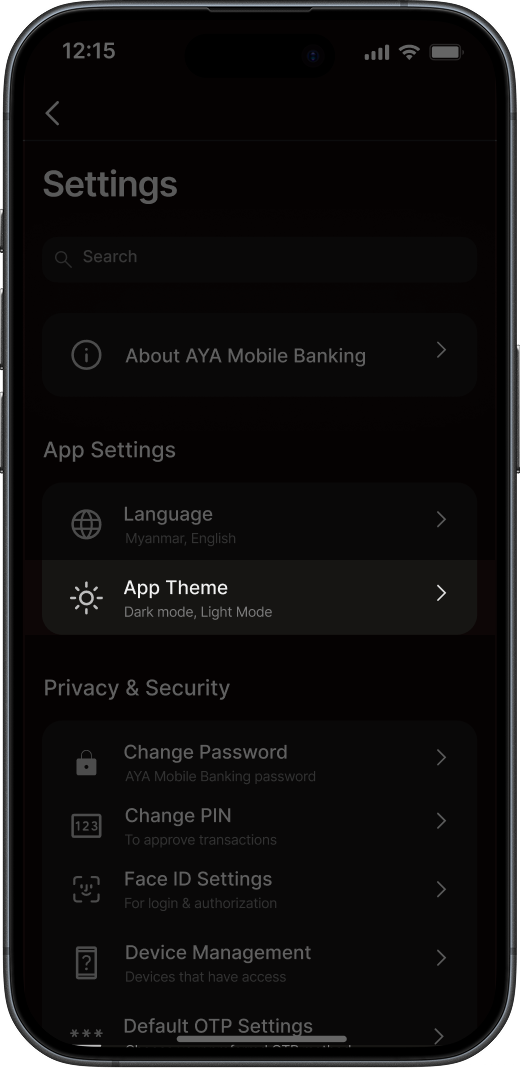

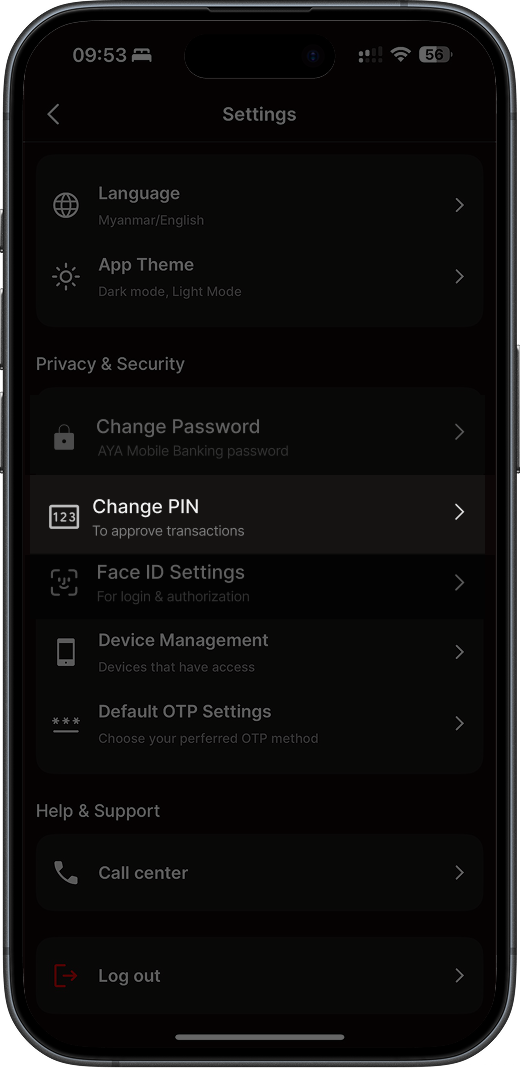

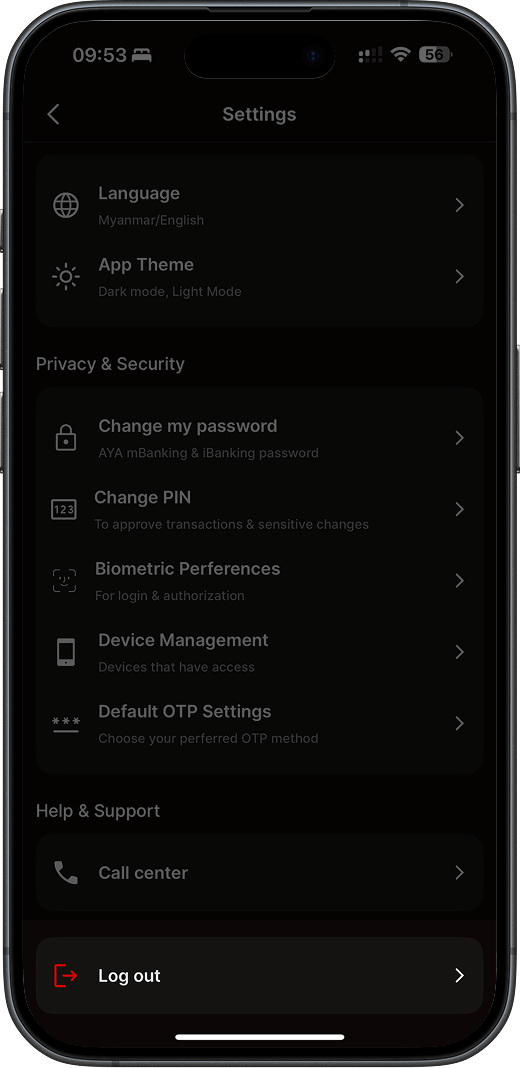

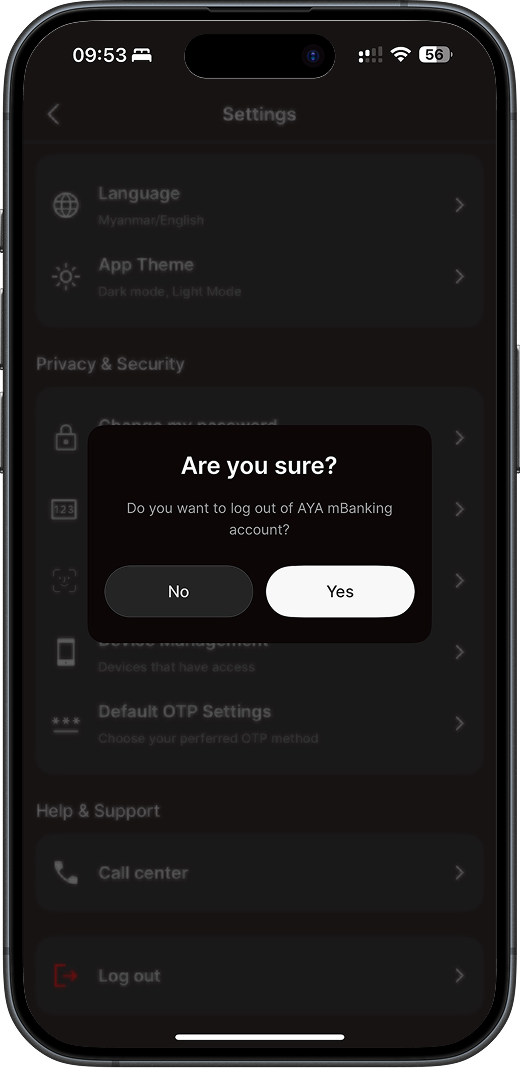

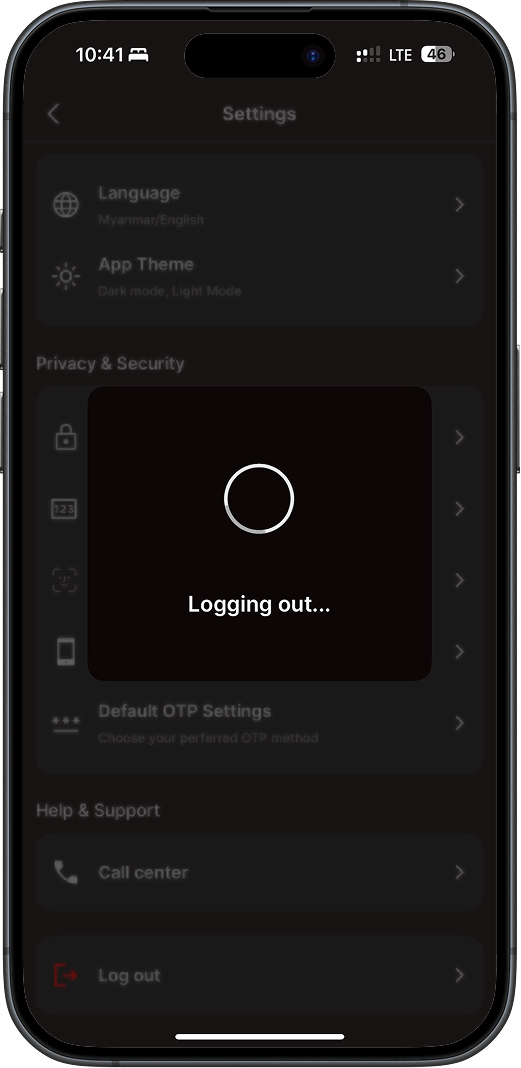

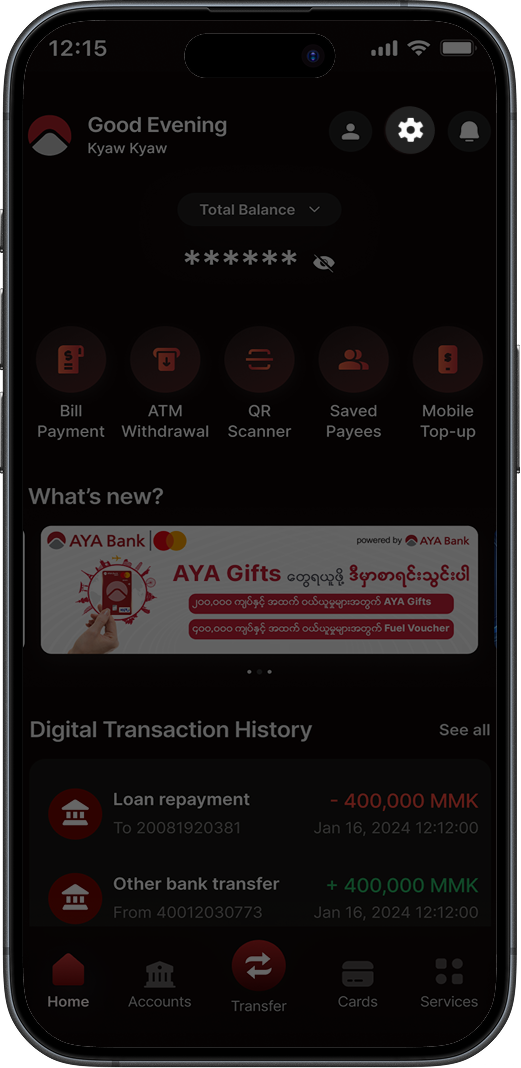

1

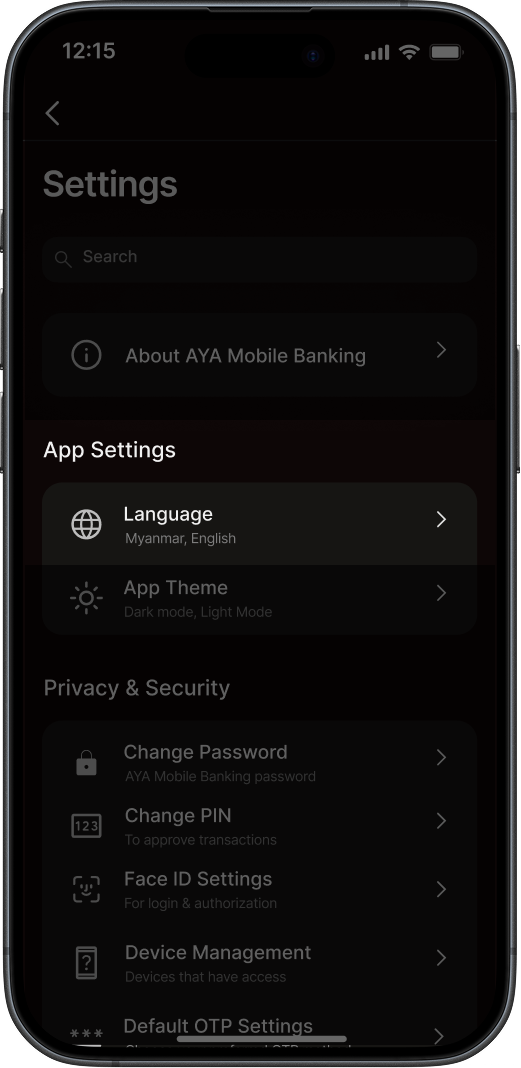

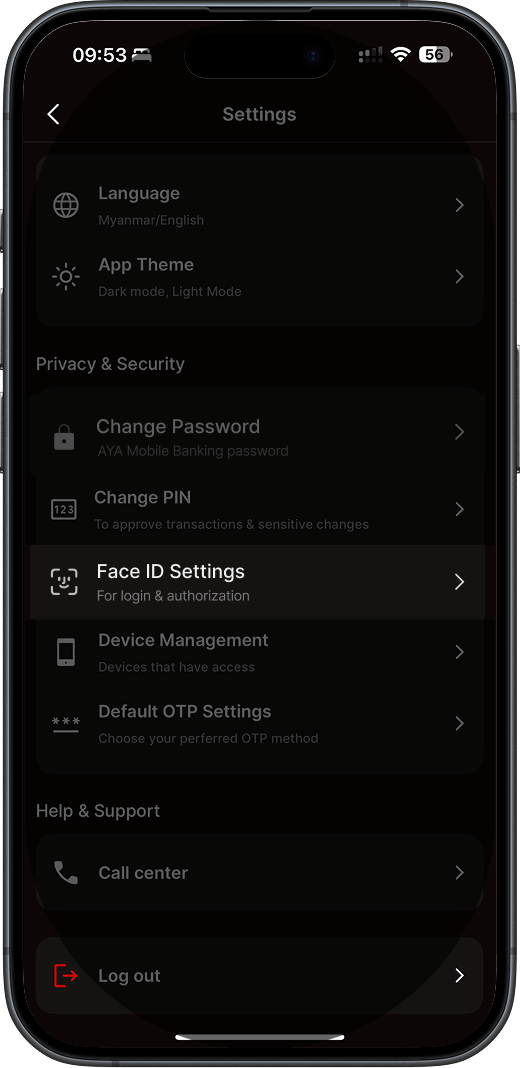

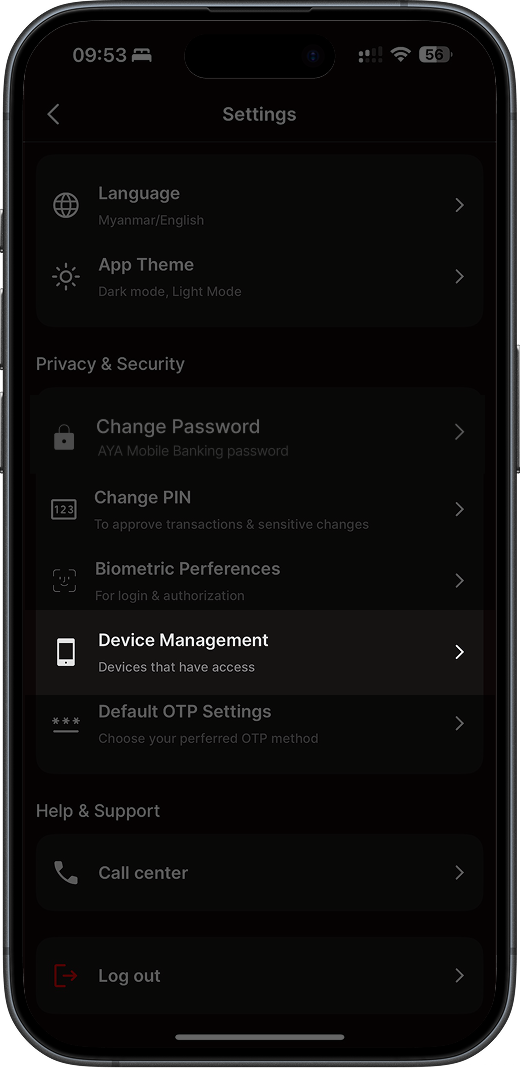

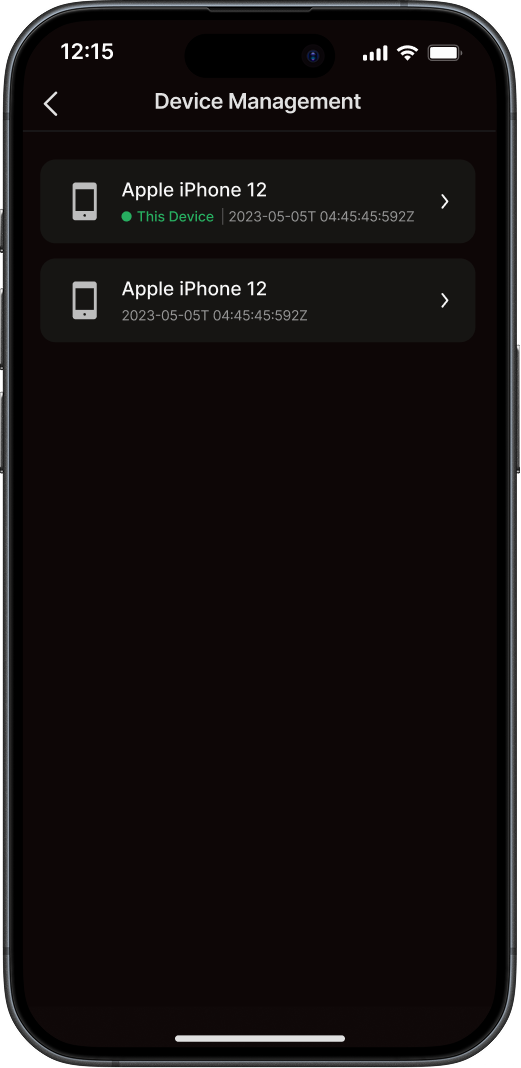

Tap on the Settings icon in the top right corner of the Home page.

-

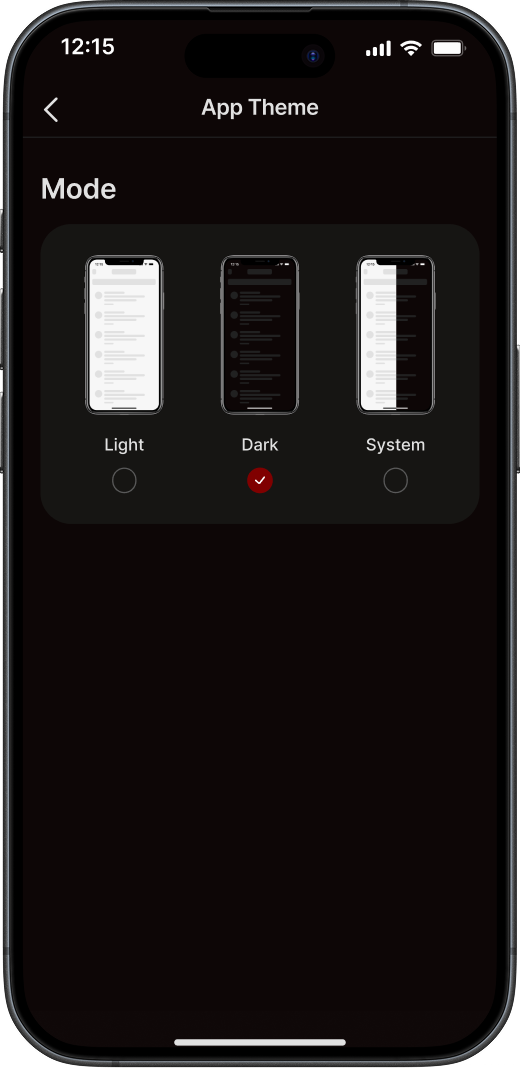

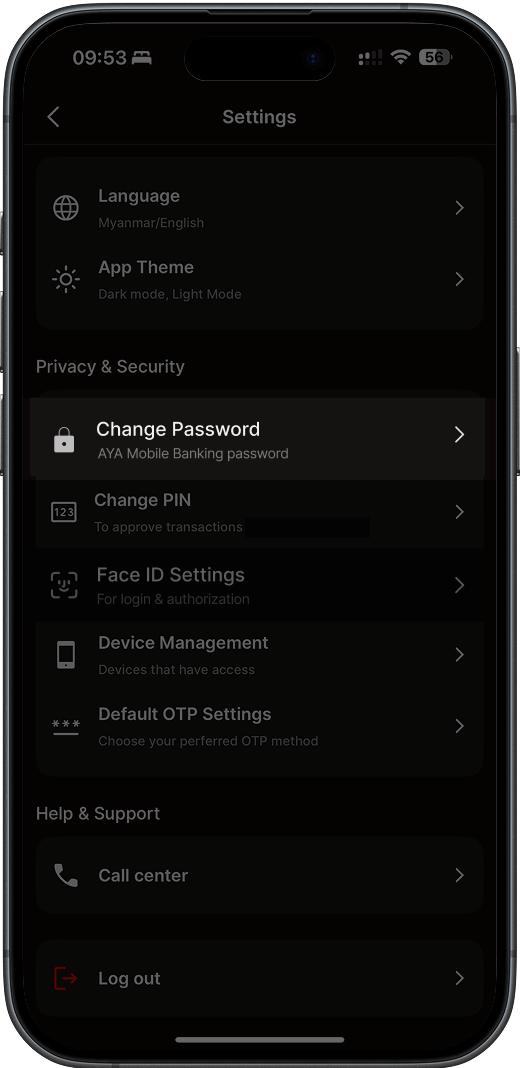

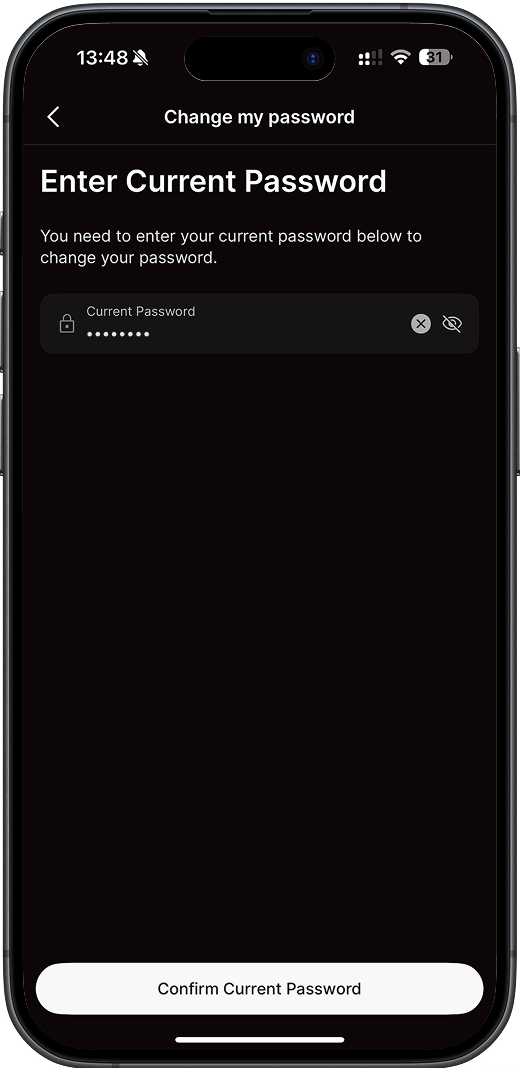

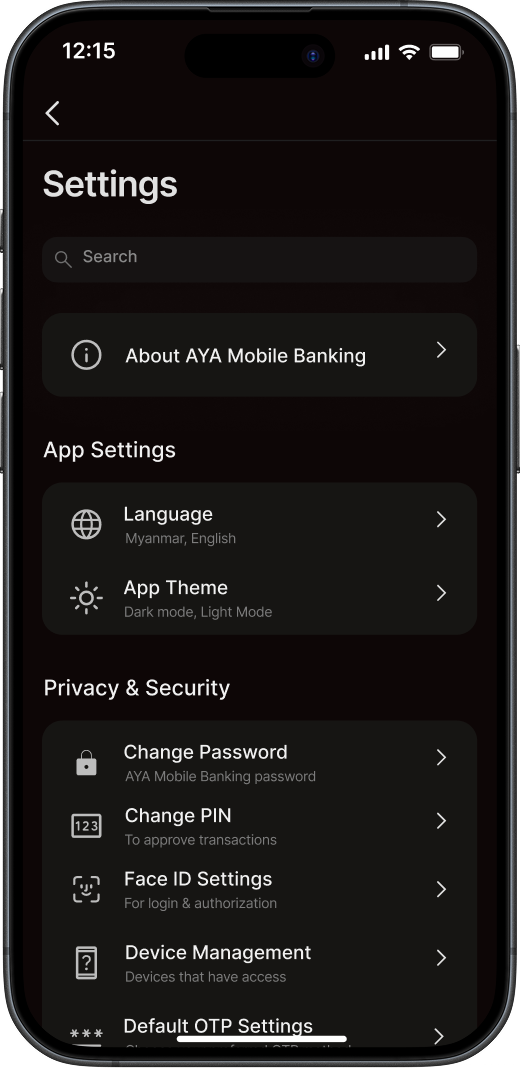

2

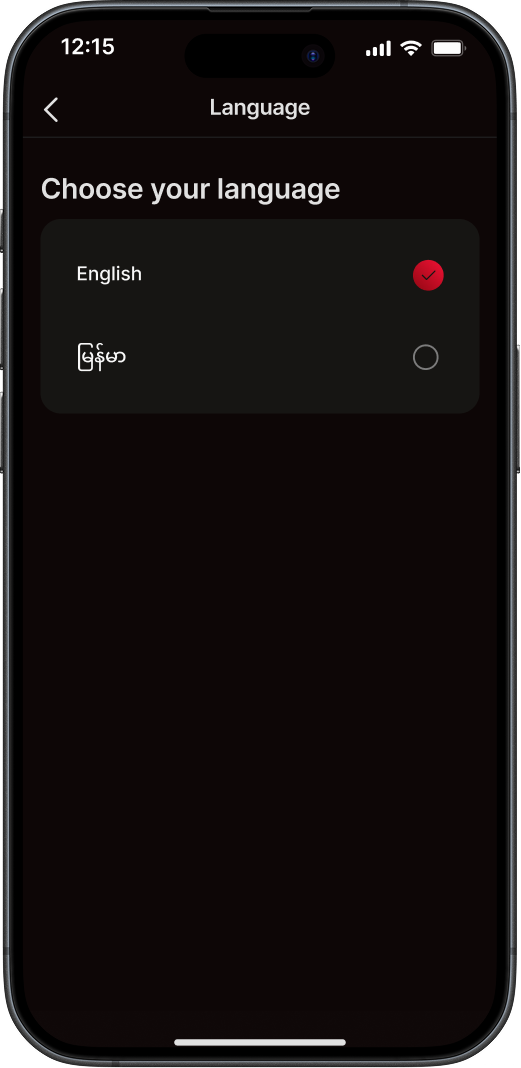

Change languages, switch between light and dark mode, update privacy and security settings, contact customer support, and log out of your AYA Mobile Banking account.

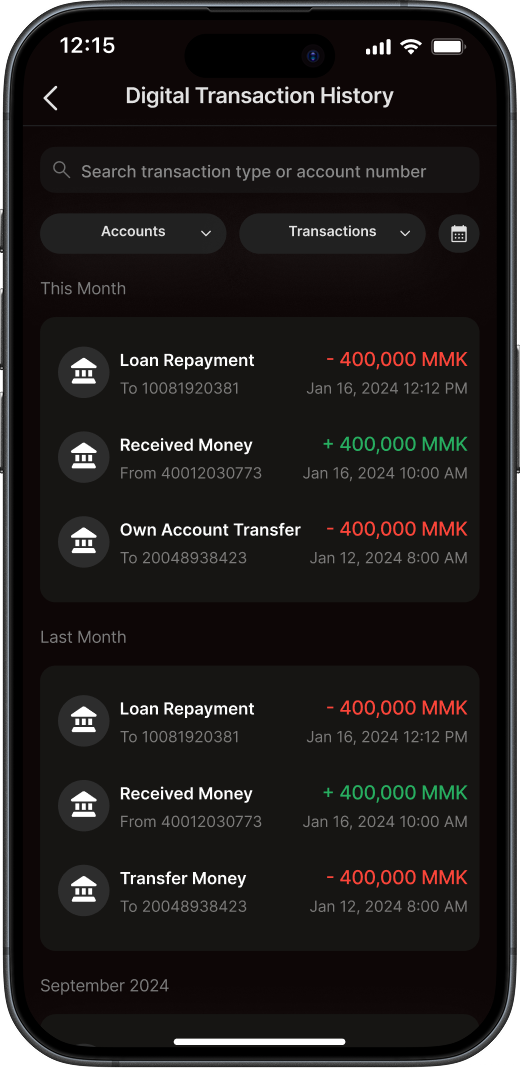

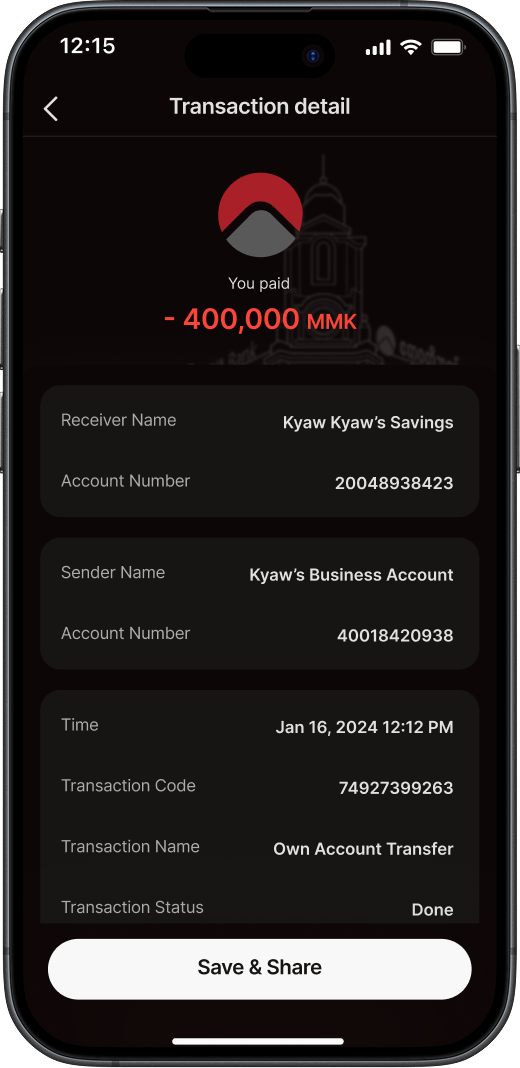

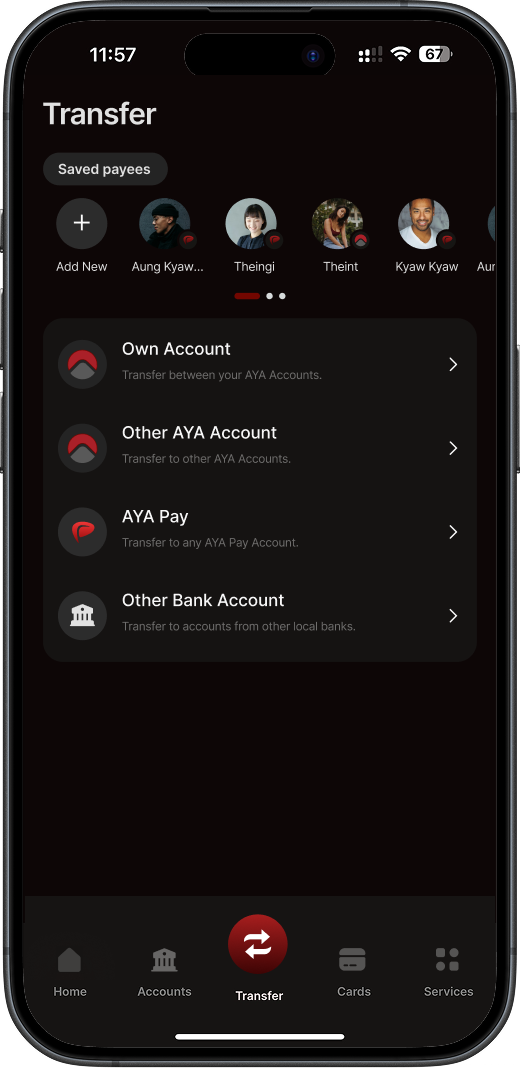

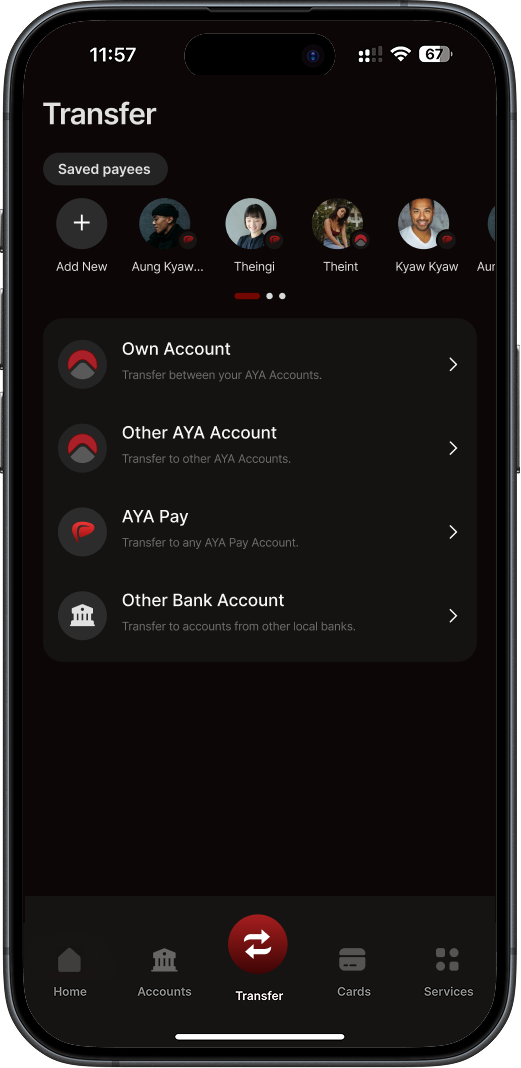

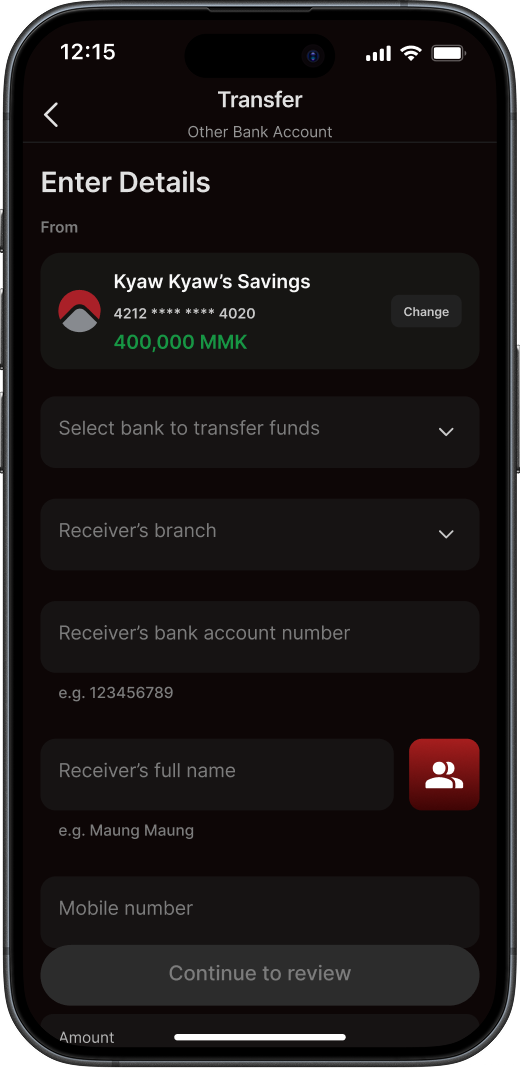

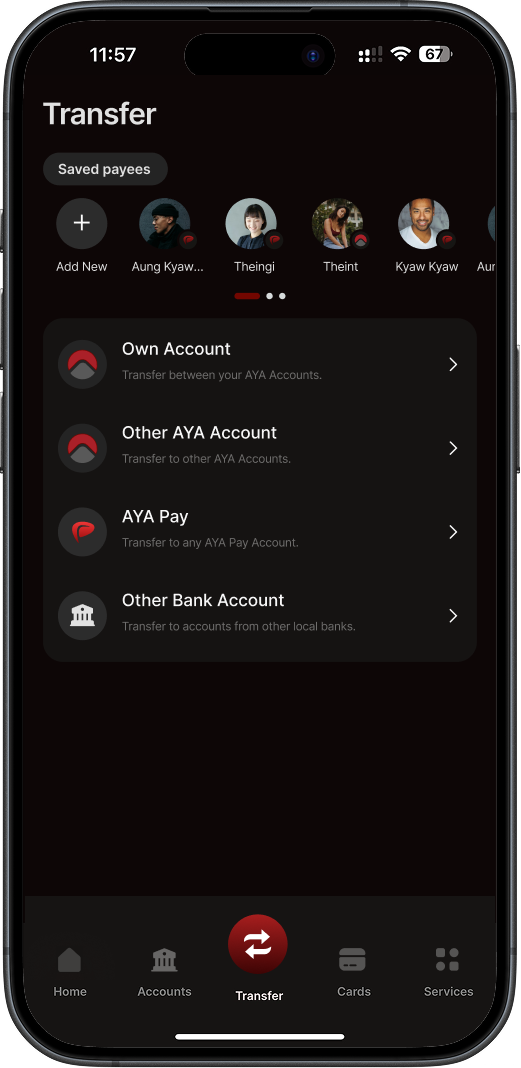

How To Transfer Money

Click on the steps to view screens

-

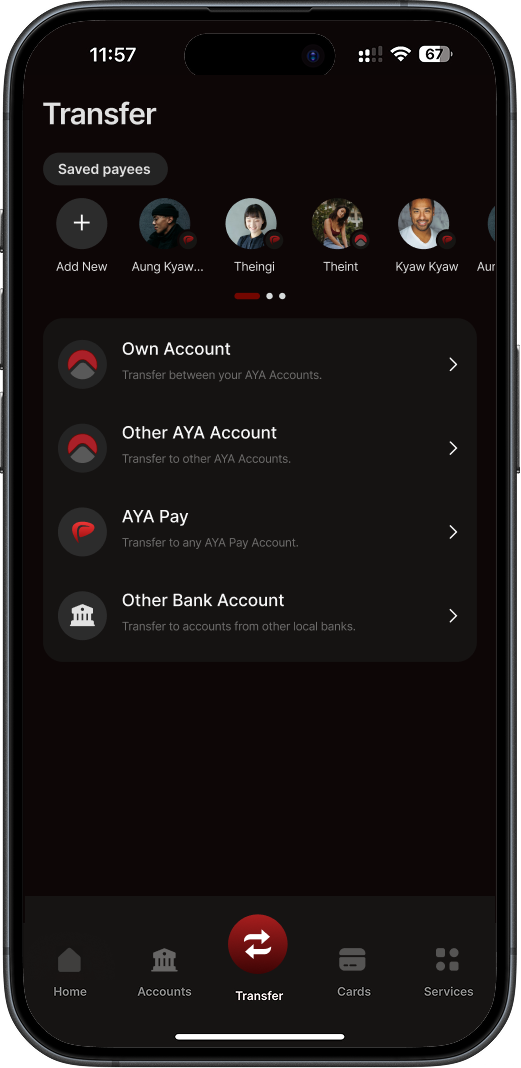

1

Go to the Transfer page and select Own Account.

-

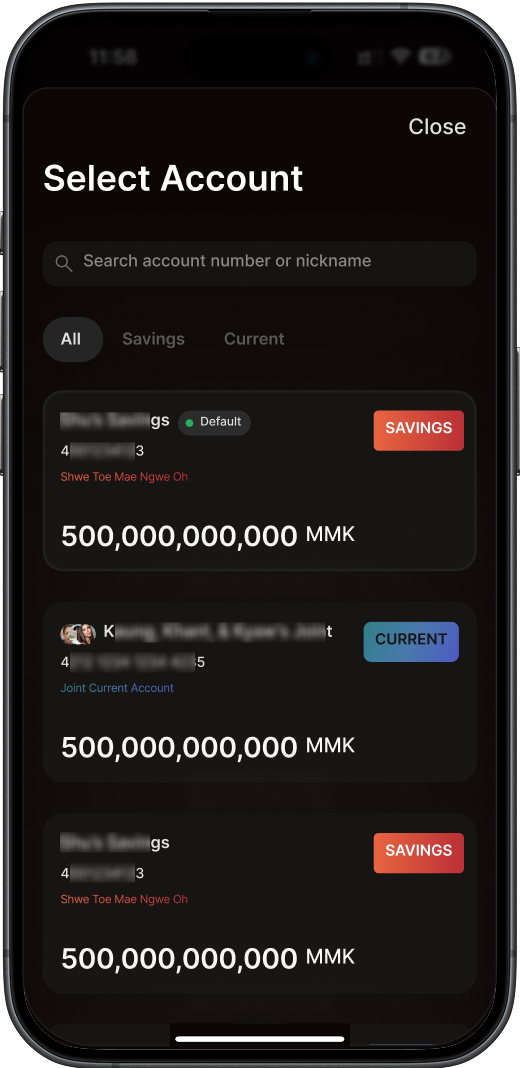

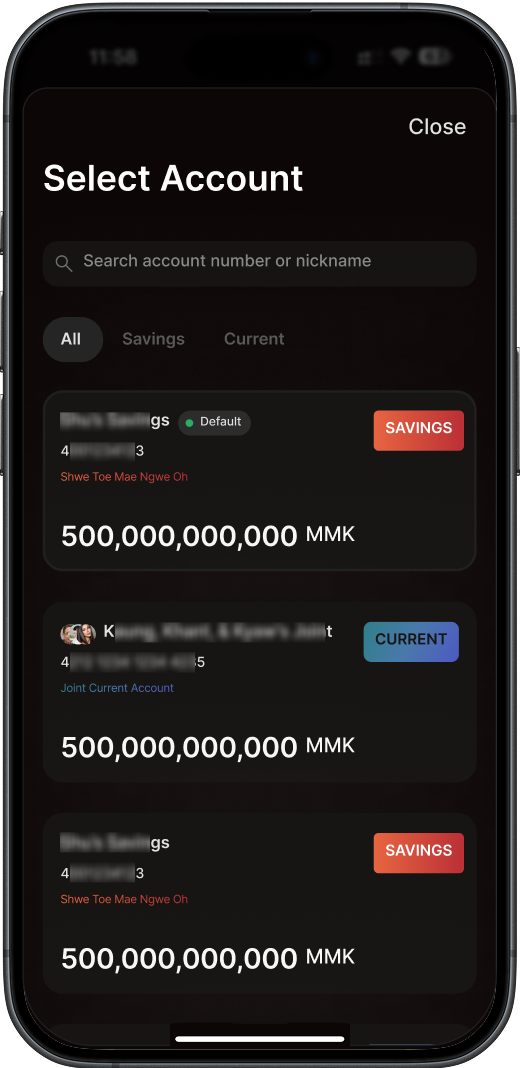

2

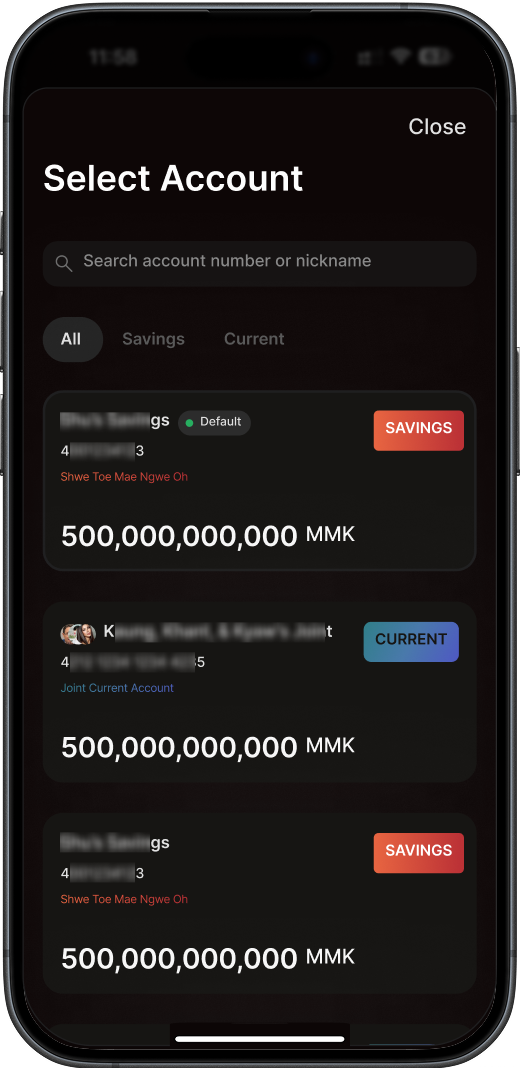

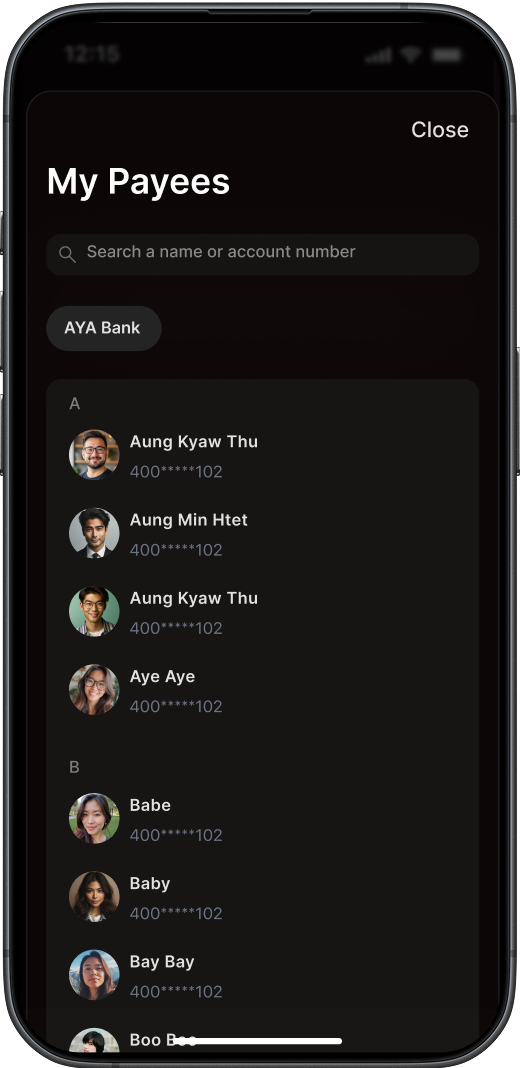

Choose the account to send money from and the account to receive it

-

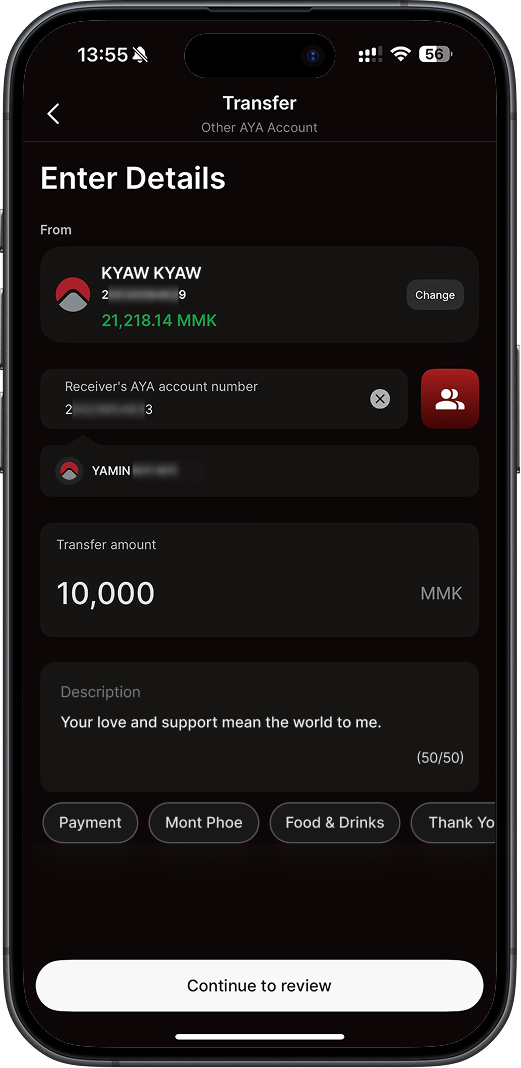

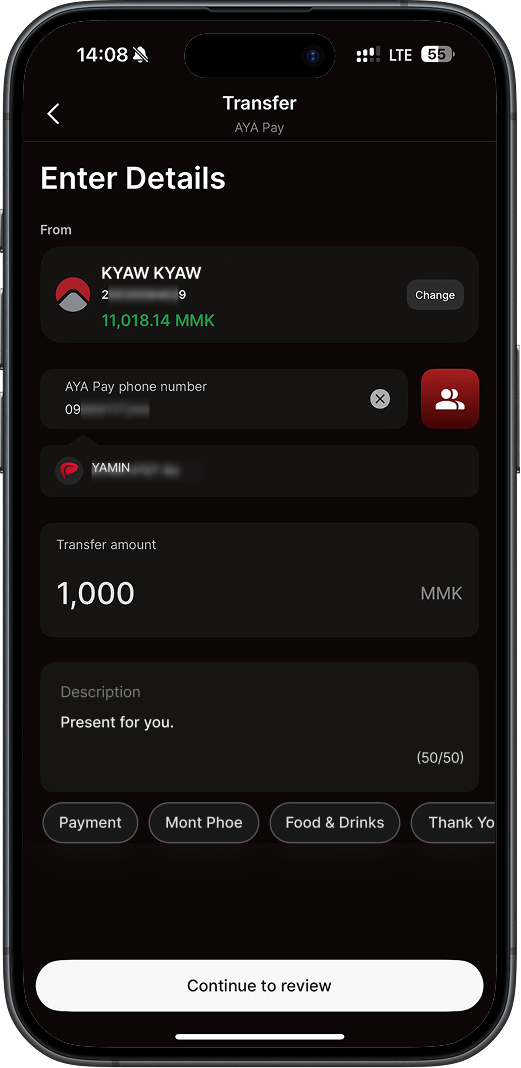

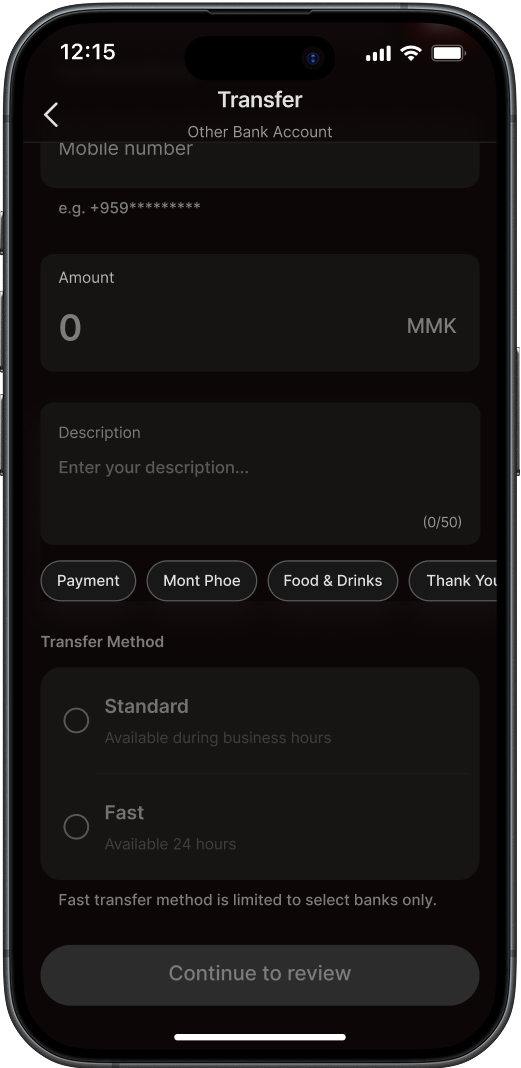

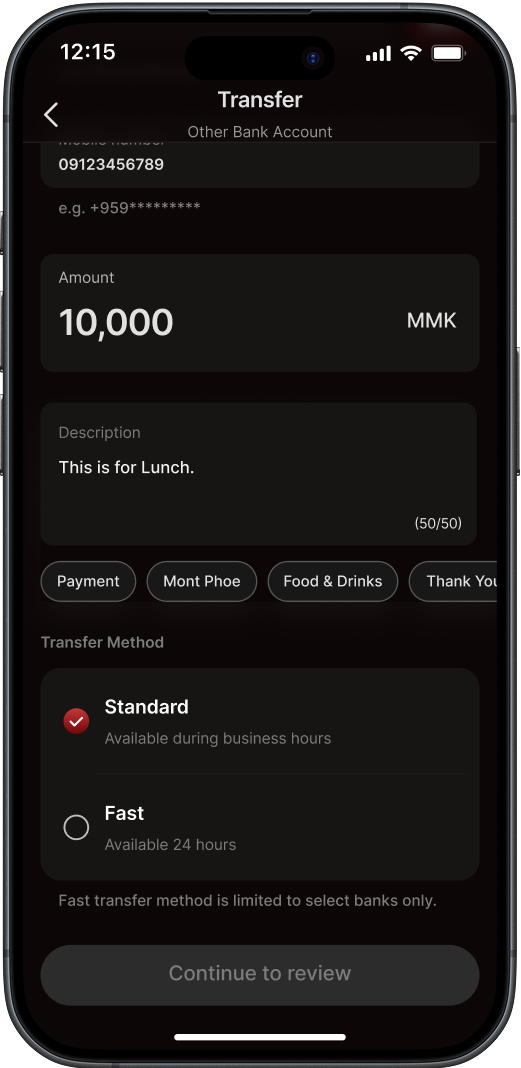

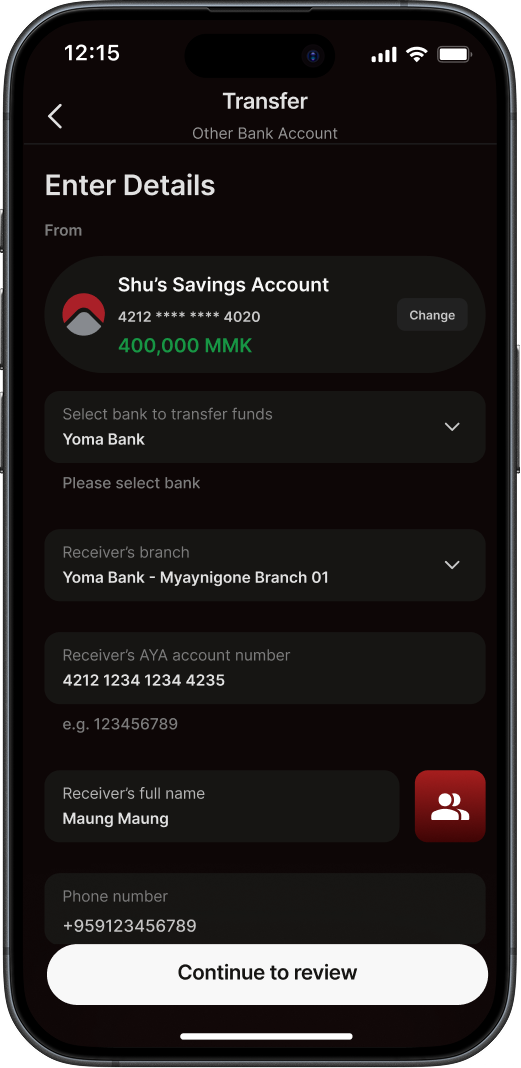

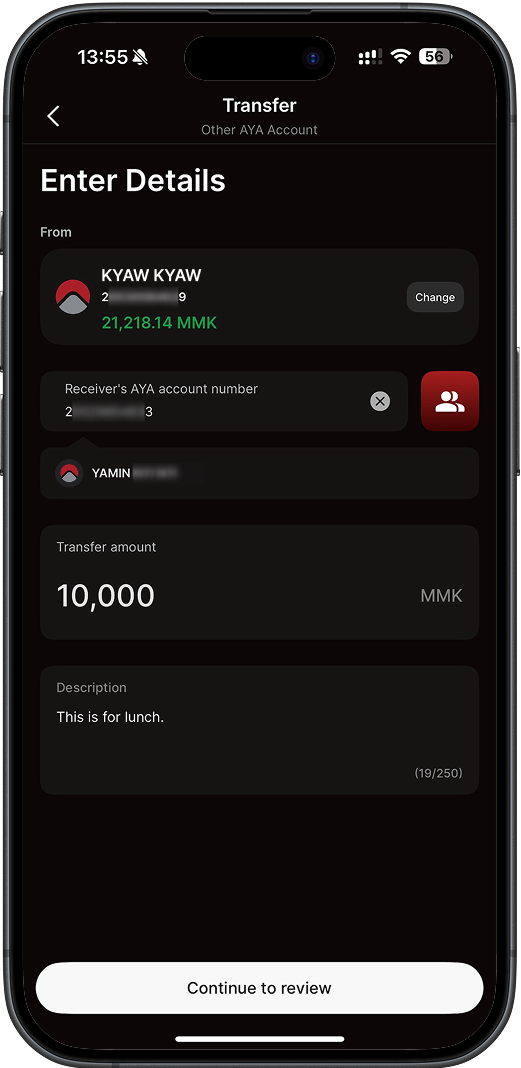

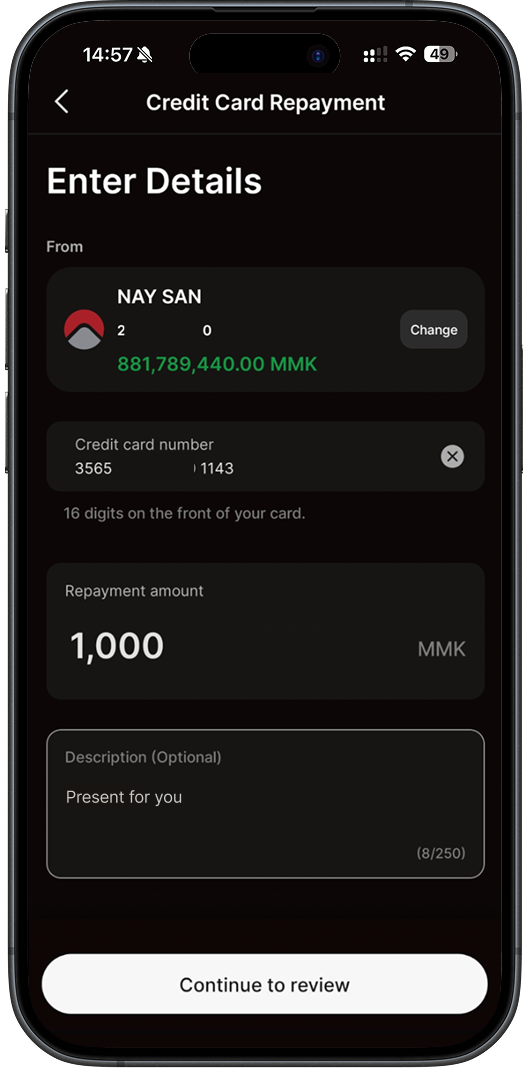

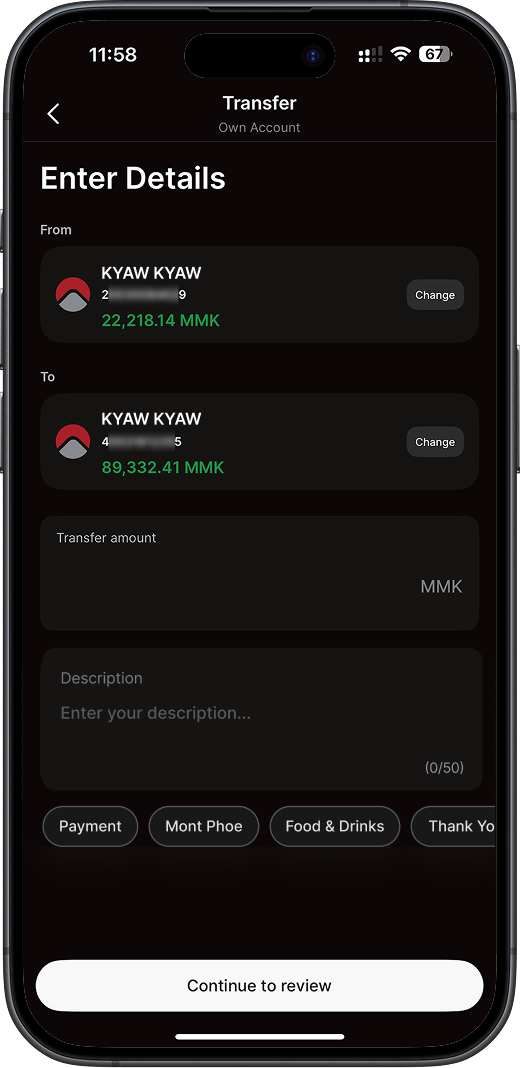

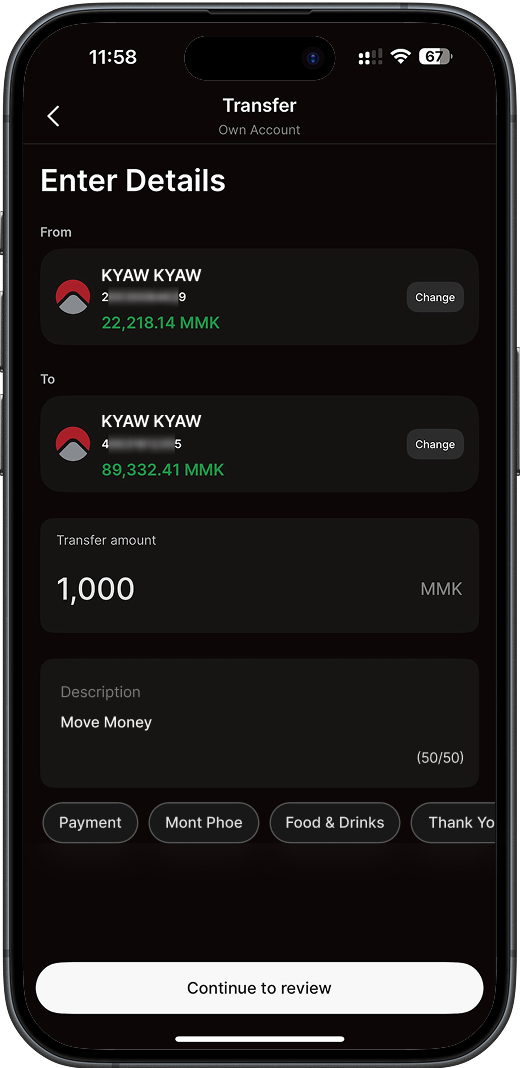

3A

Enter the amount and a description, then click Continue to review.

3B -

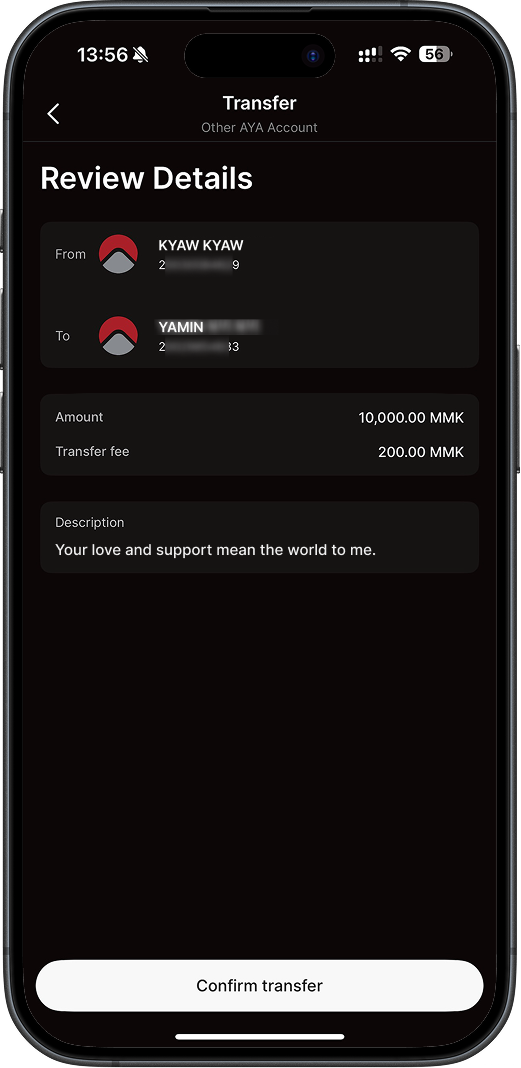

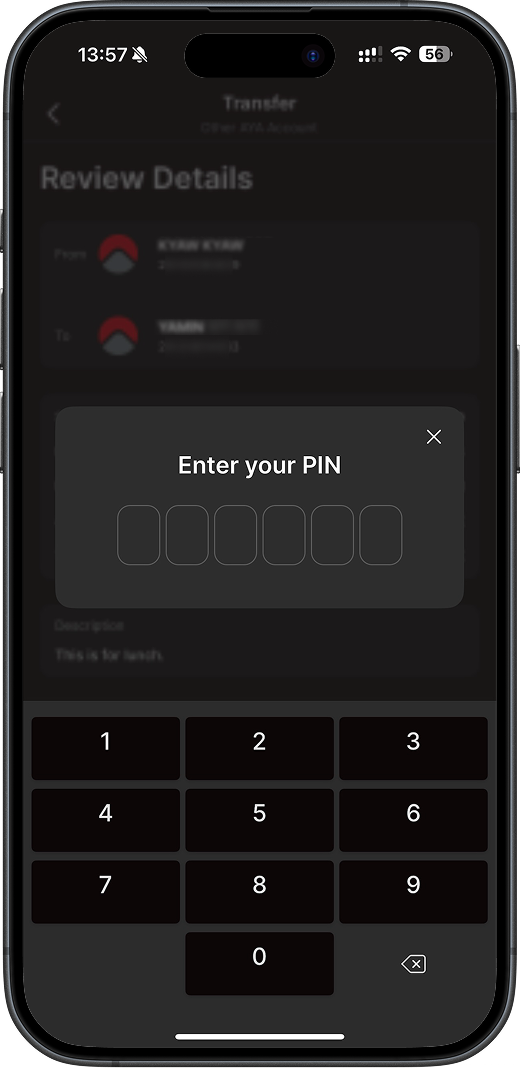

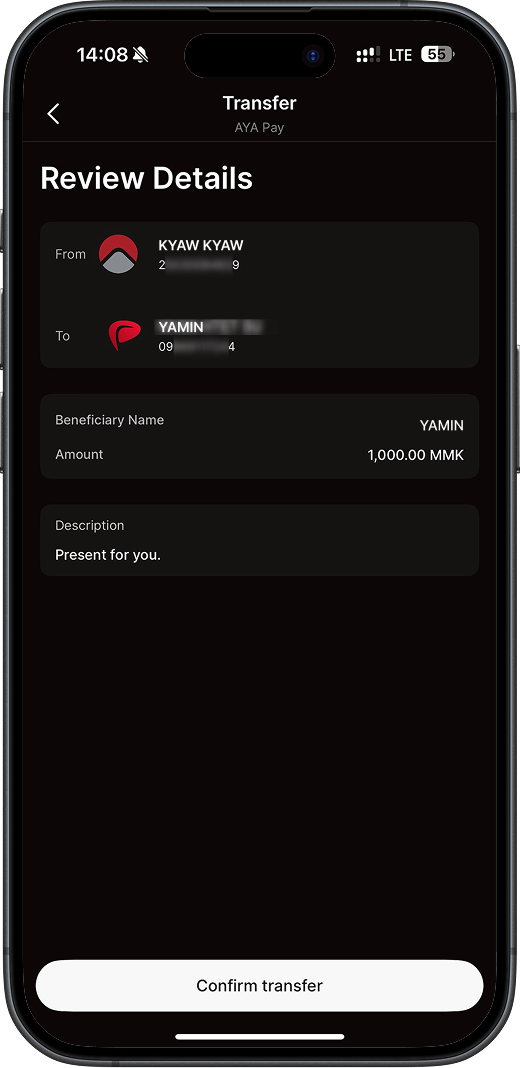

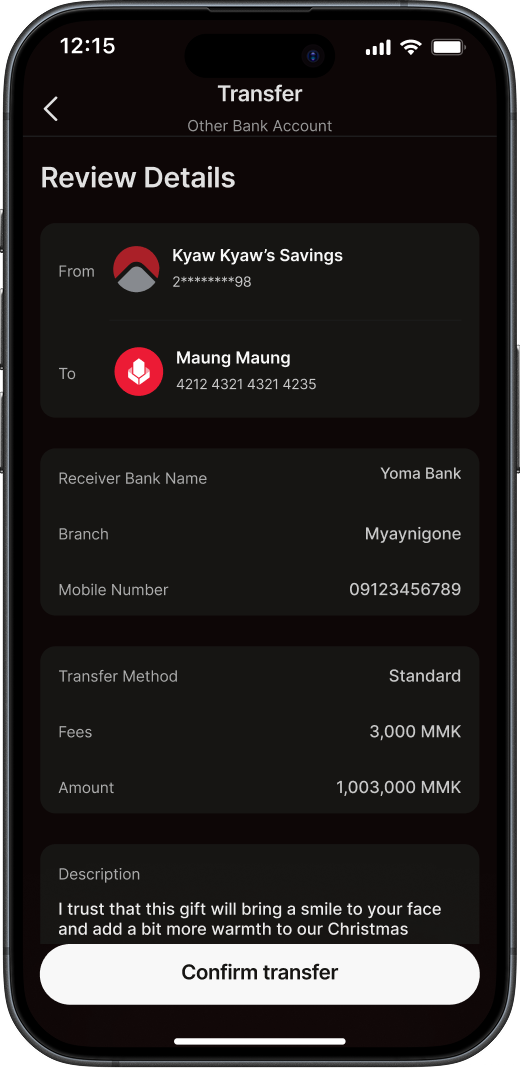

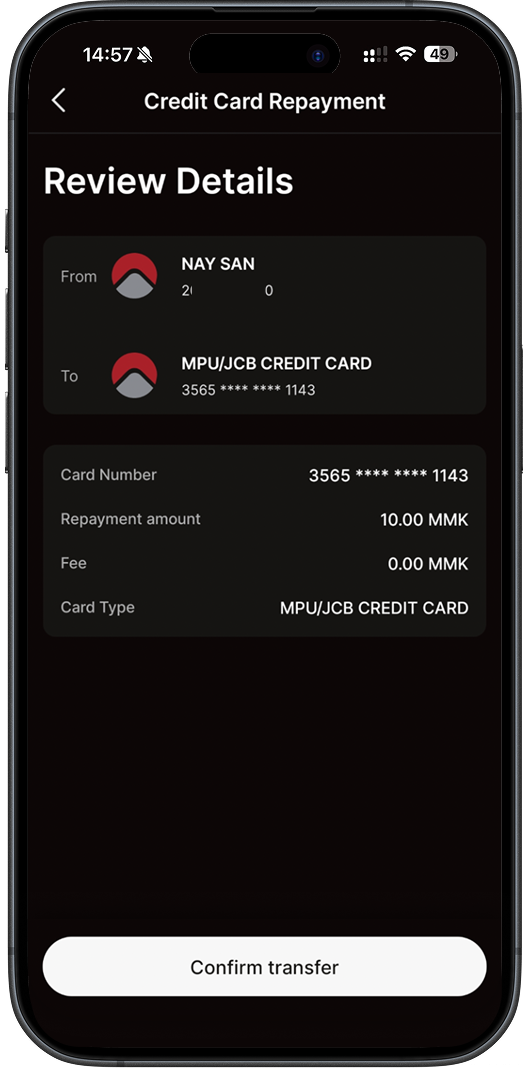

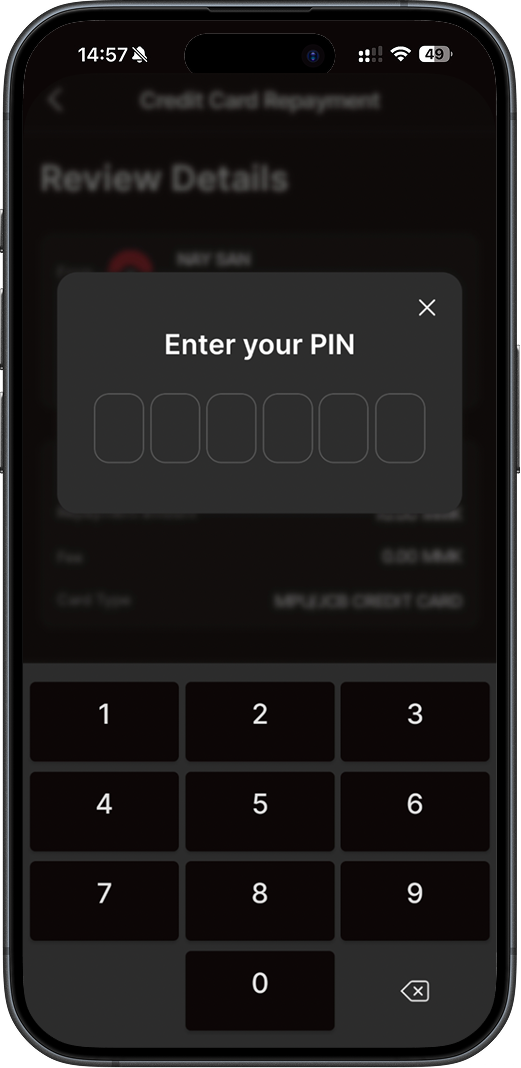

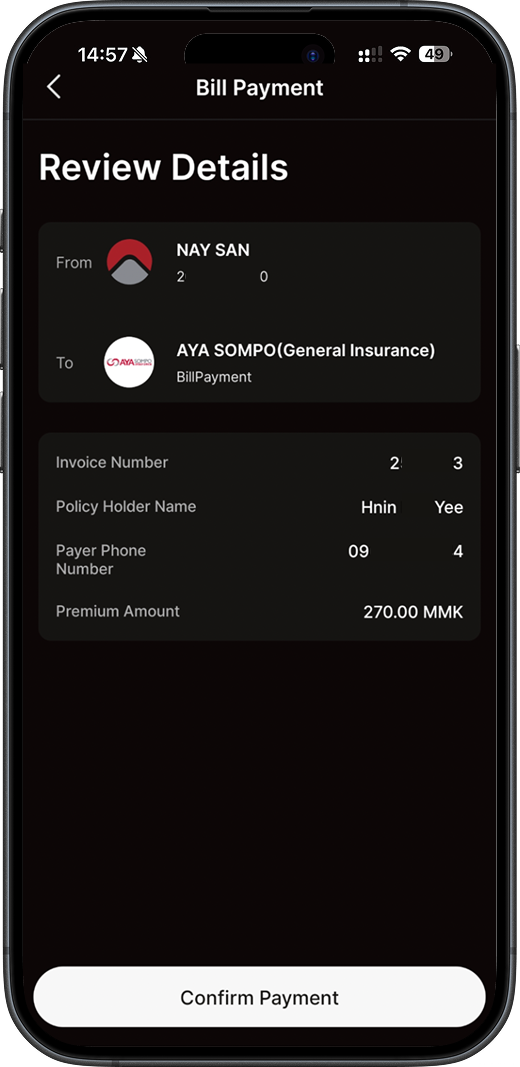

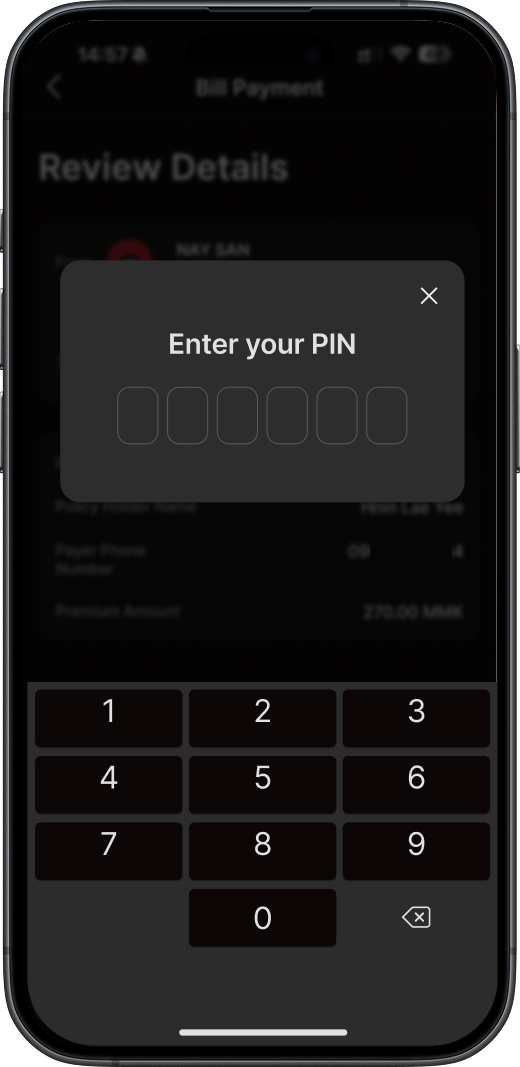

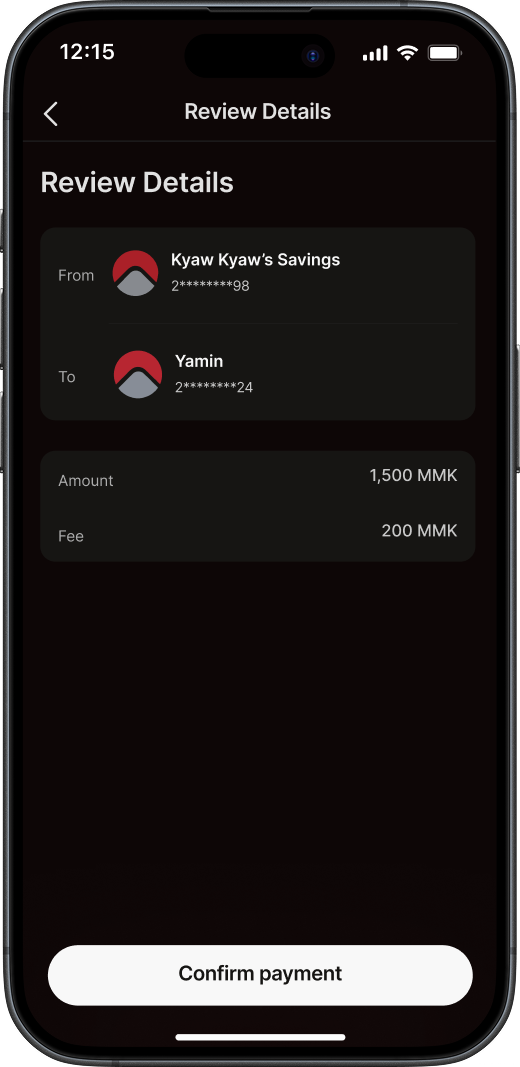

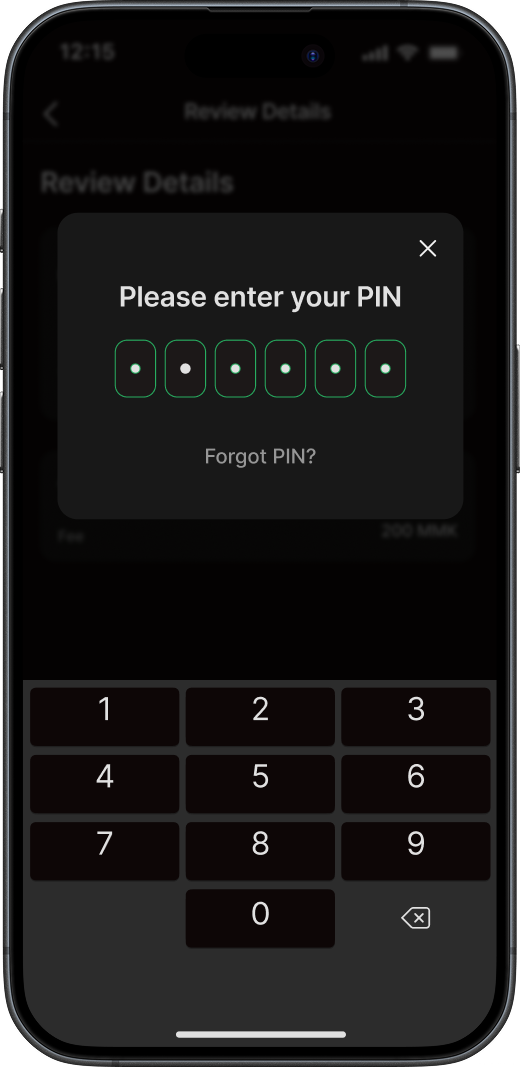

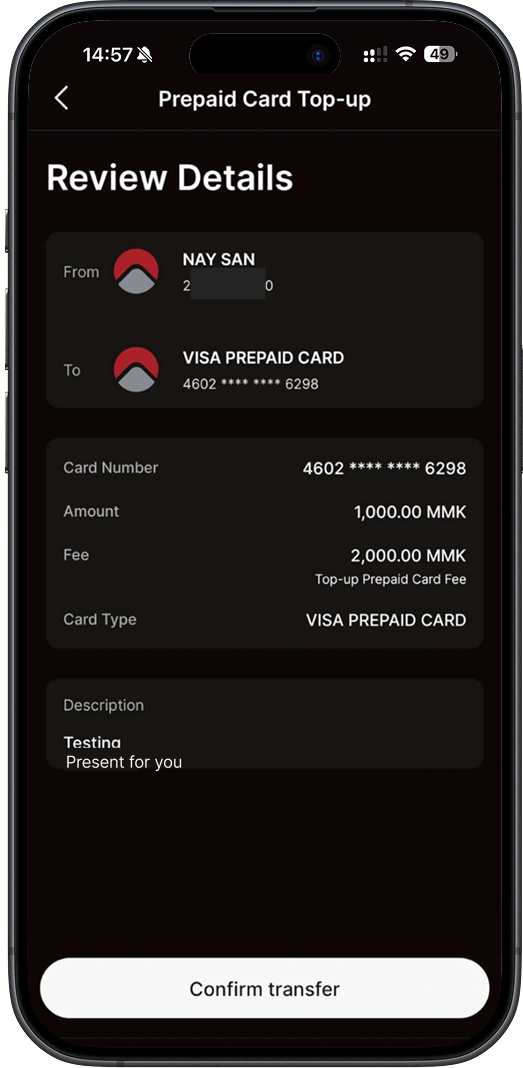

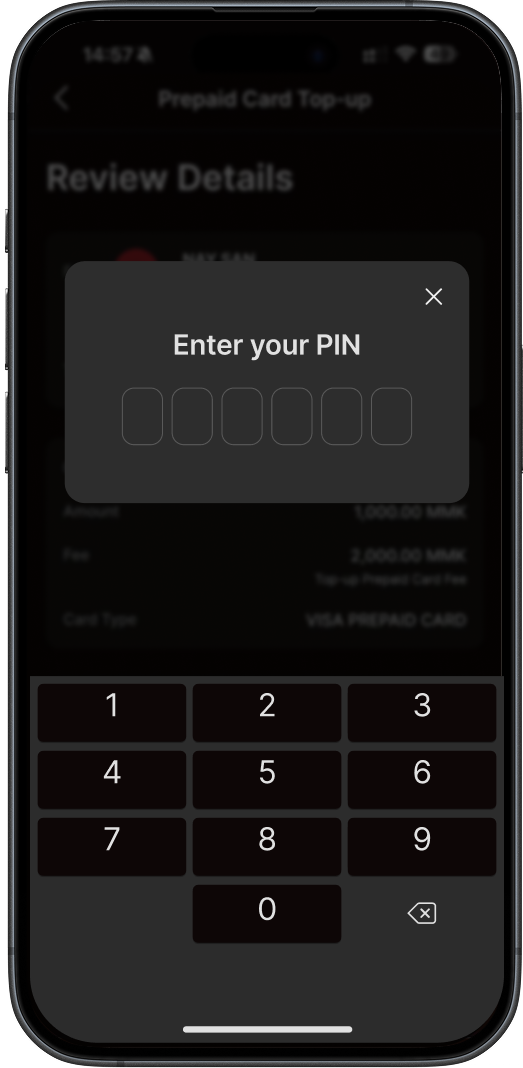

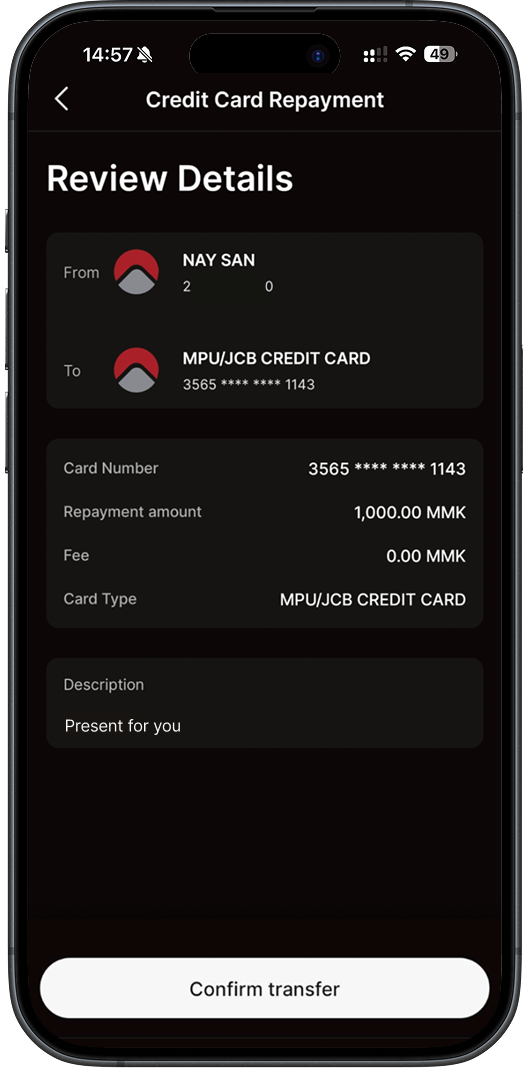

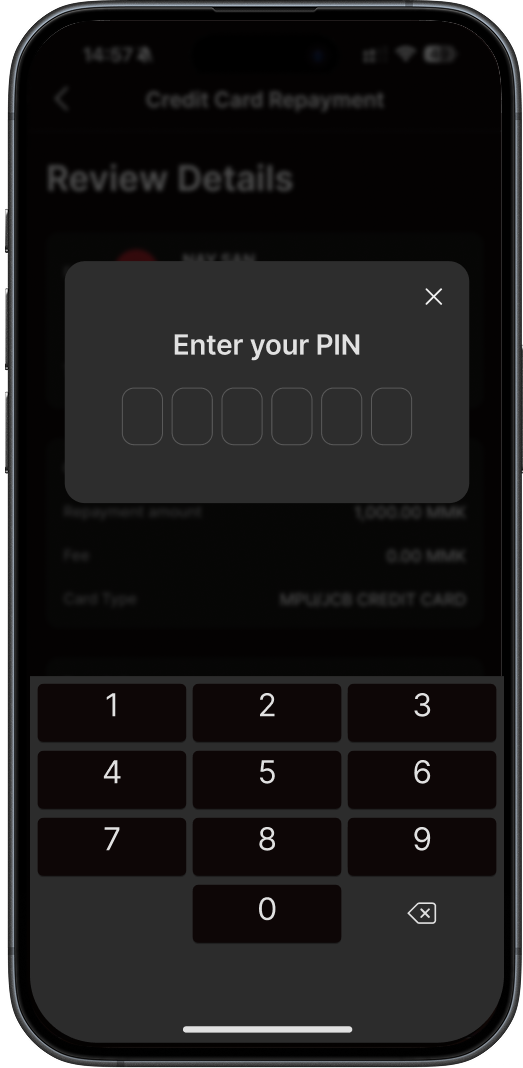

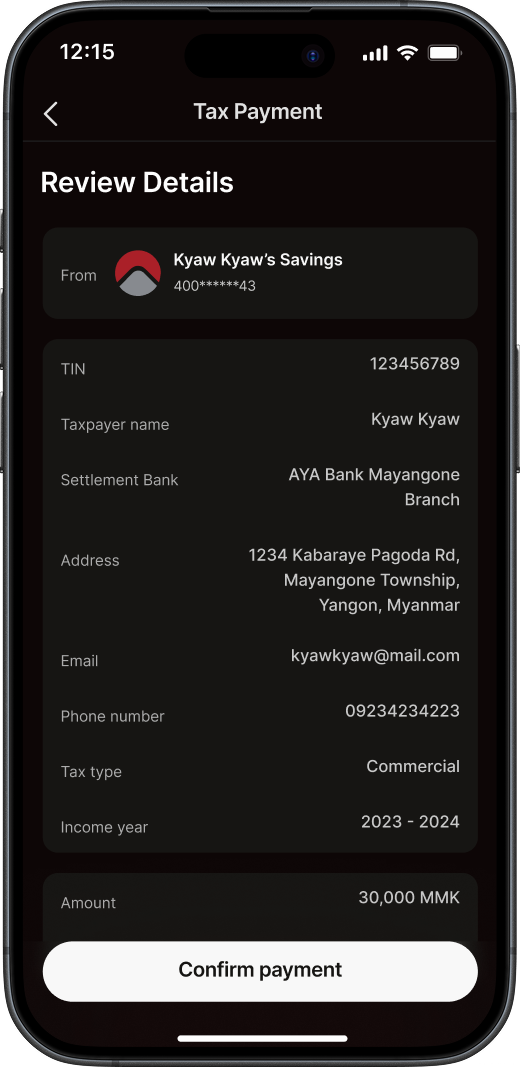

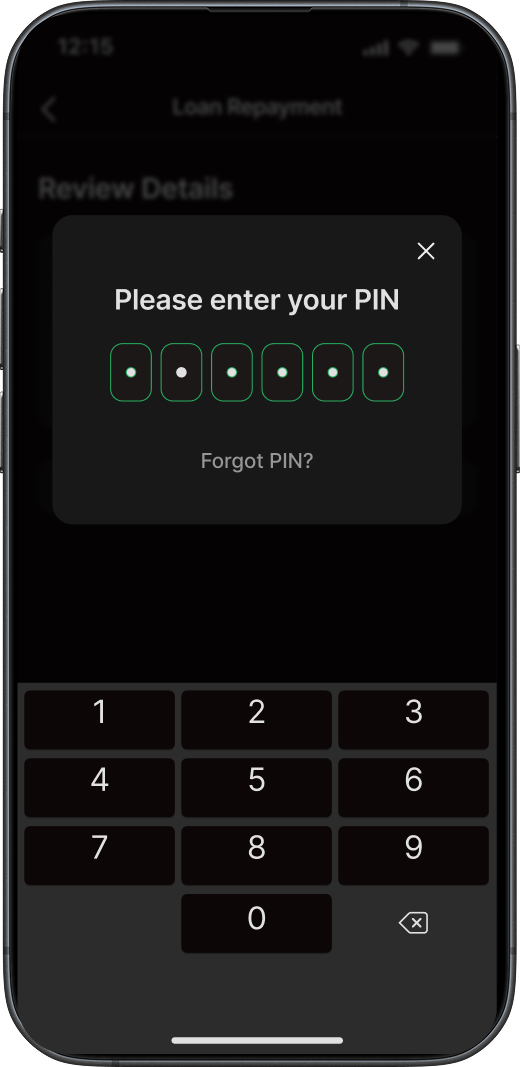

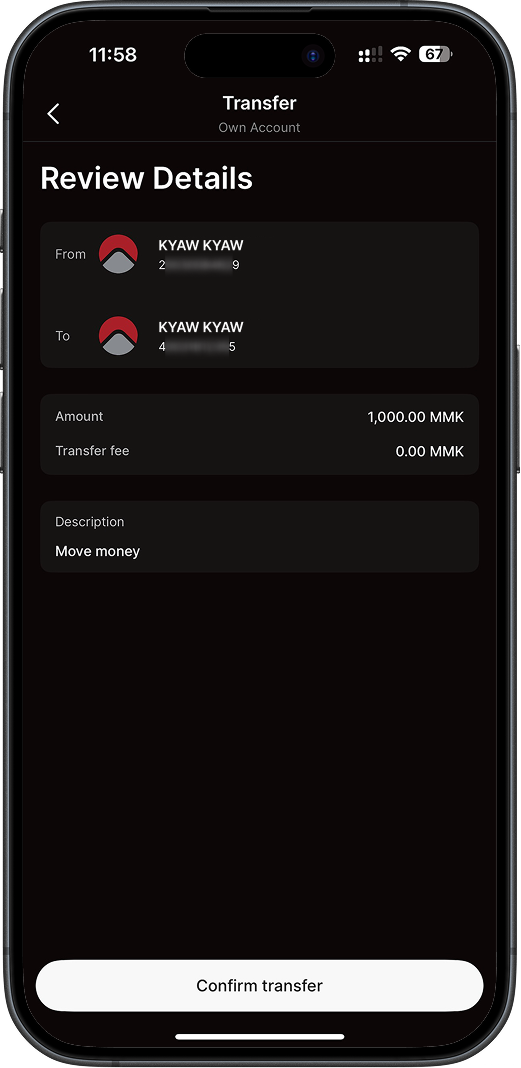

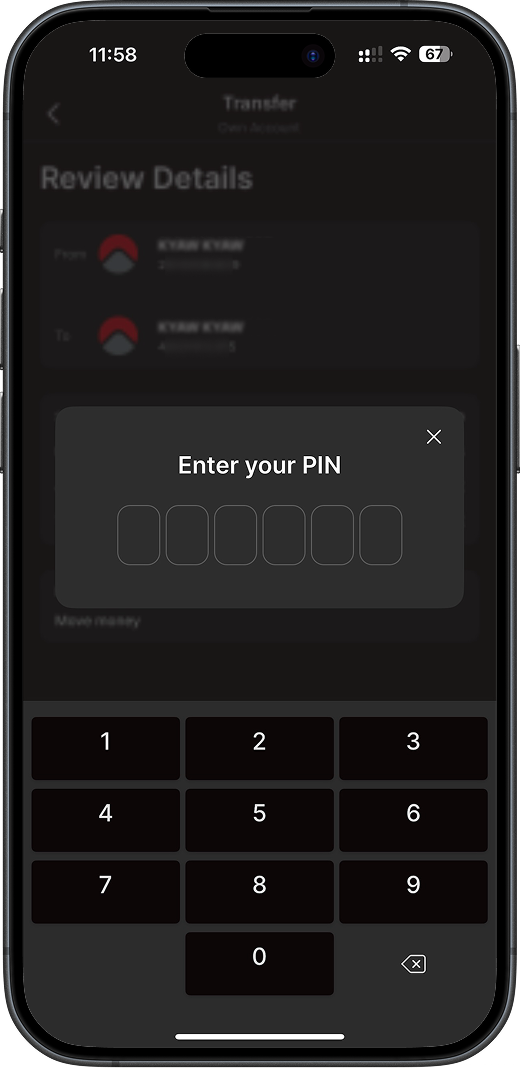

4A

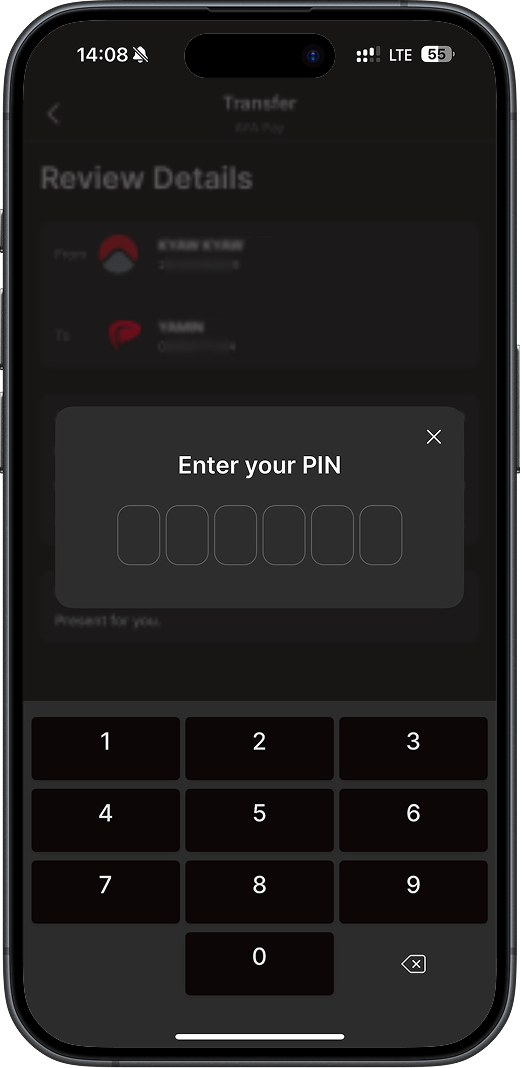

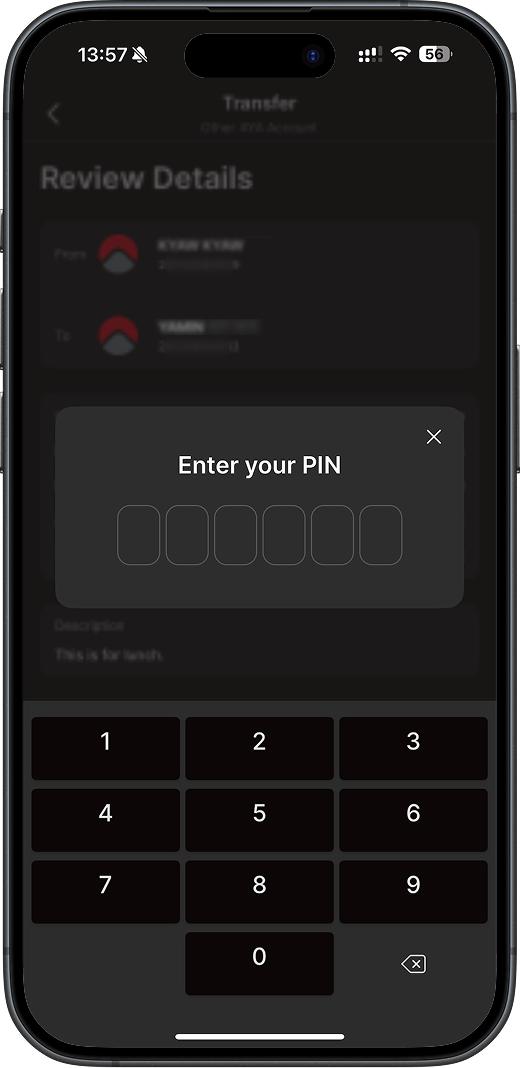

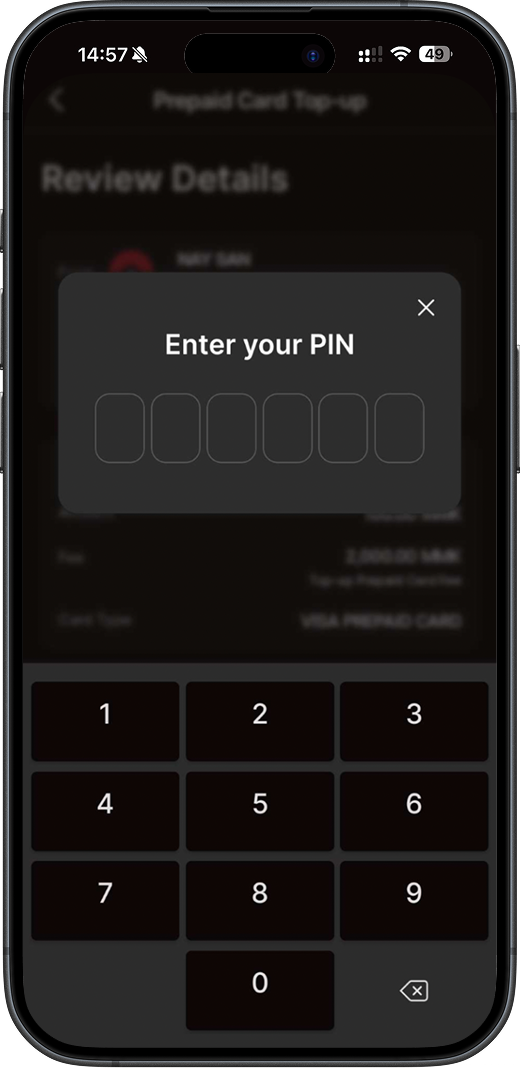

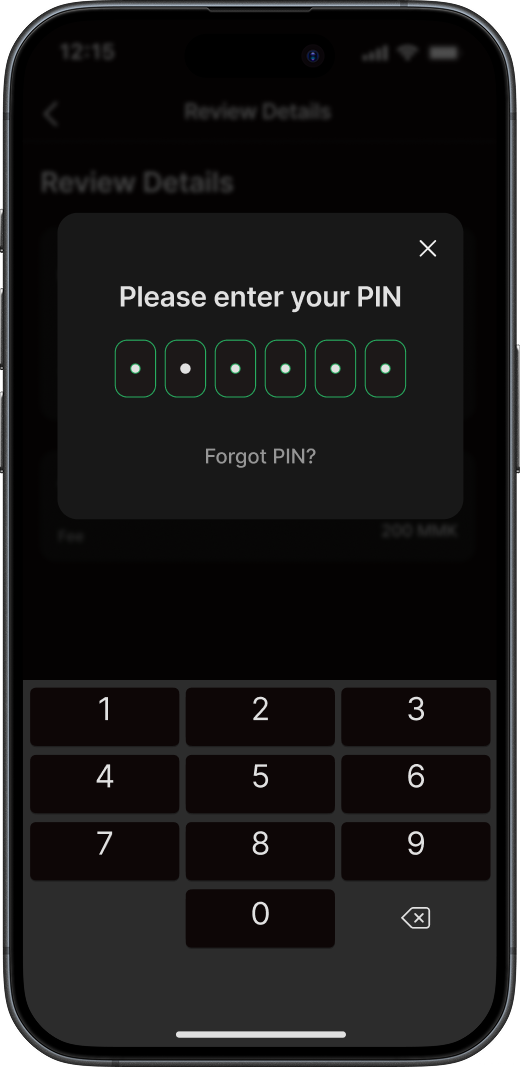

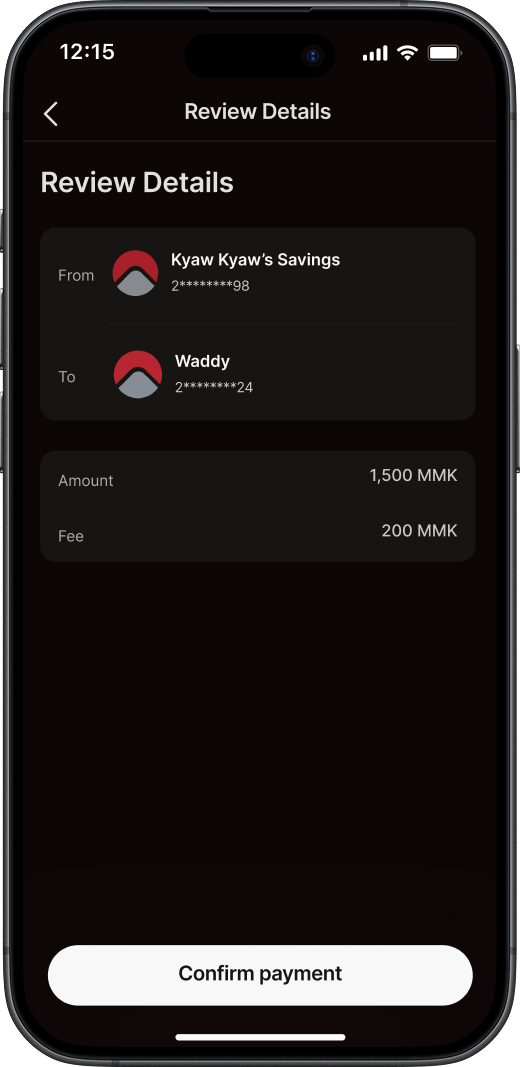

After carefully reviewing the transfer details, click Confirm transfer and verify the transaction by entering your PIN.

4B -

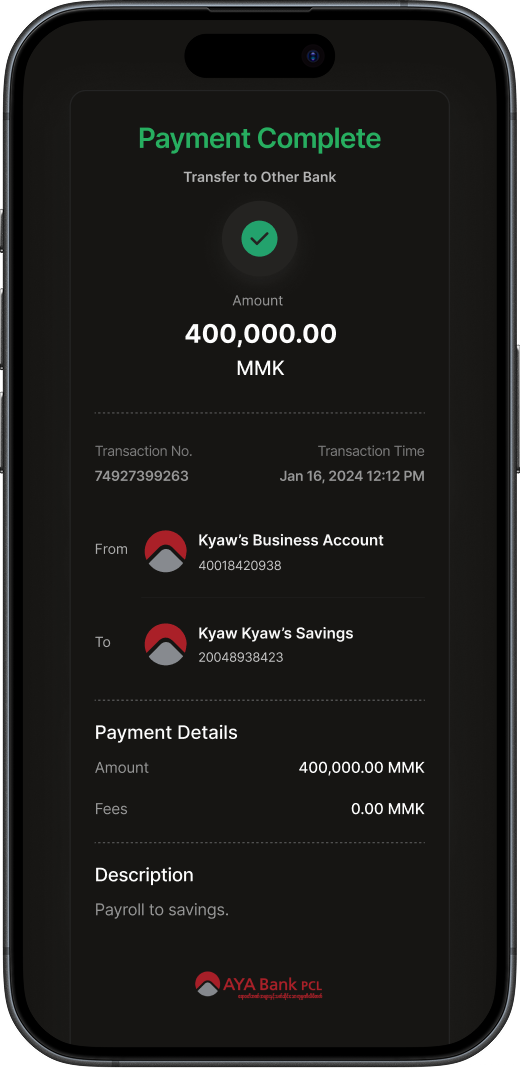

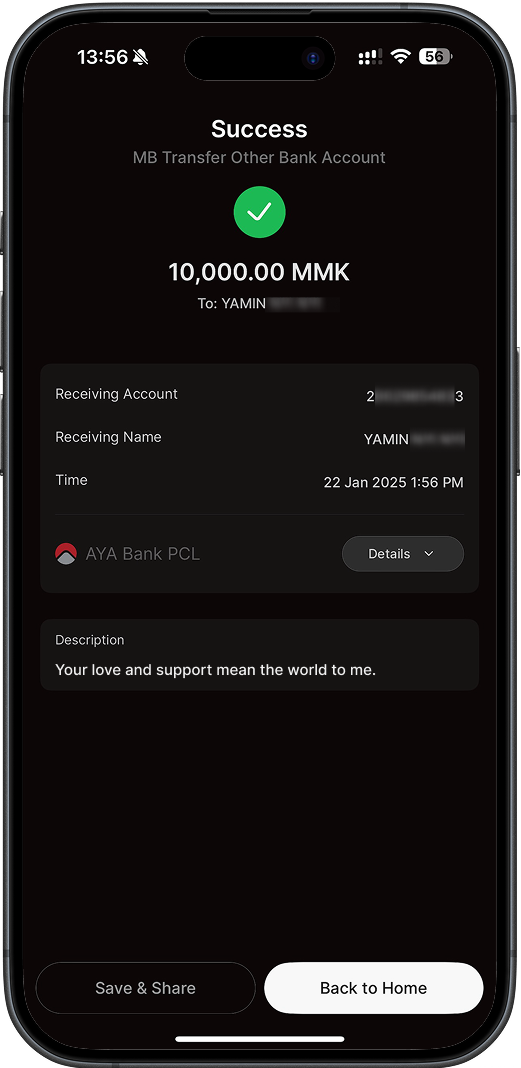

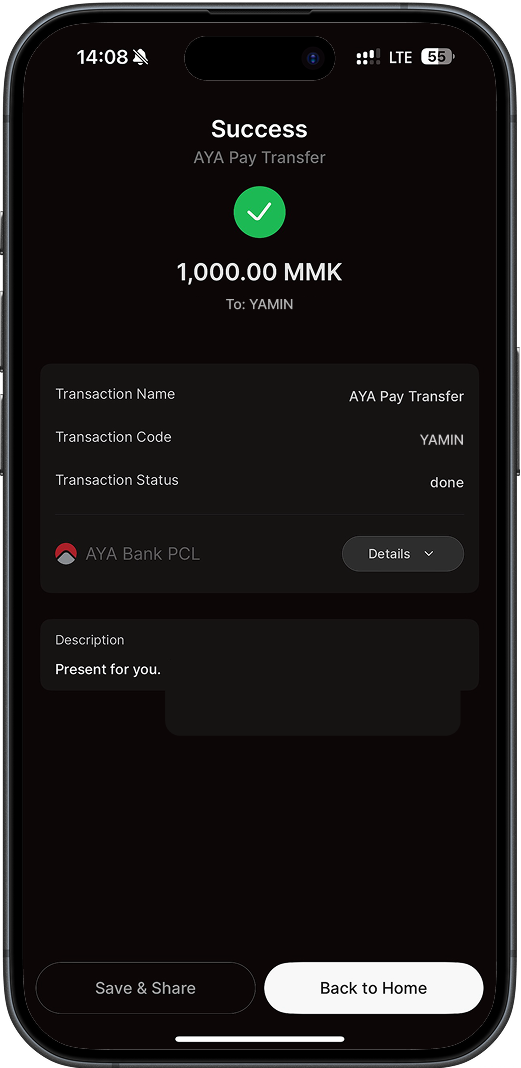

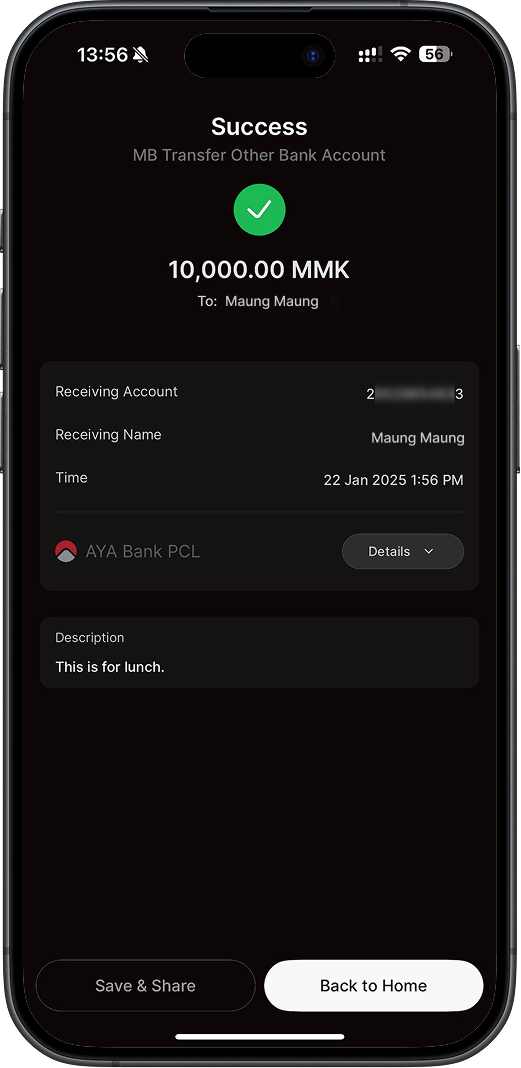

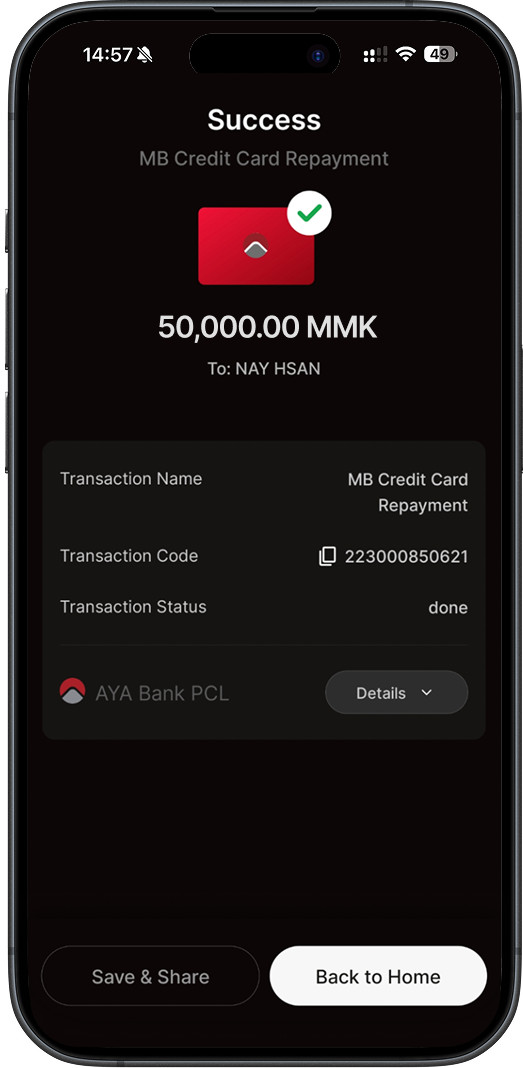

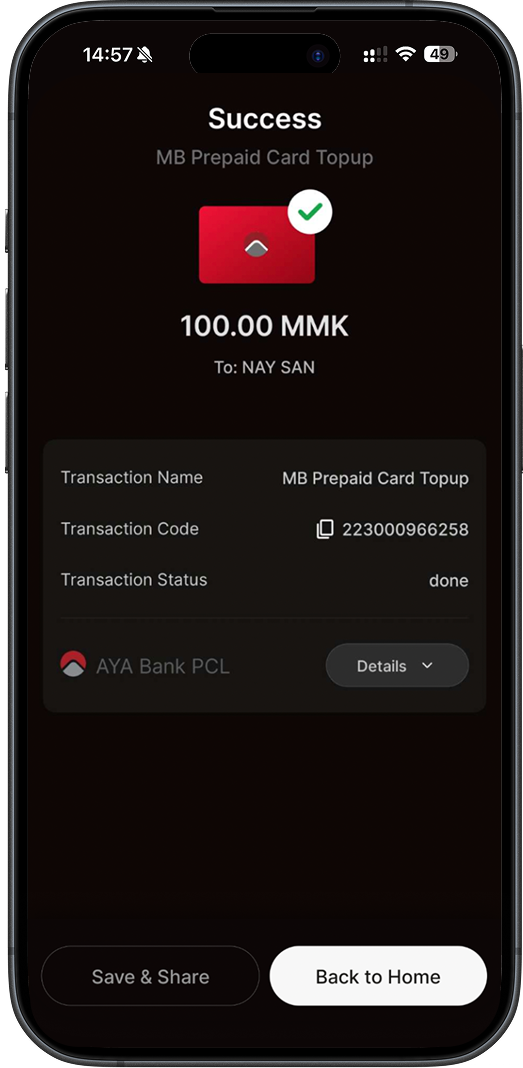

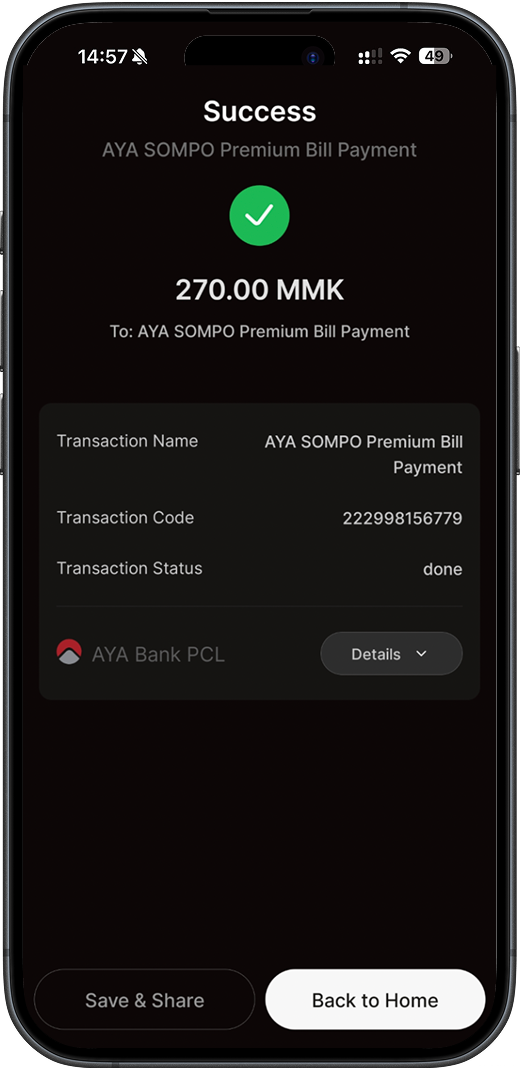

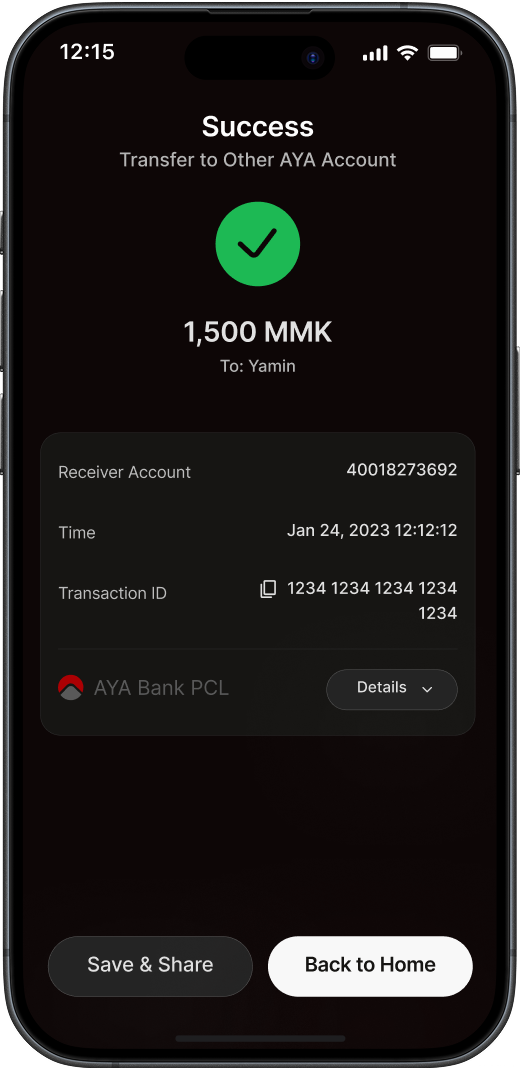

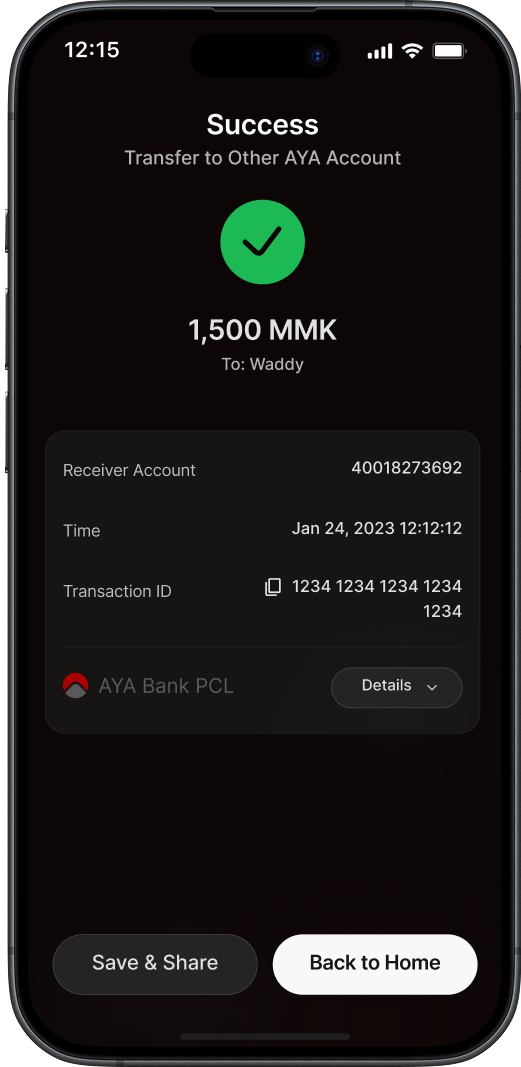

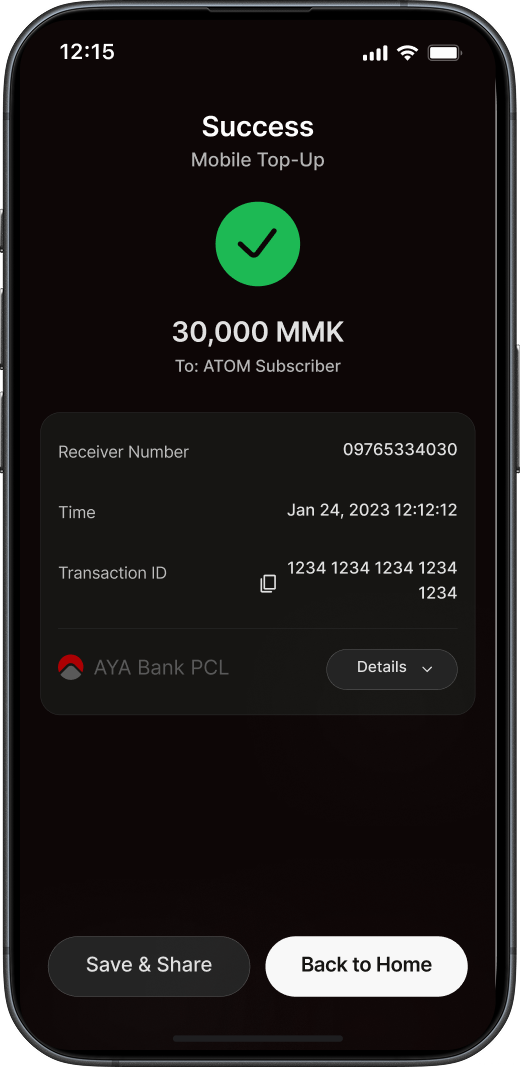

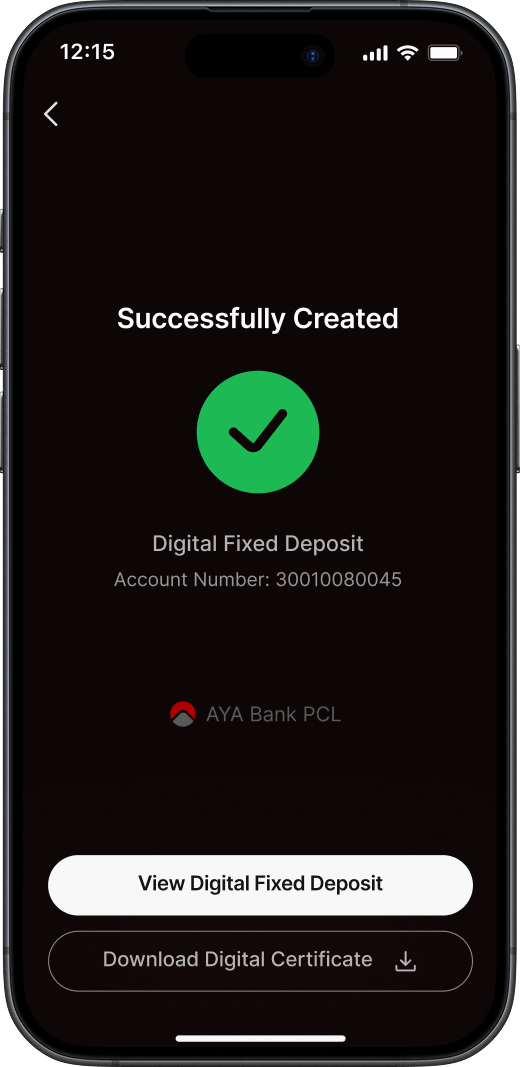

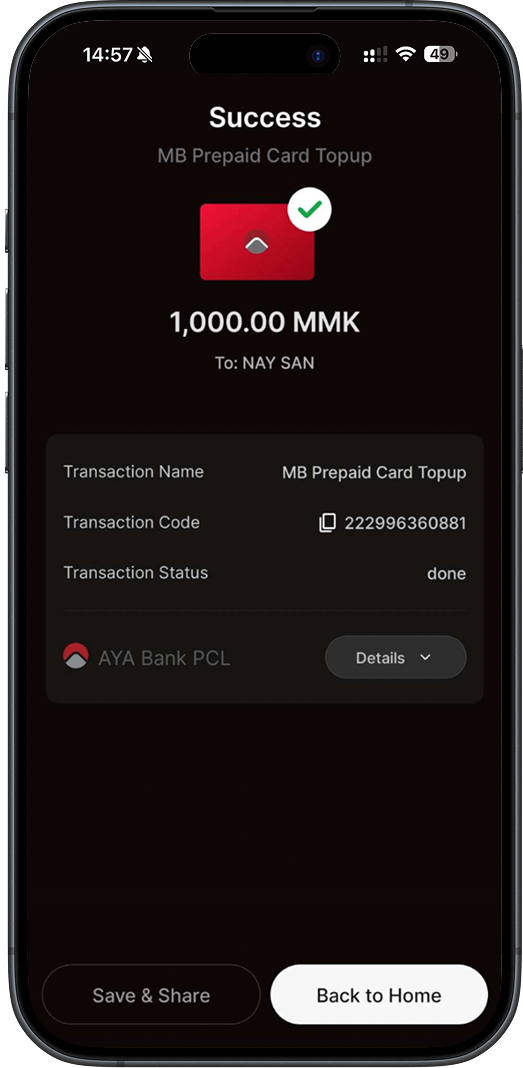

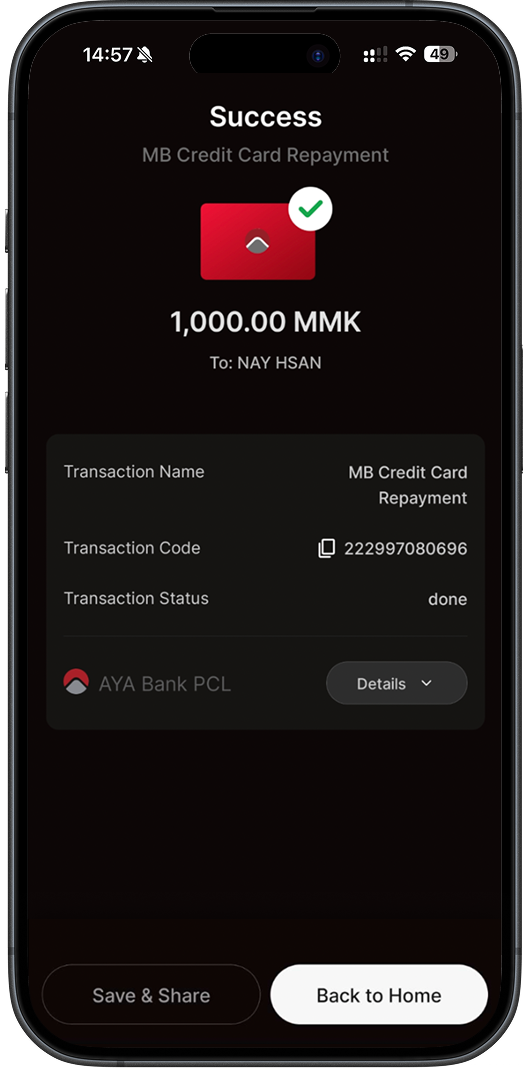

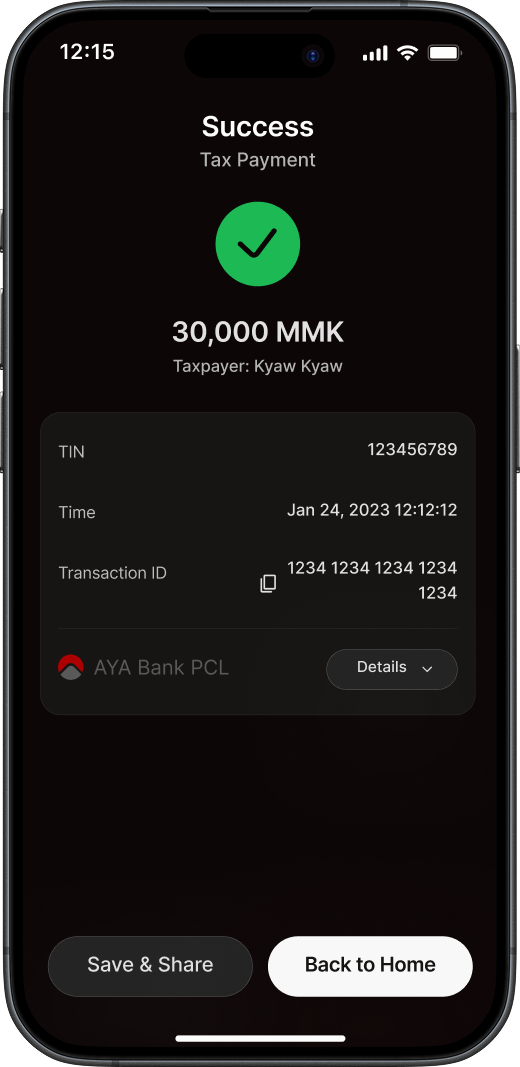

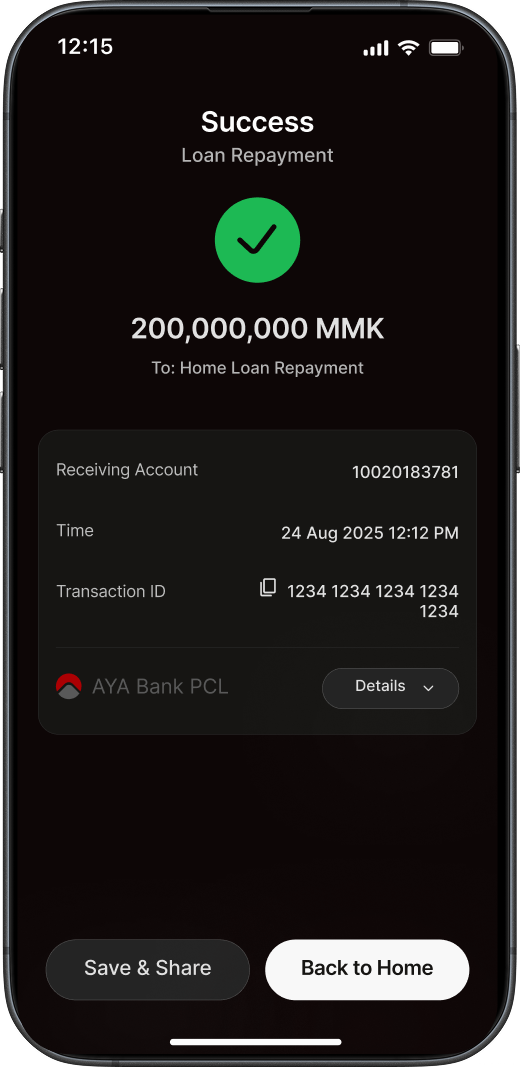

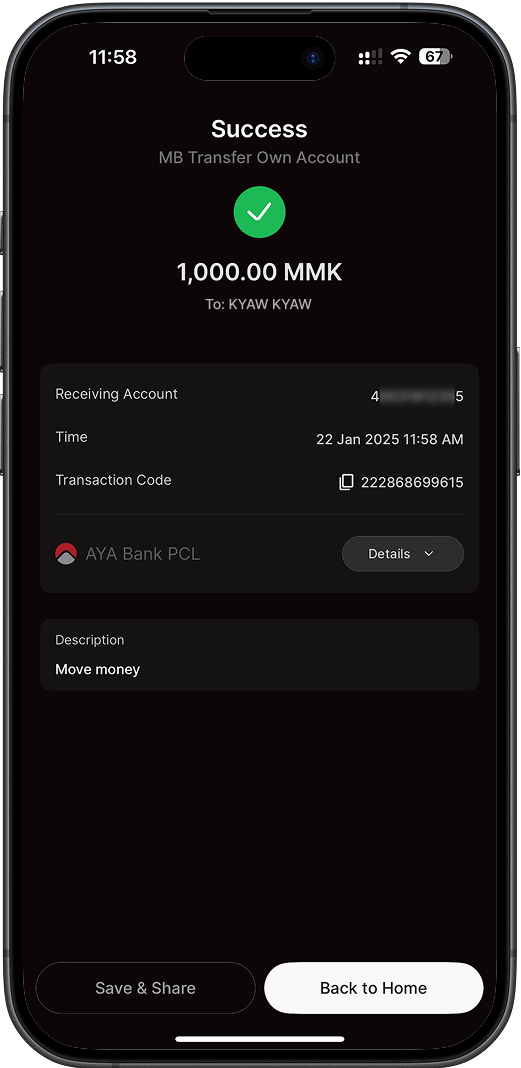

5

If the transfer is successful, the success screen will appear. Click Save & Share to download or share the e-receipt. Click Back to Home to return to the Home page.

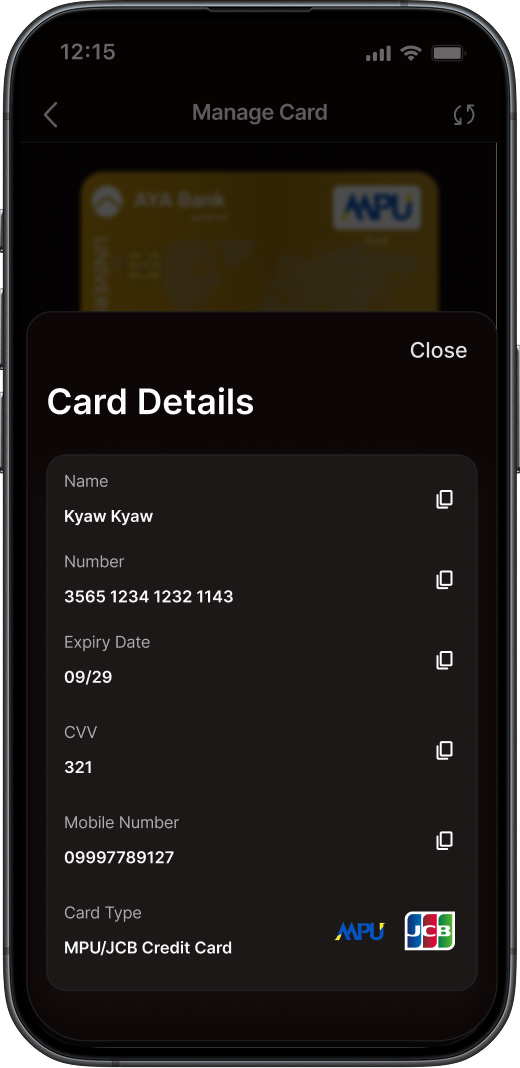

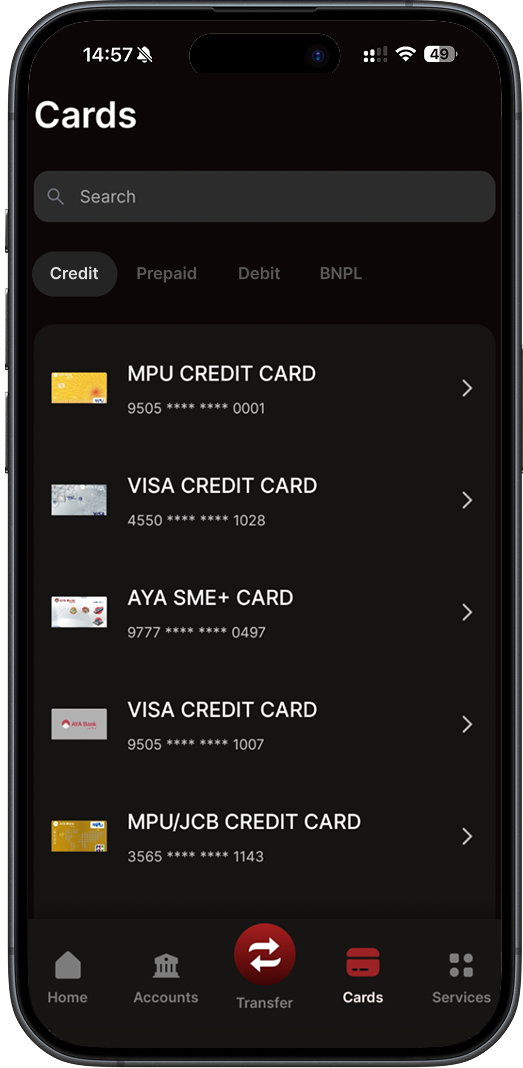

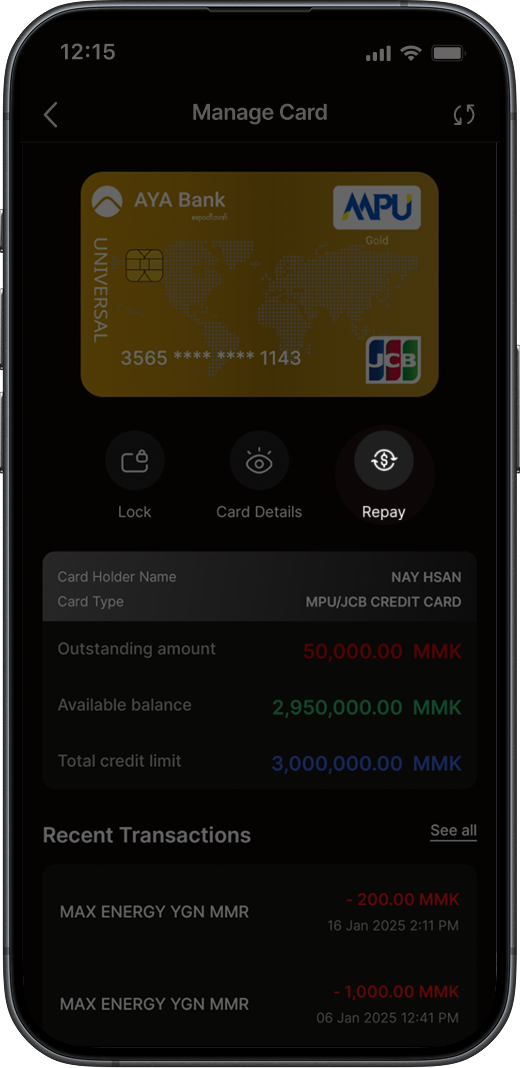

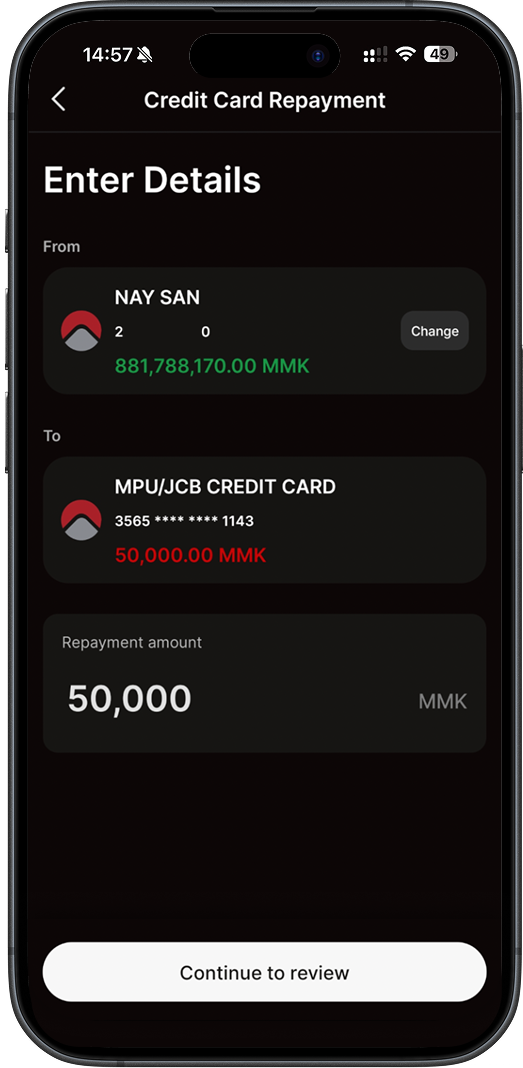

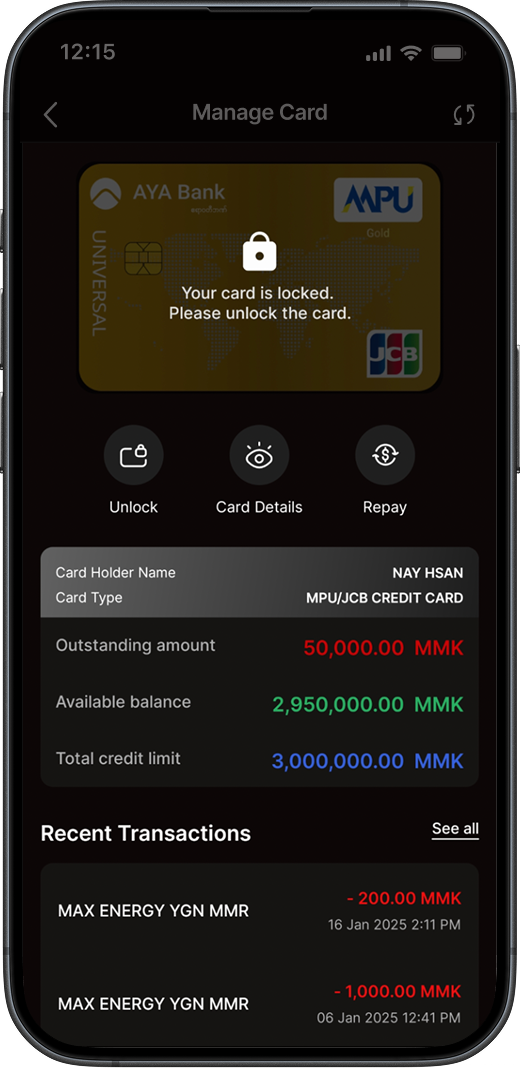

How To Manage Cards

Click on the steps to view screens

-

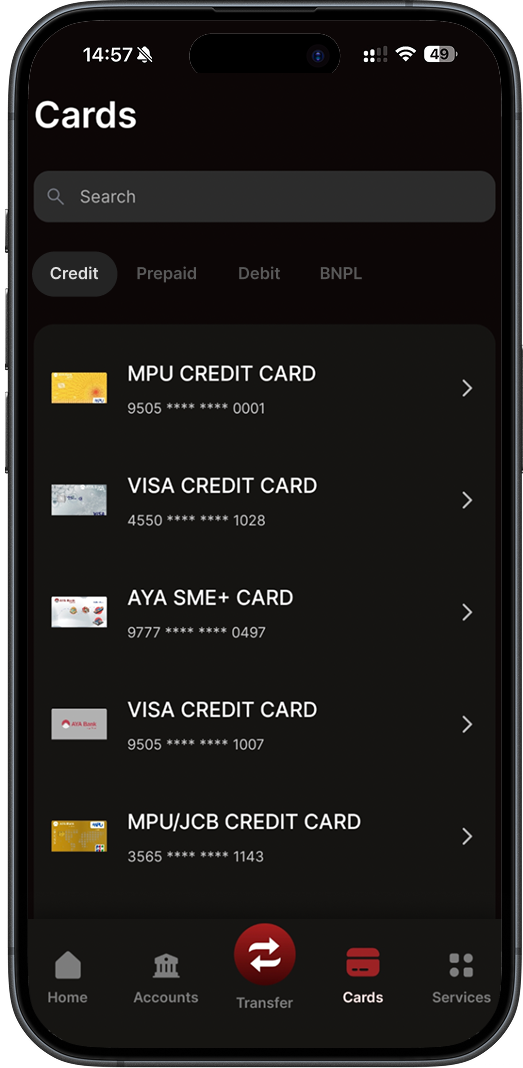

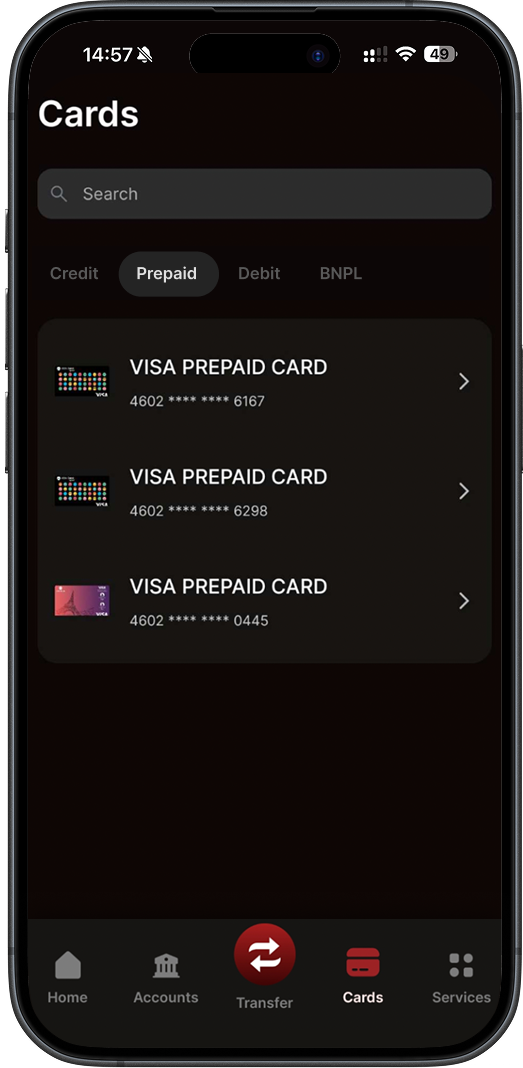

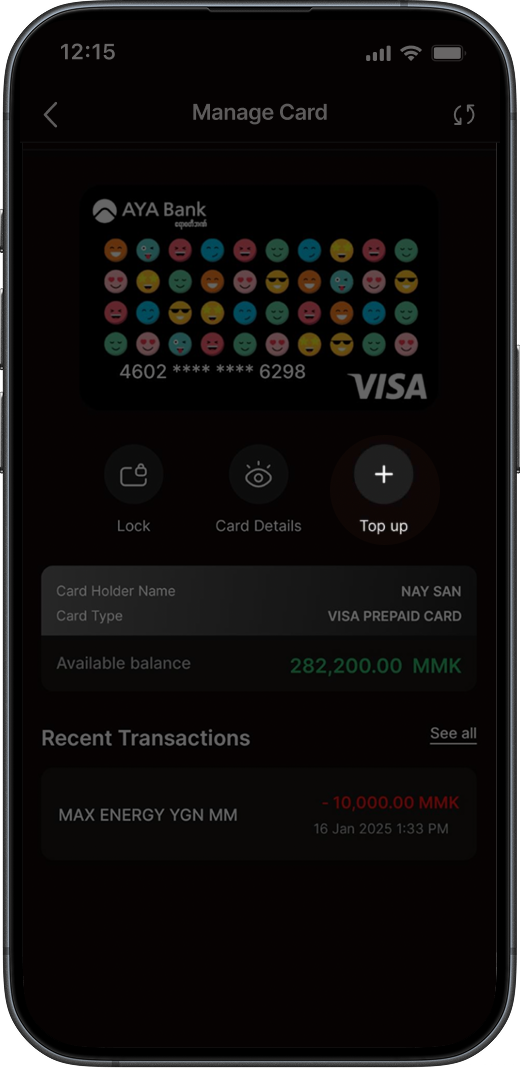

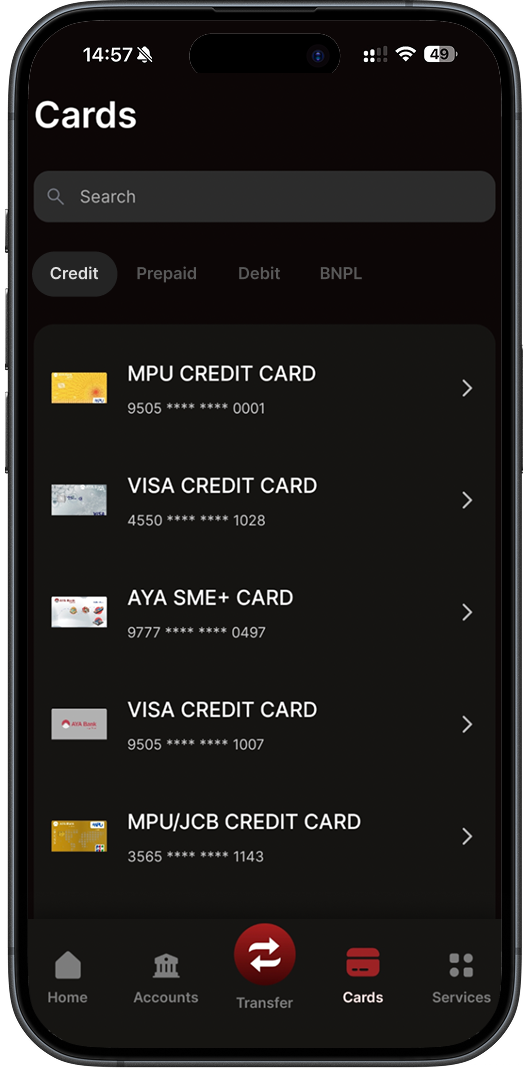

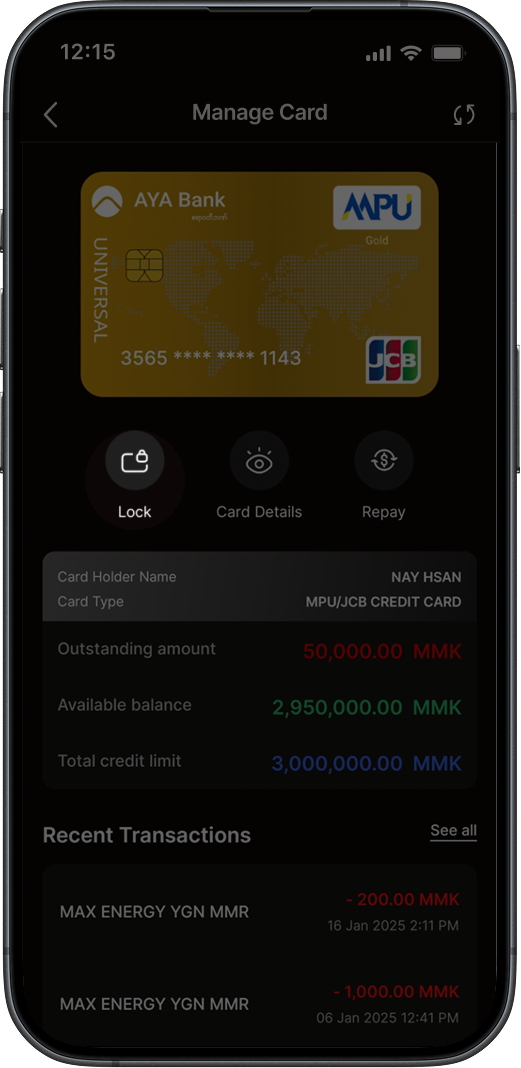

1

Go to the Cards page and click on a card.

-

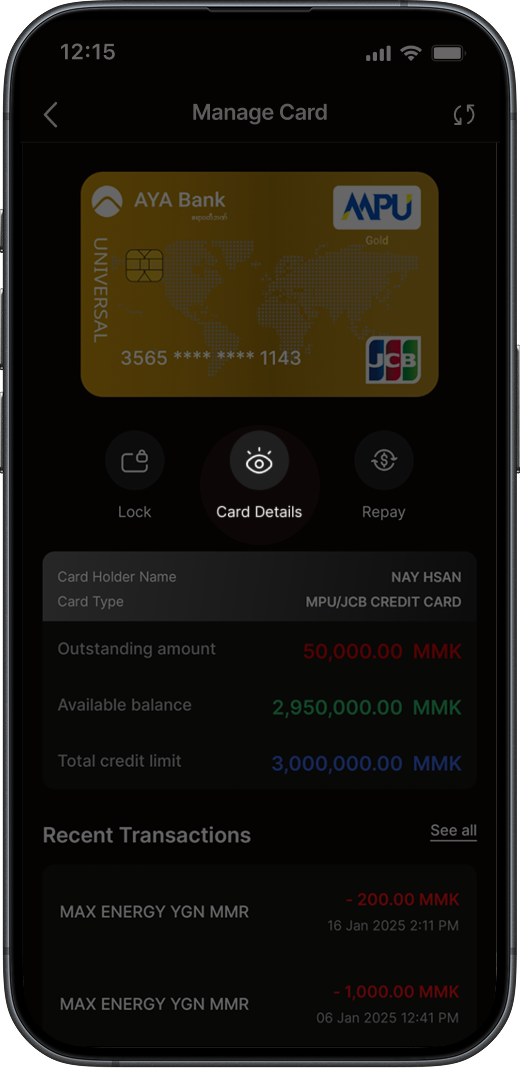

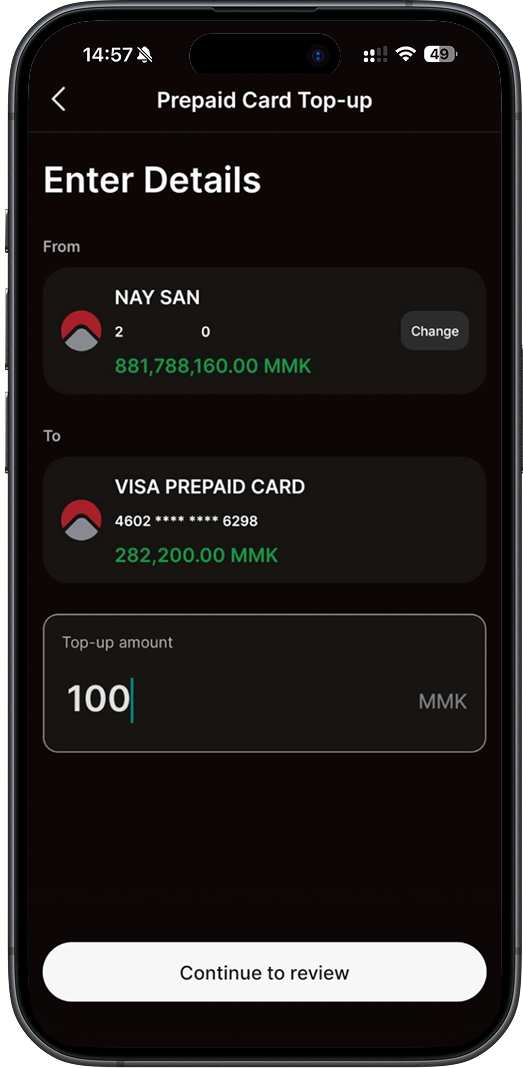

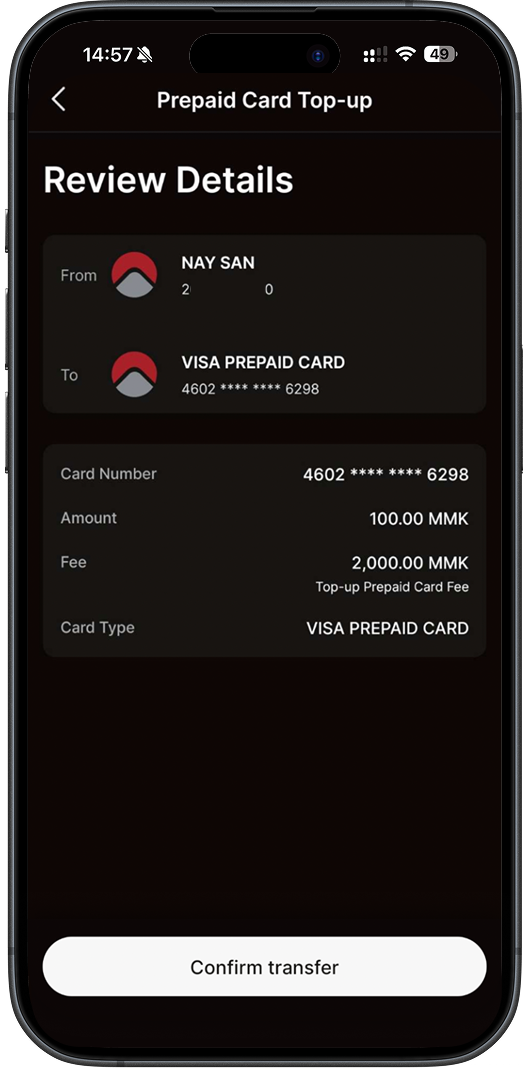

2

In the Manage Cards page, tap Lock to lock your card and tap Confirm to proceed

-

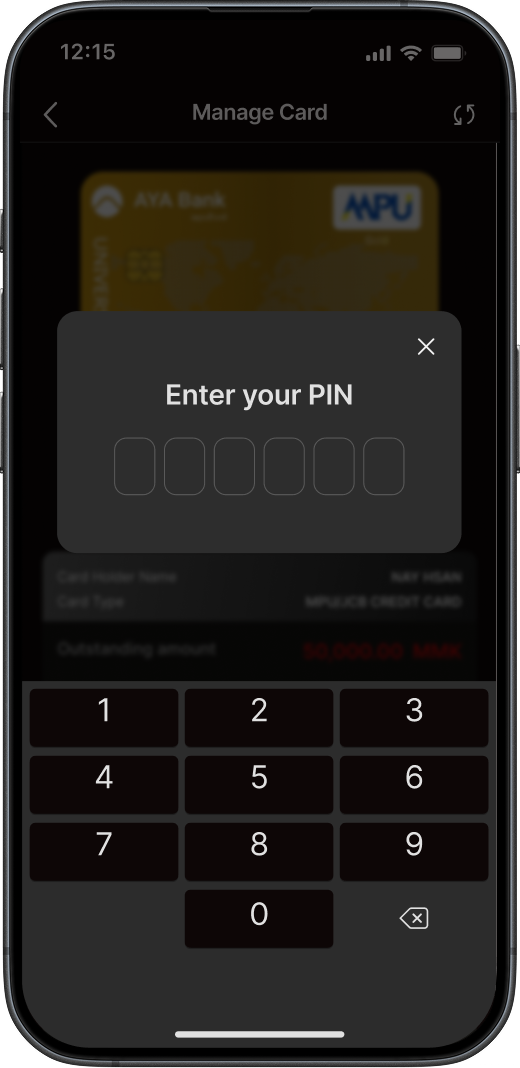

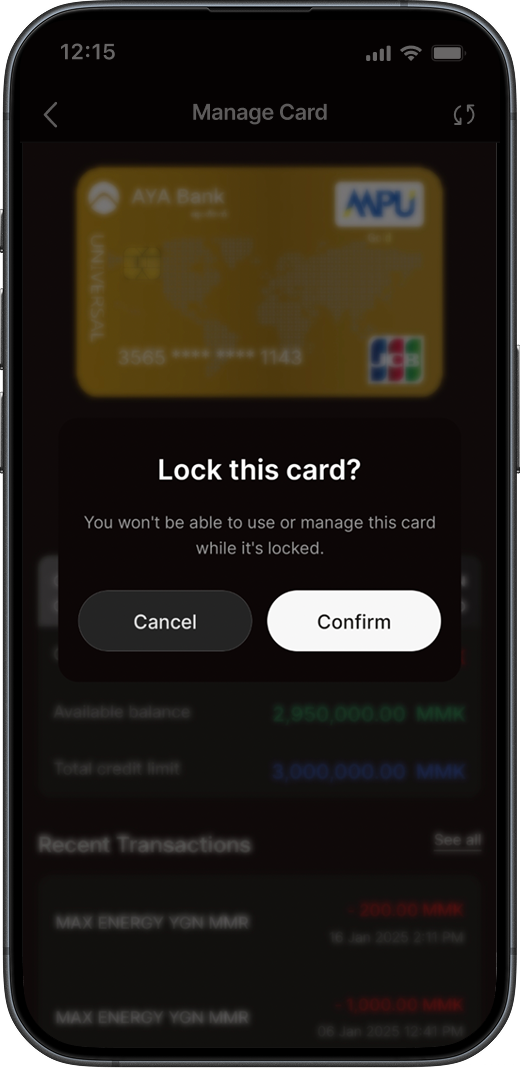

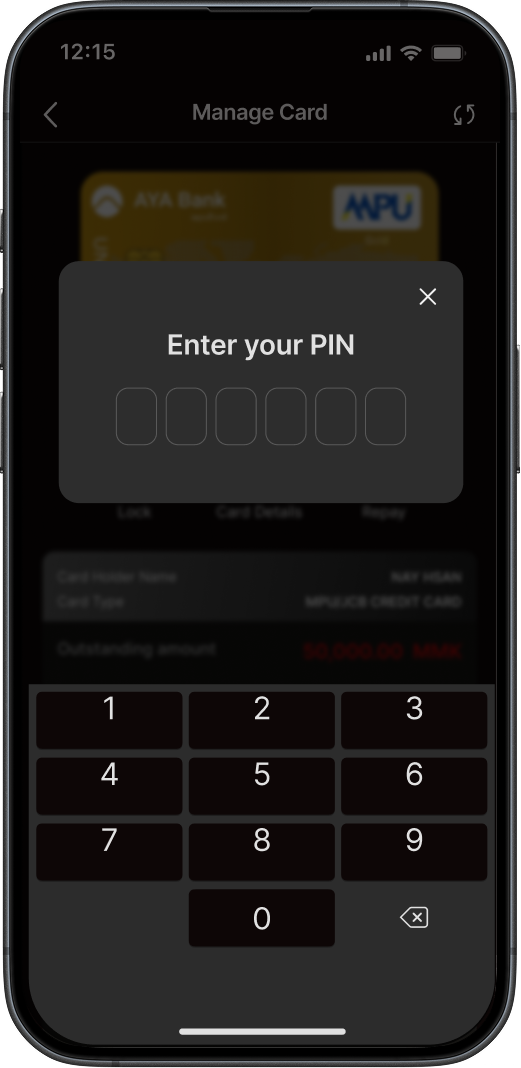

3A

In the pop-up box, click Confirm to continue and enter your PIN to authorize this action.

3B -

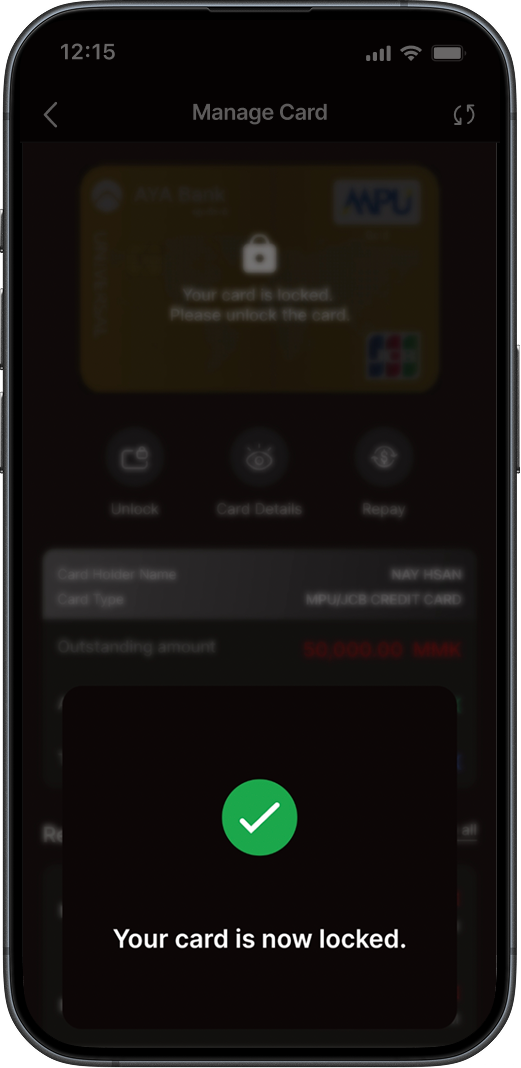

4

Once your card is locked, card usage and management will be disabled.

-

5

To unlock your card, tap Unlock to lock your card, tap Confirm in the pop-up box to proceed, and enter your PIN.

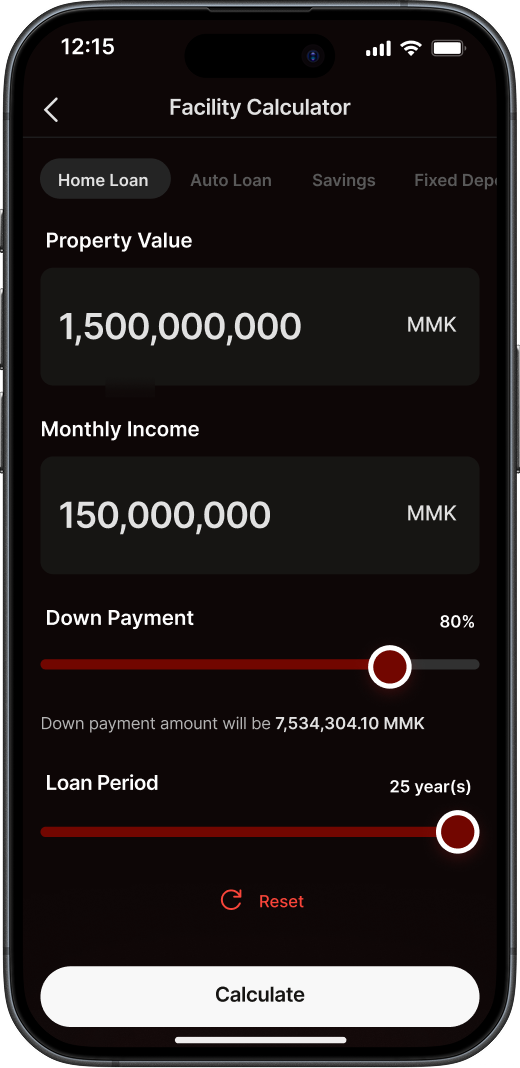

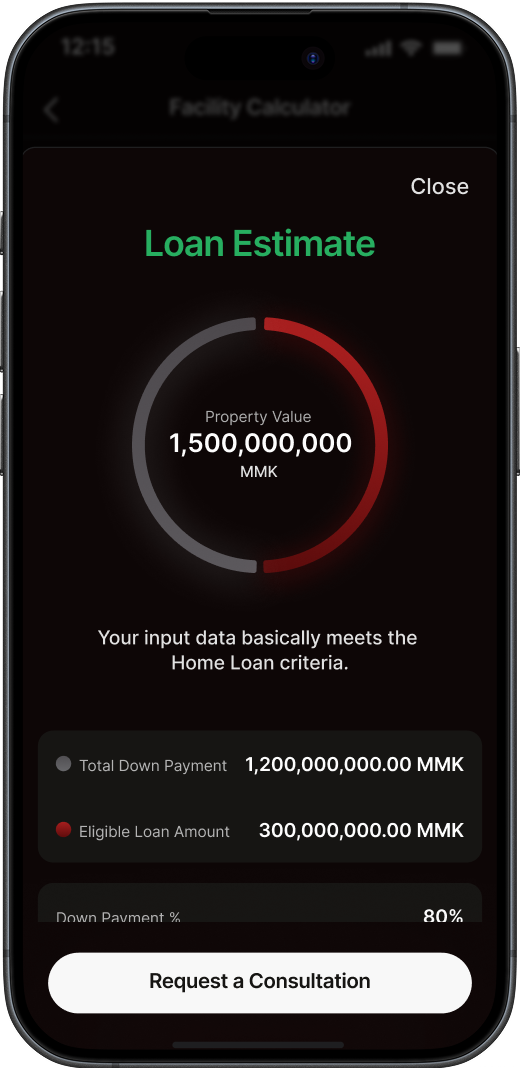

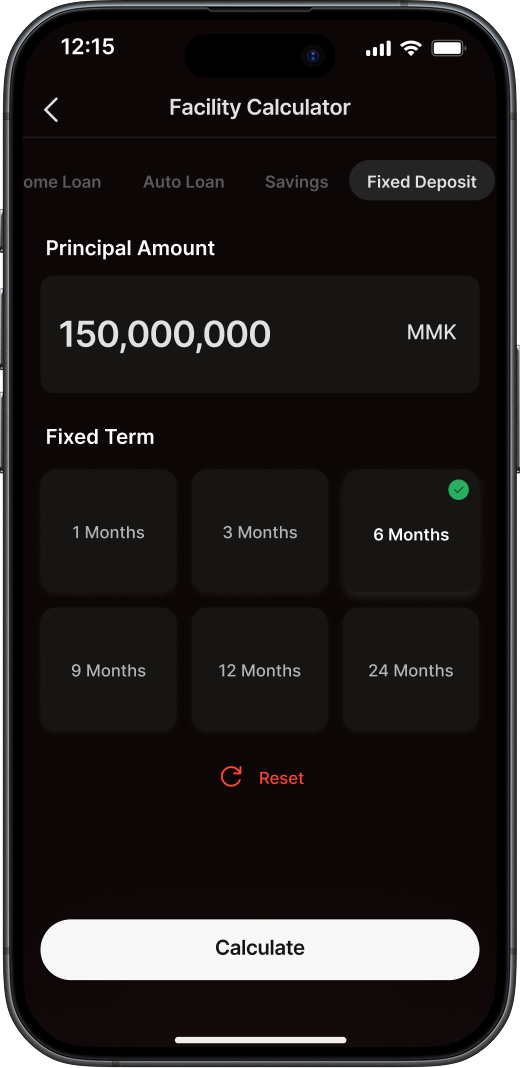

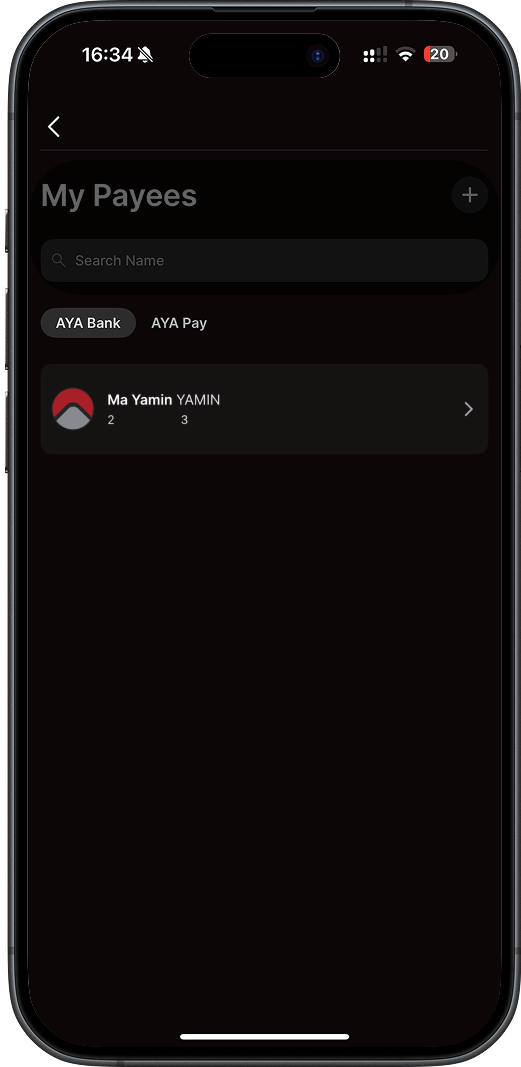

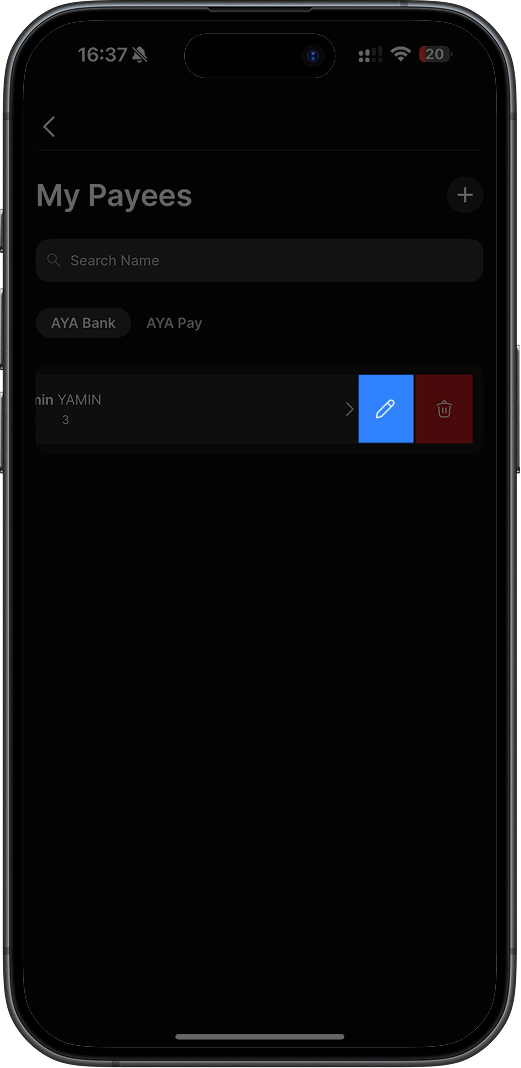

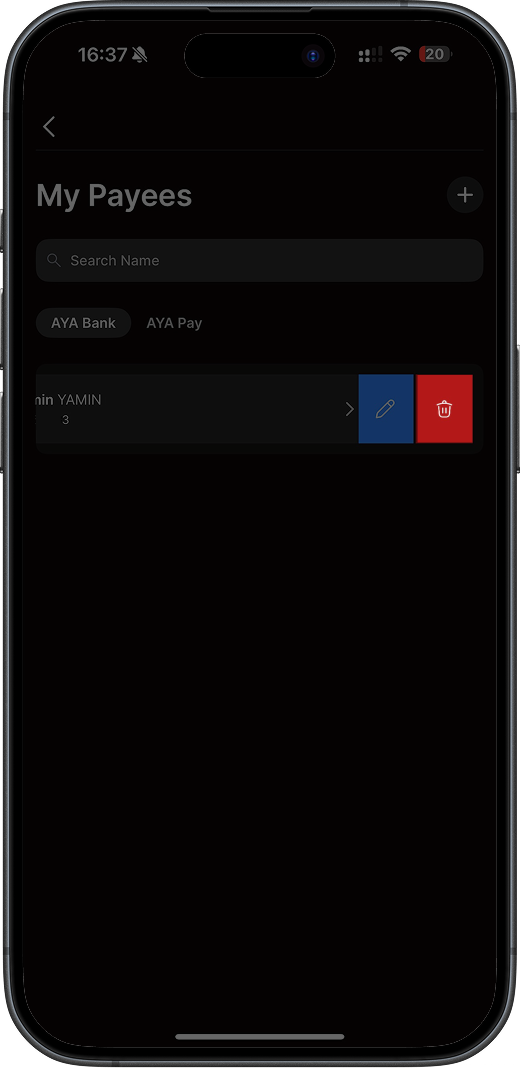

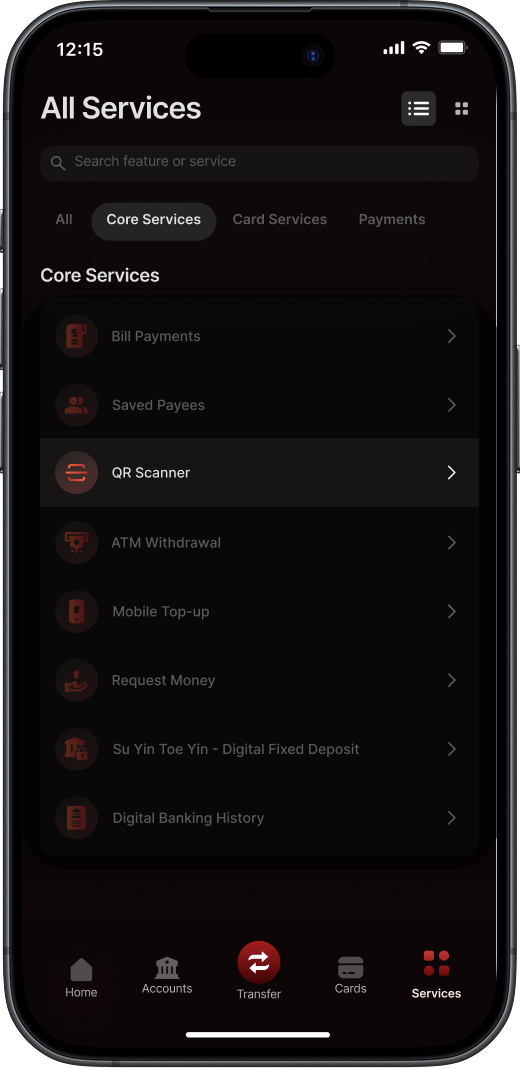

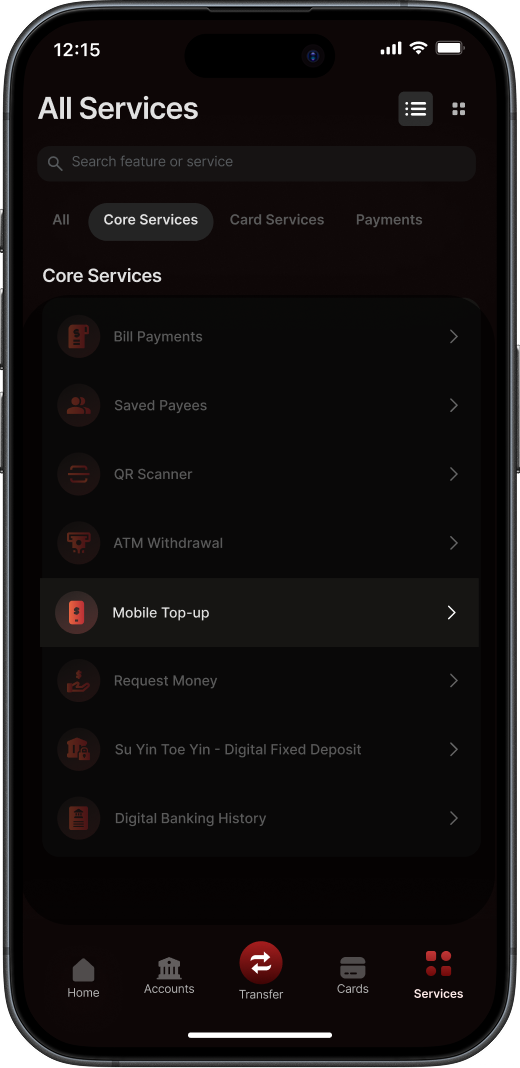

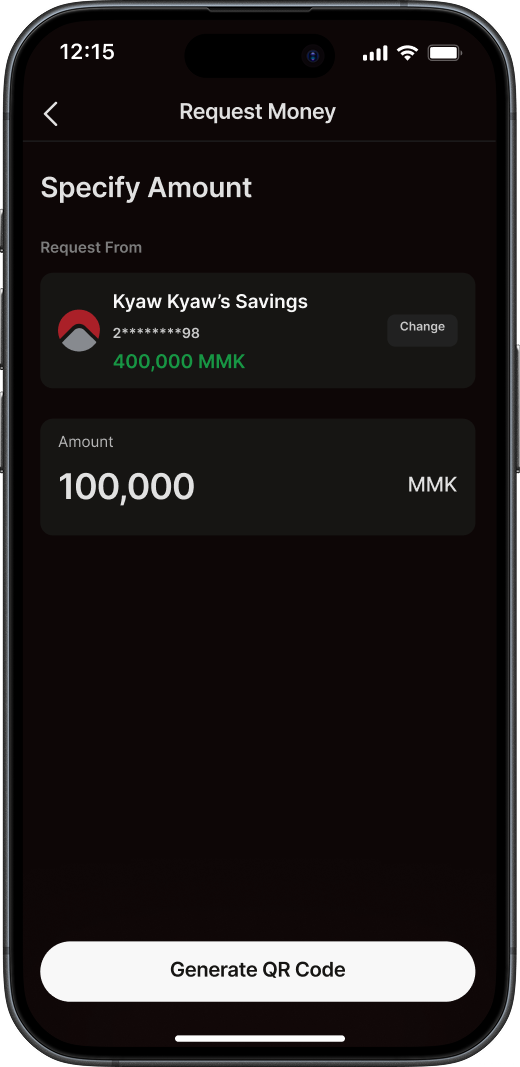

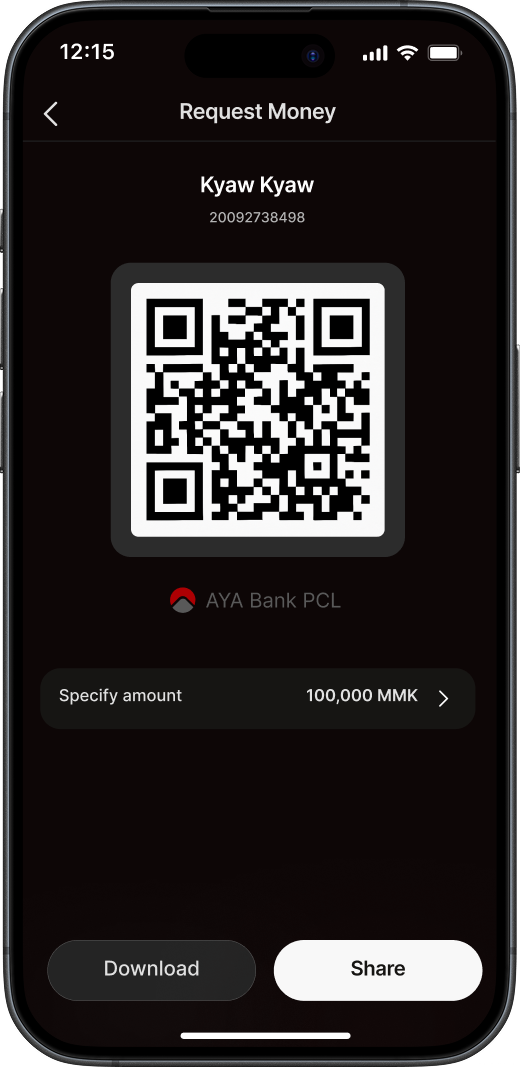

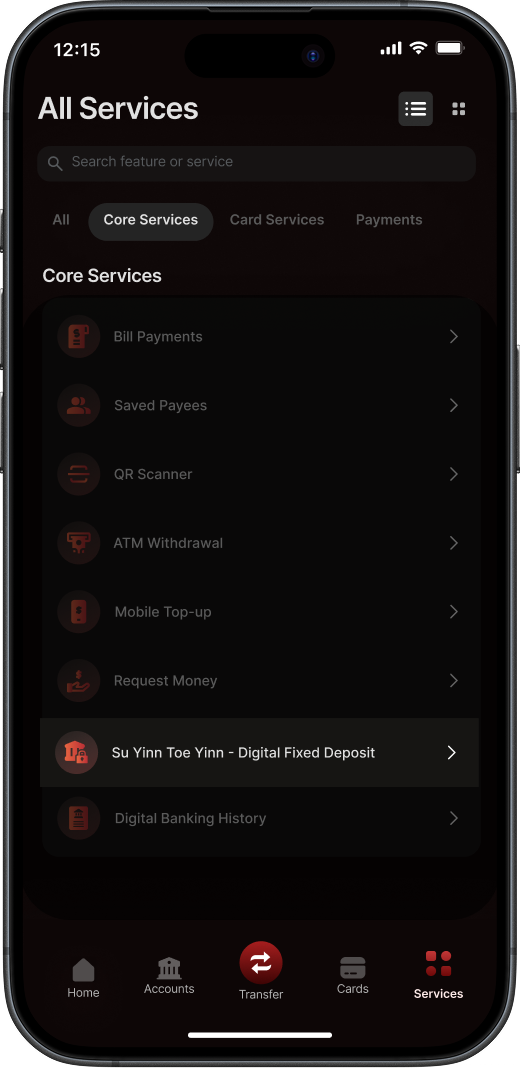

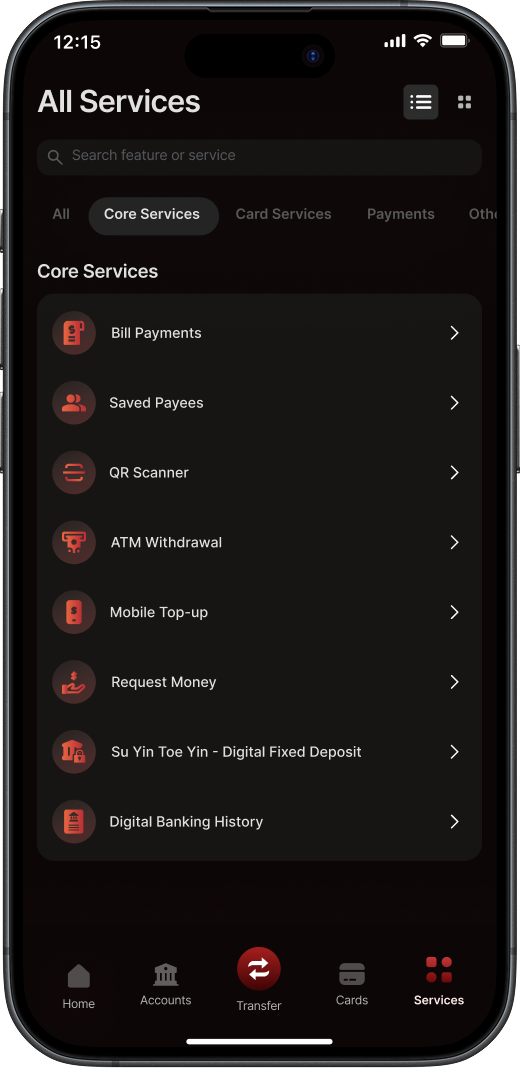

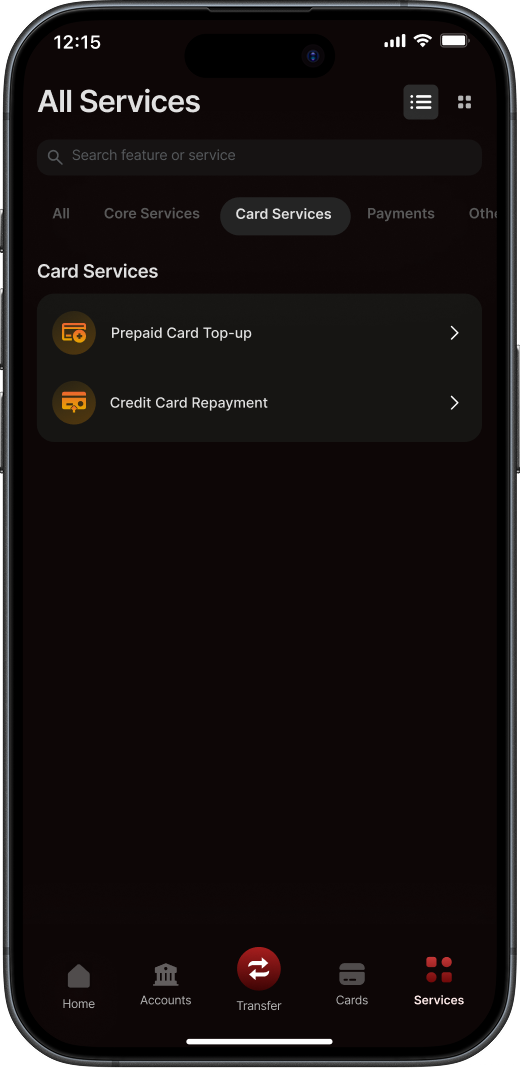

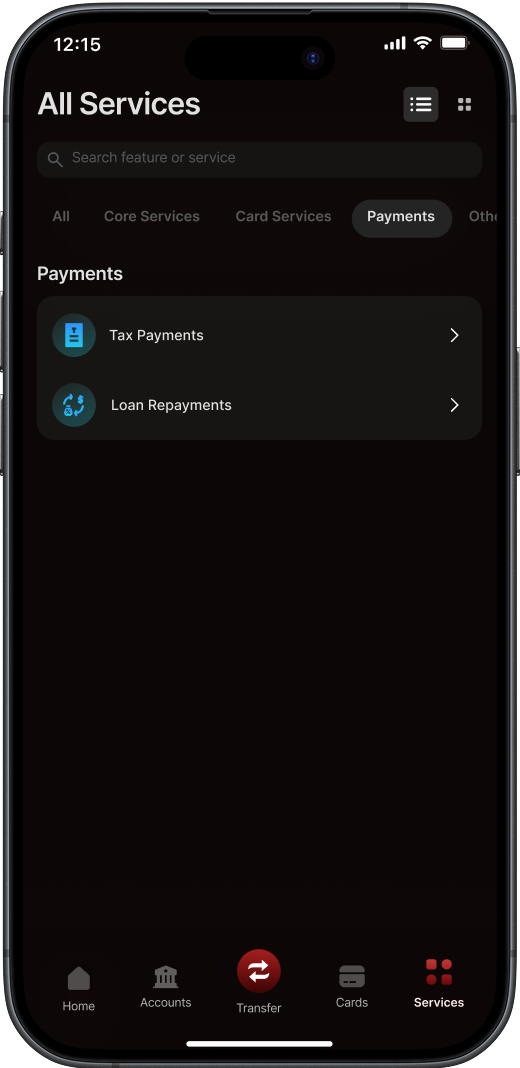

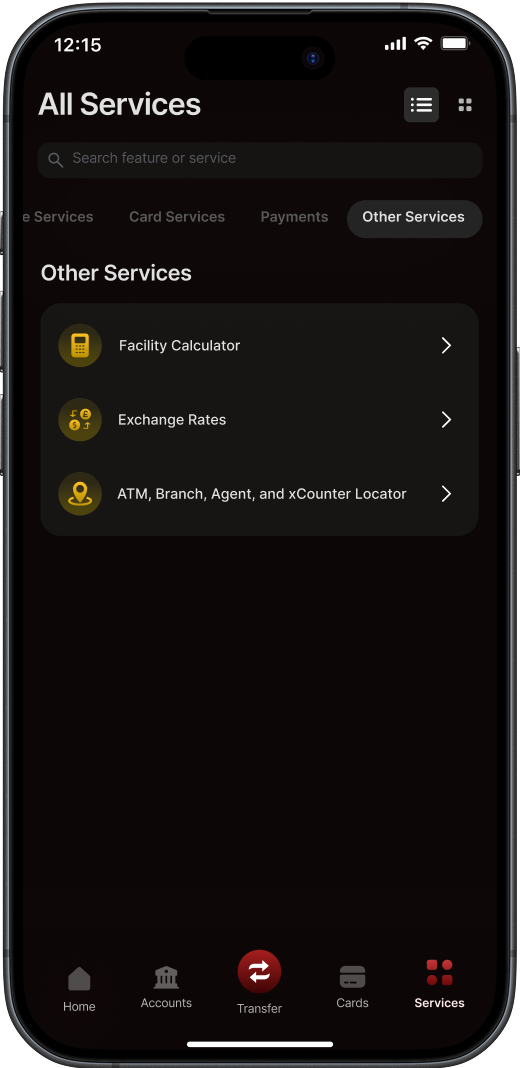

How To Use Functions Under 'All Services'

Click on the steps to view screens

-

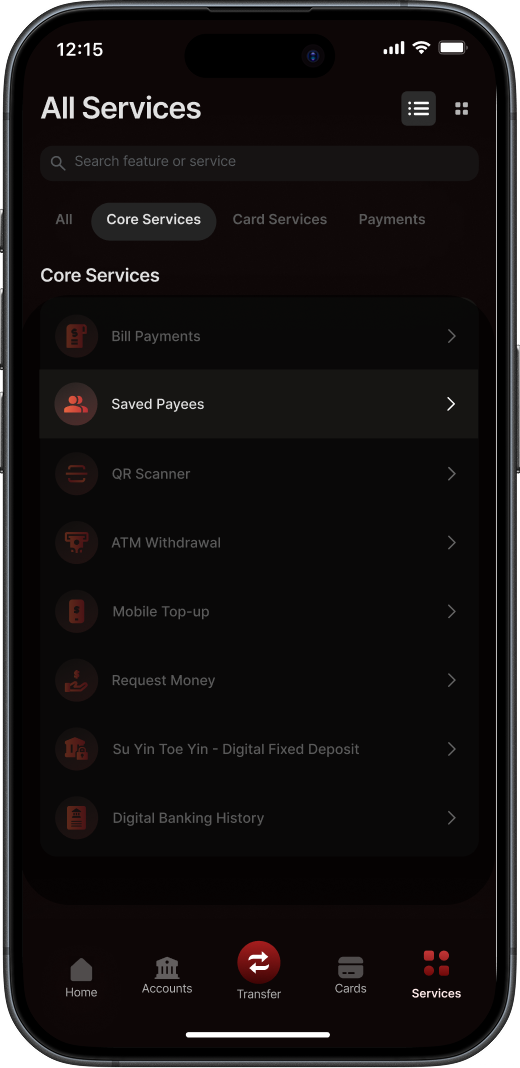

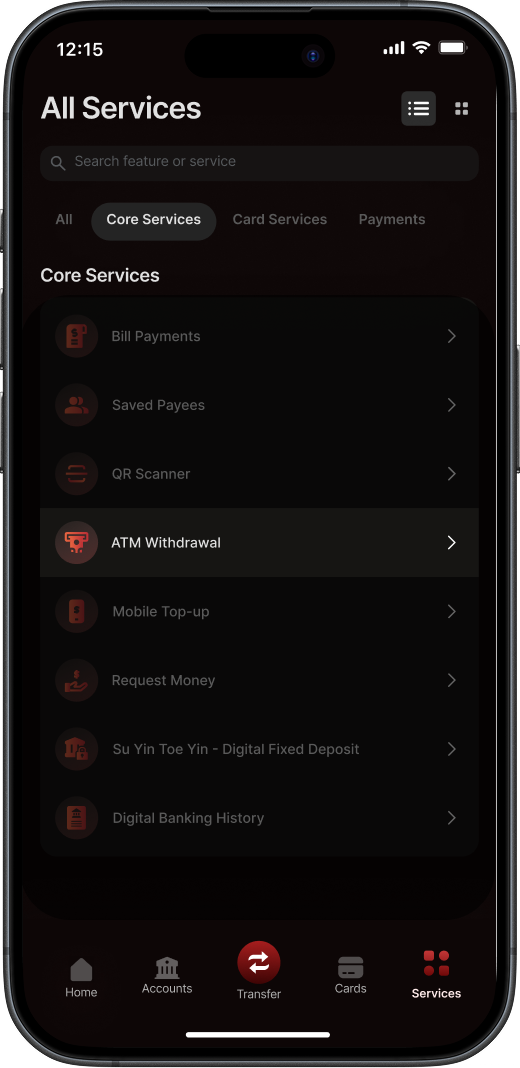

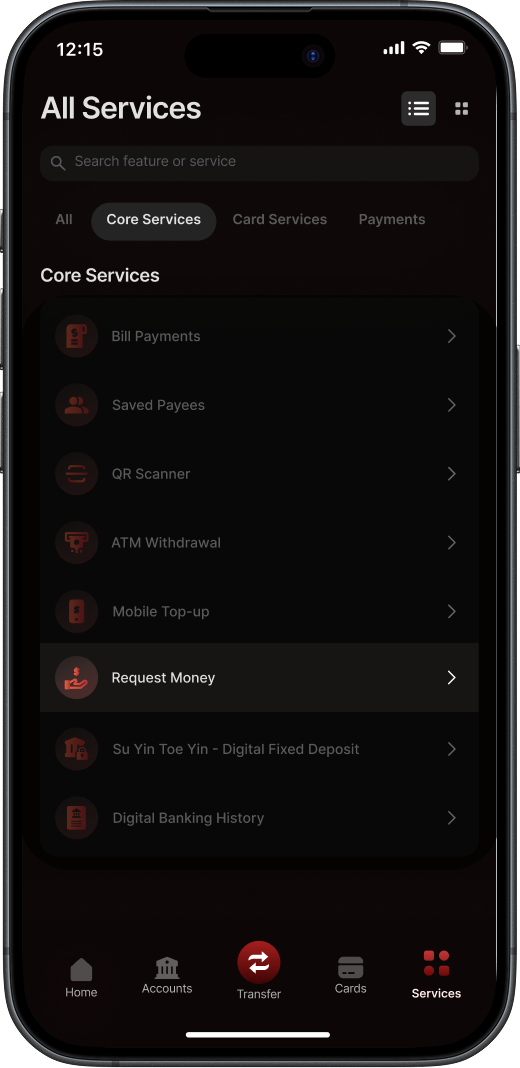

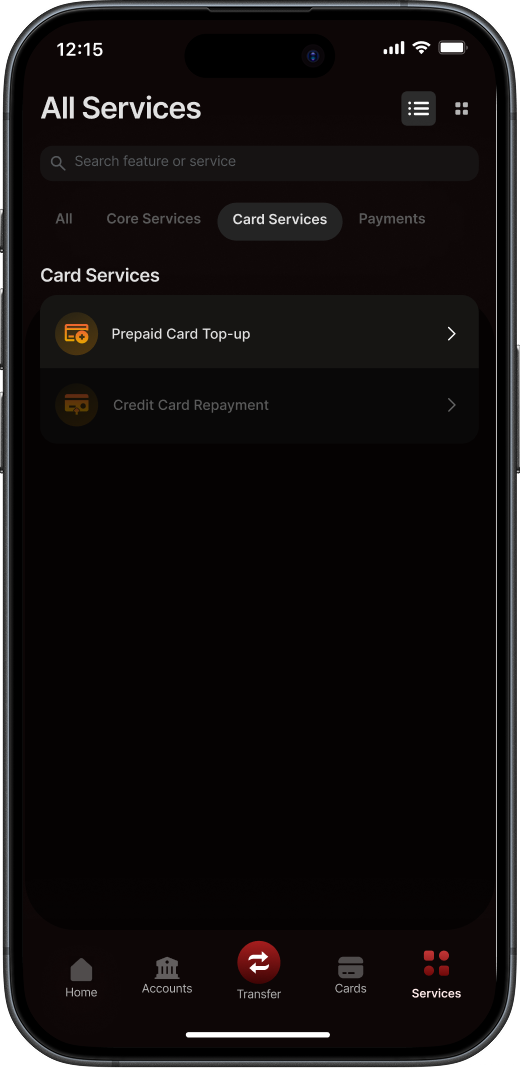

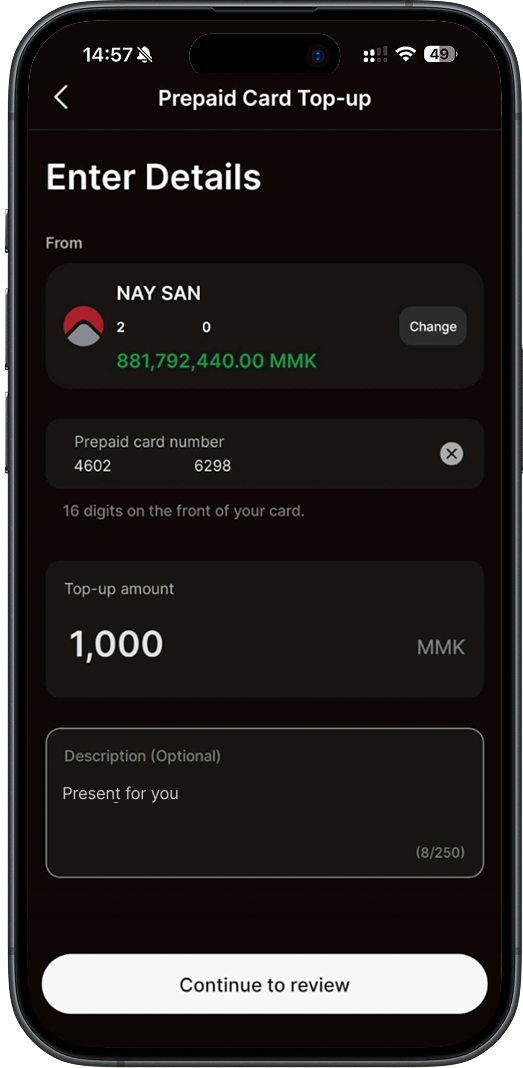

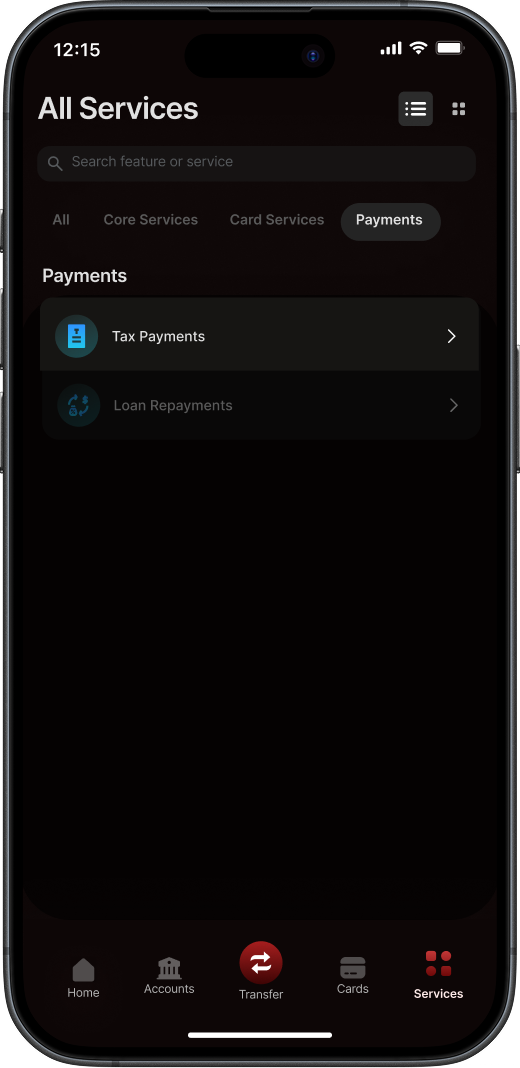

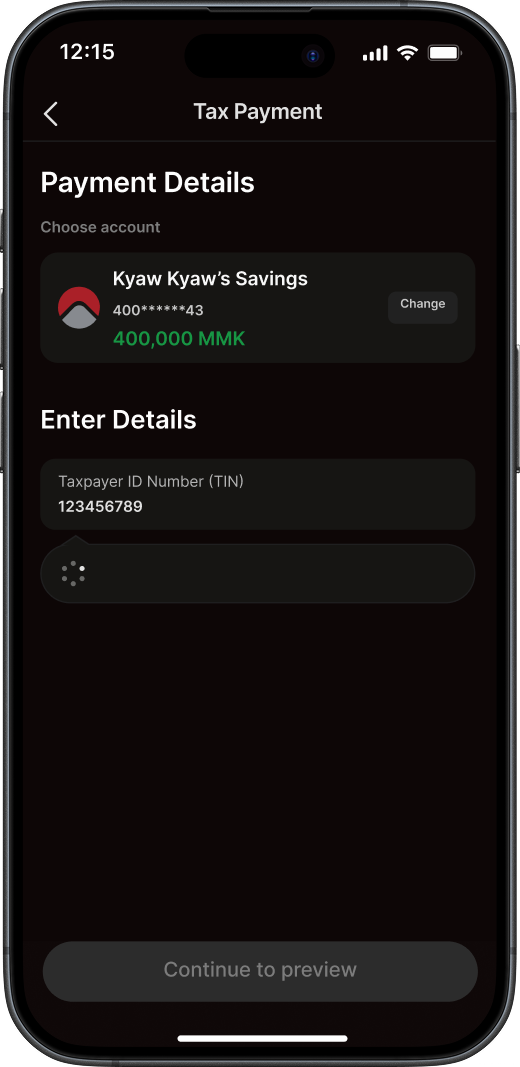

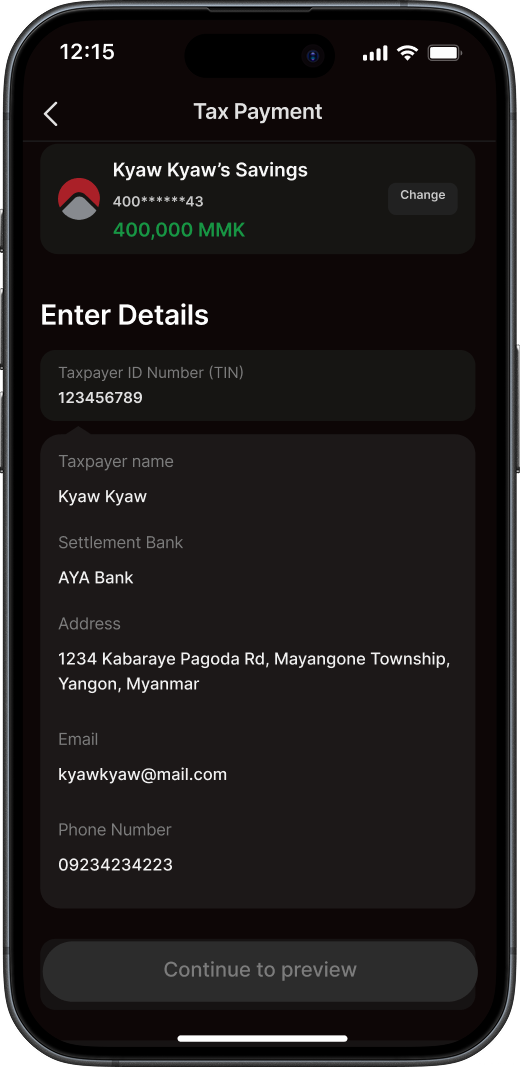

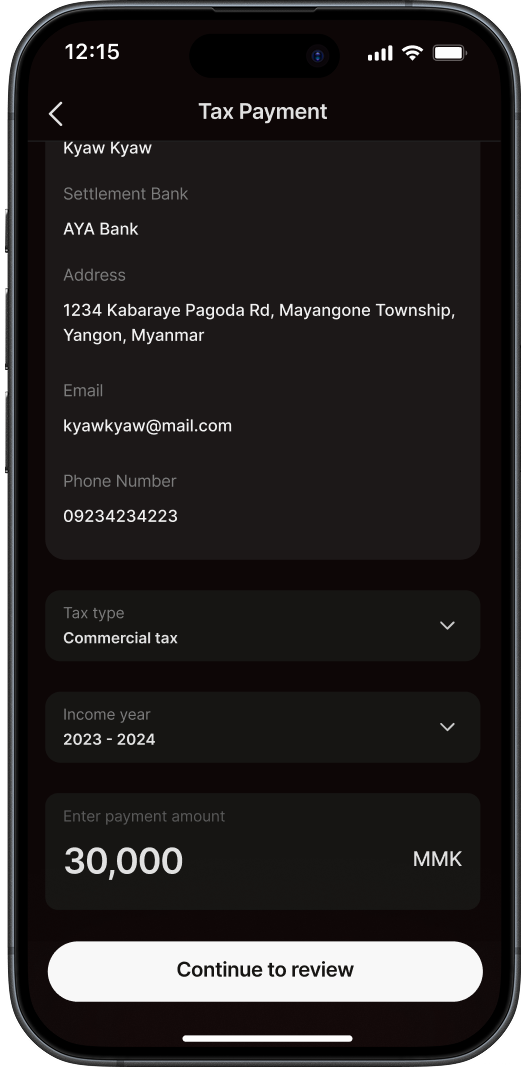

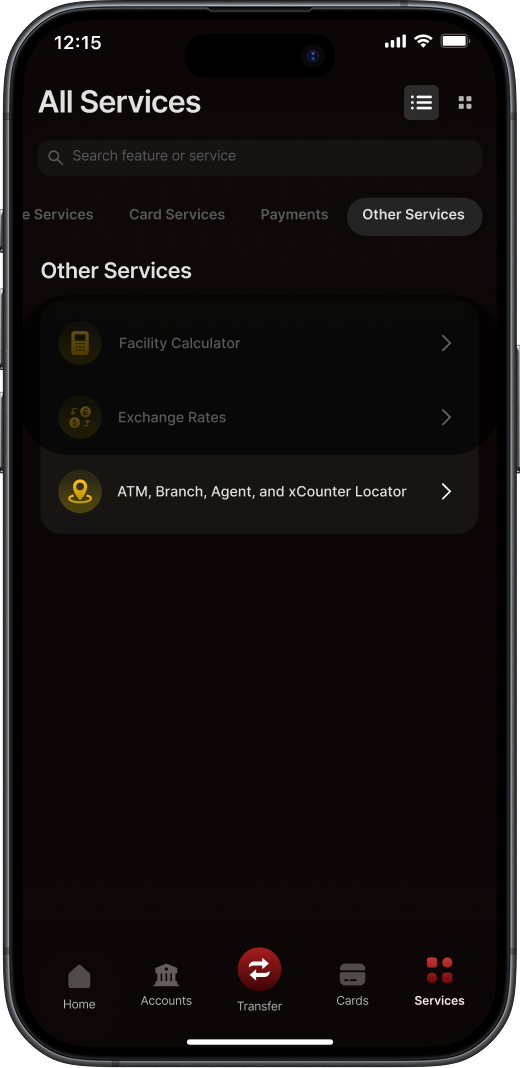

1A

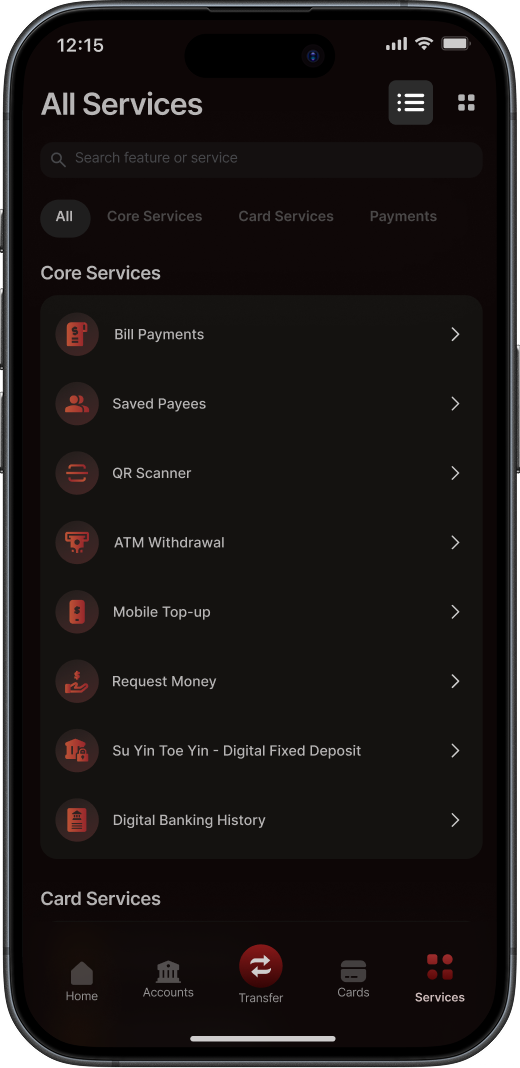

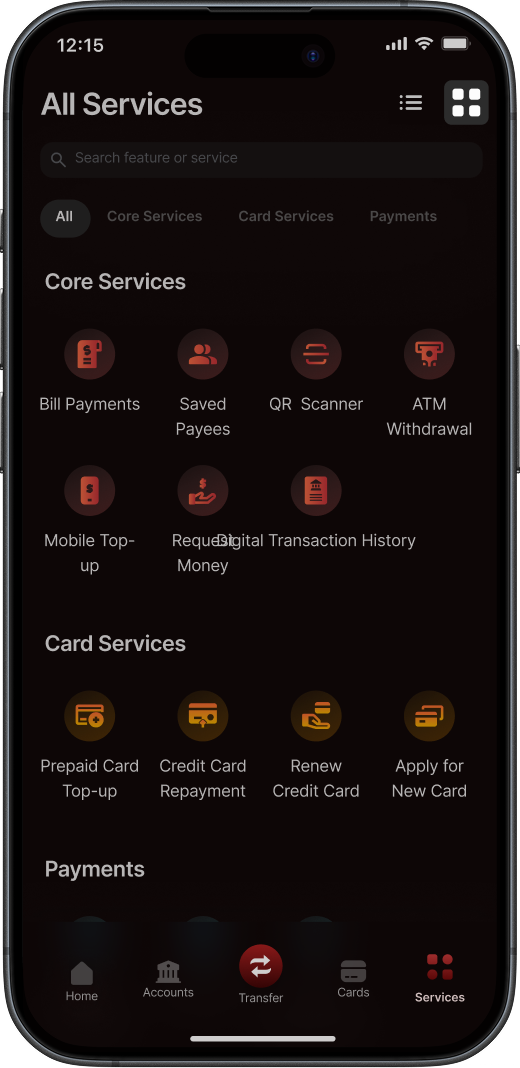

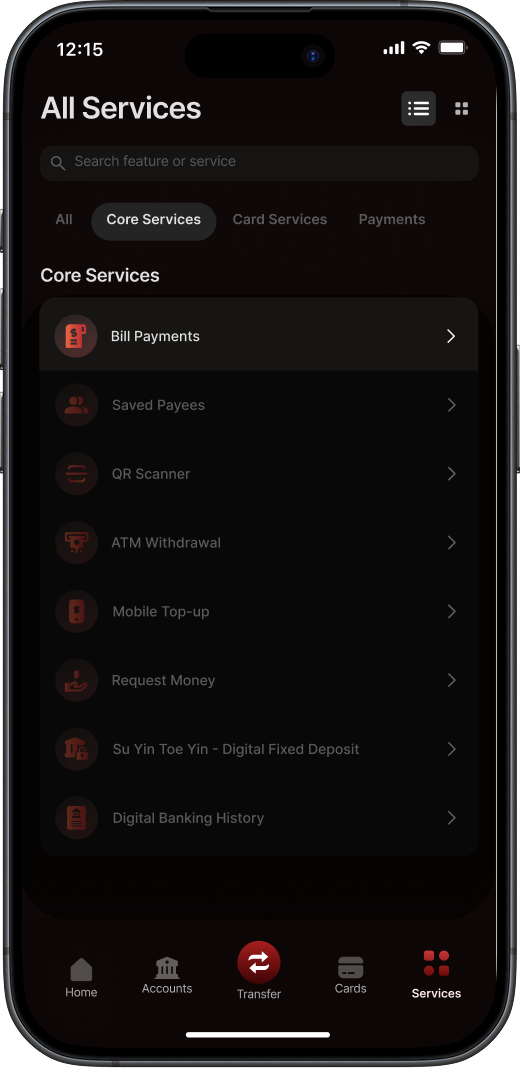

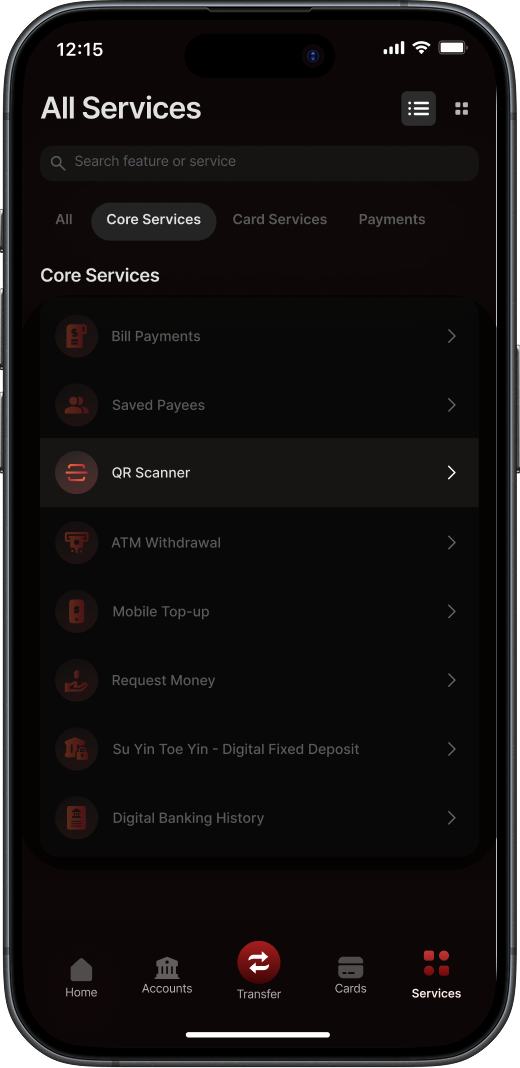

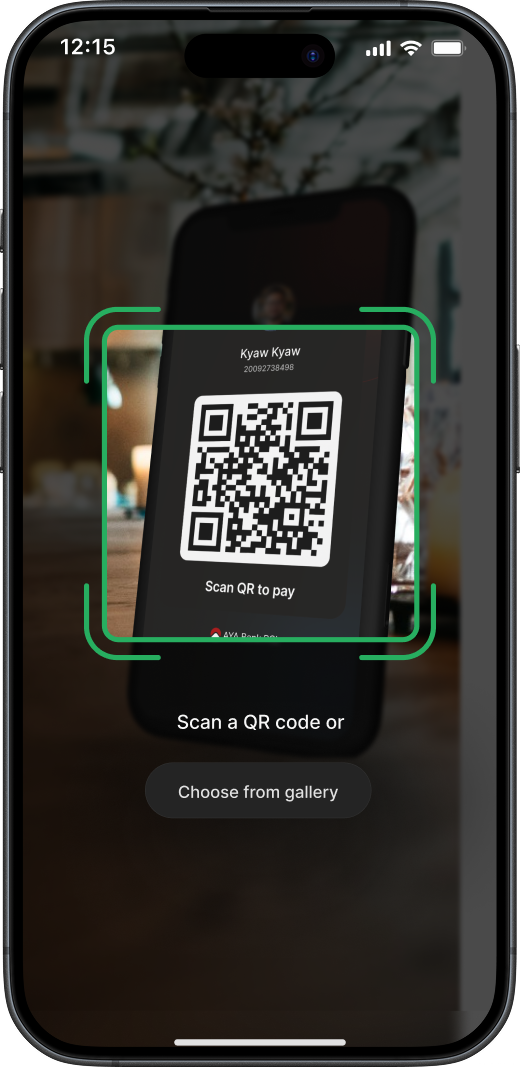

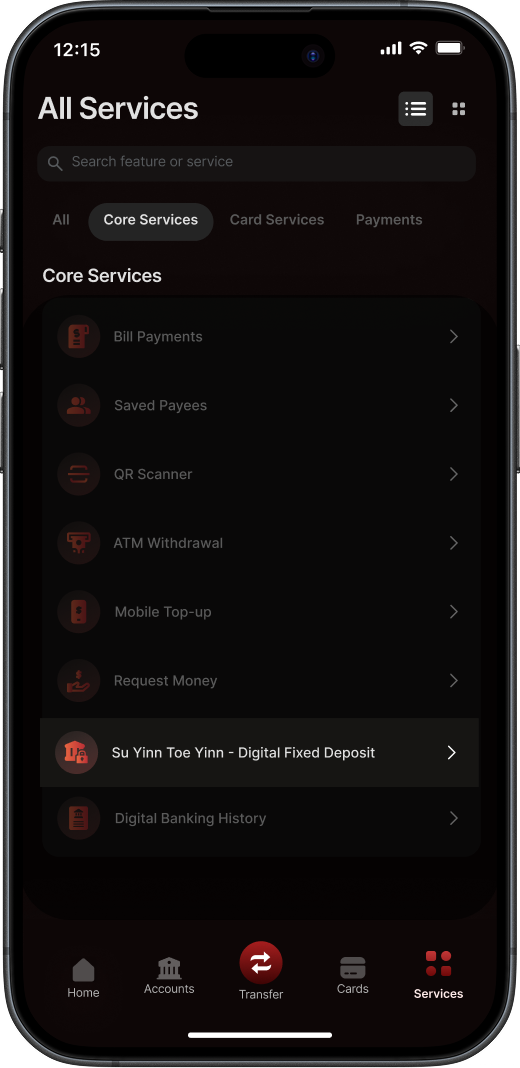

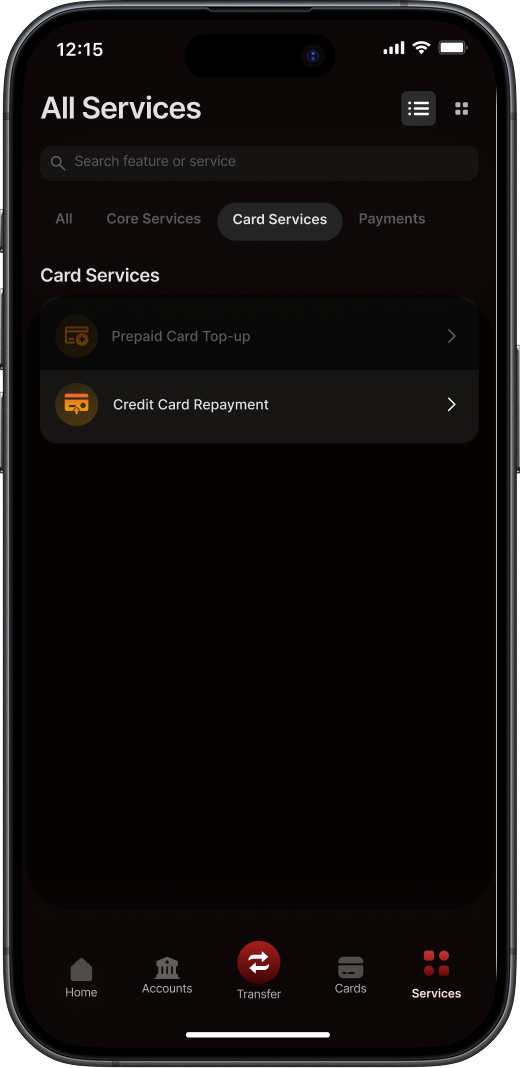

Tap on Services in the bottom navigation menu to access the All Services page.

1B -

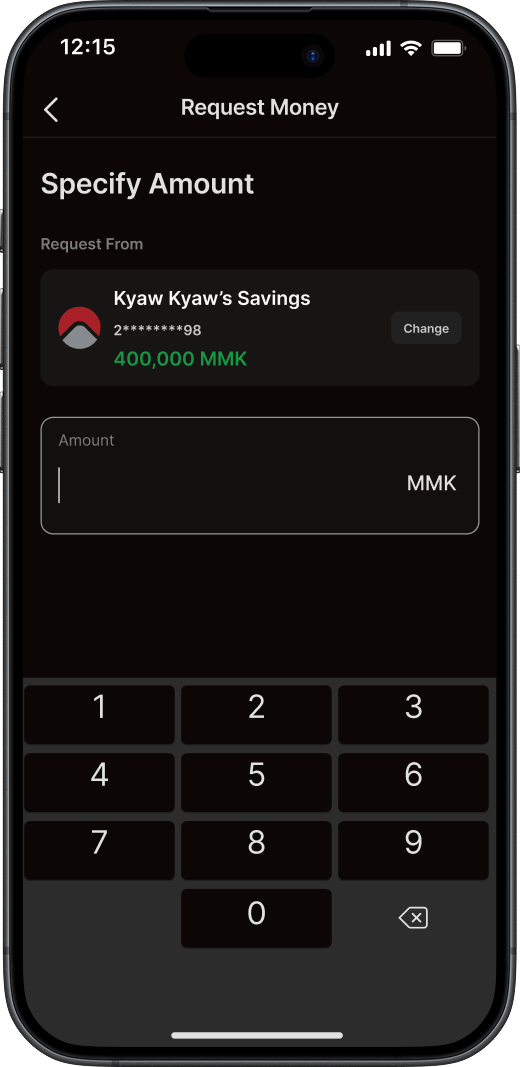

2A

The services are organized into four main categories, each accessible through tabs at the top (Core Services, Card Services, Payments, and Other Services).

2B

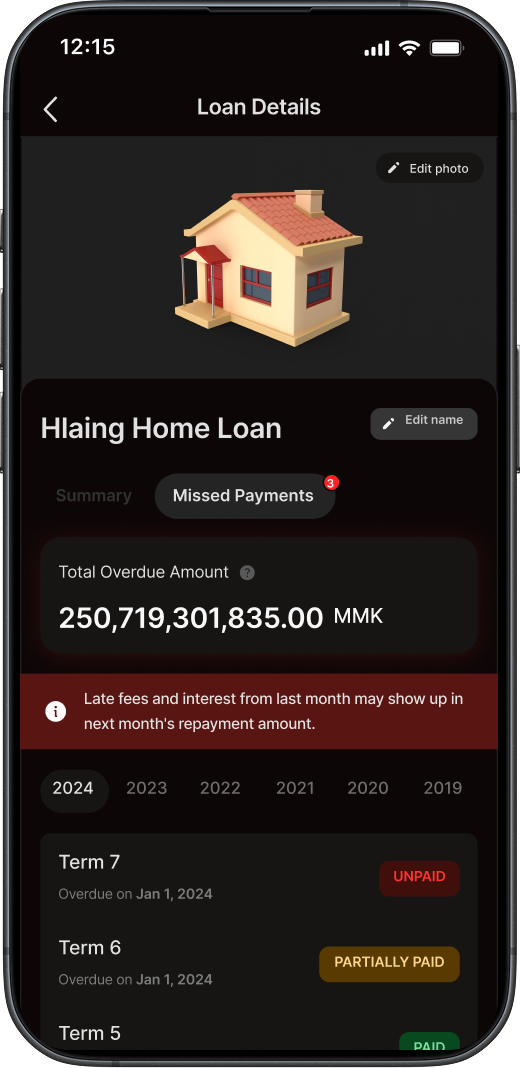

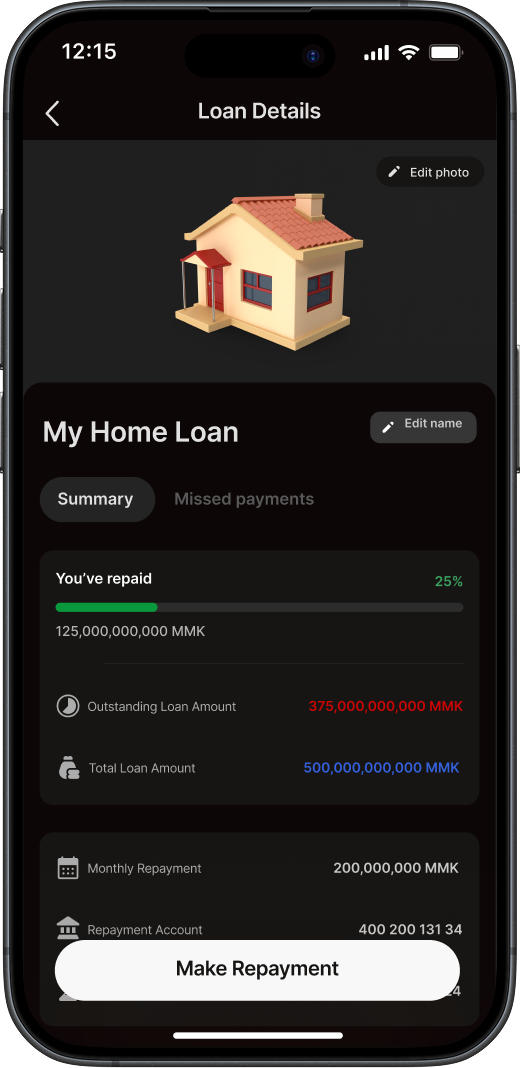

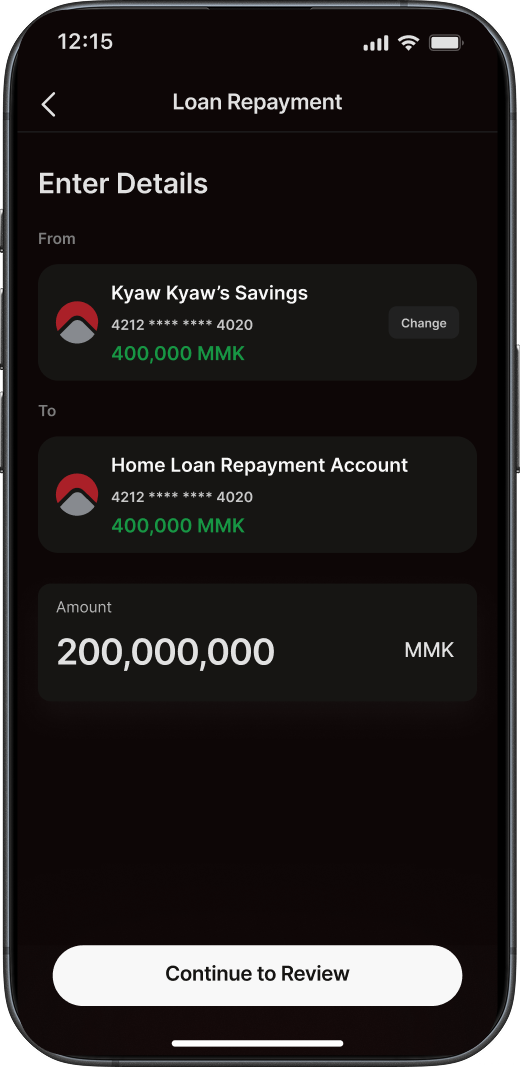

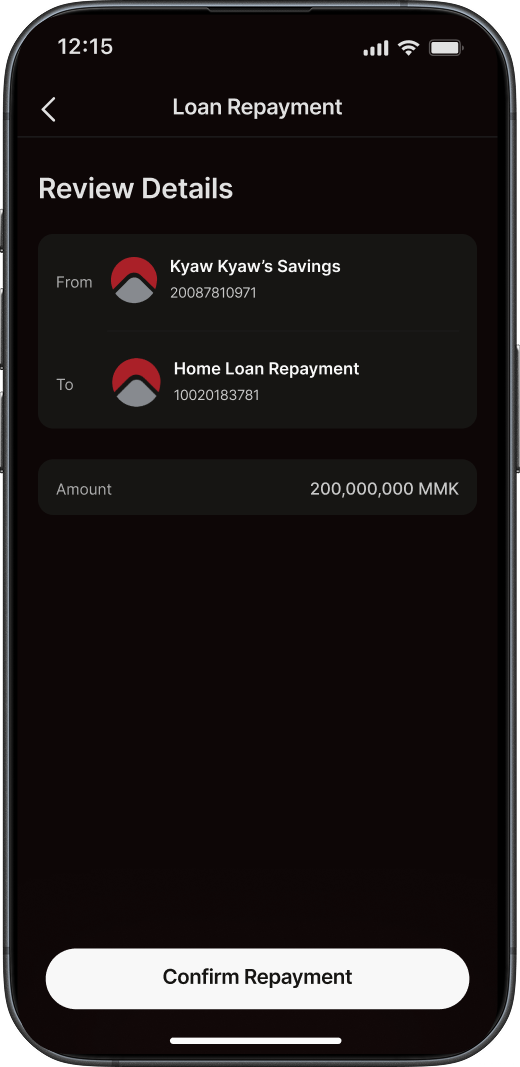

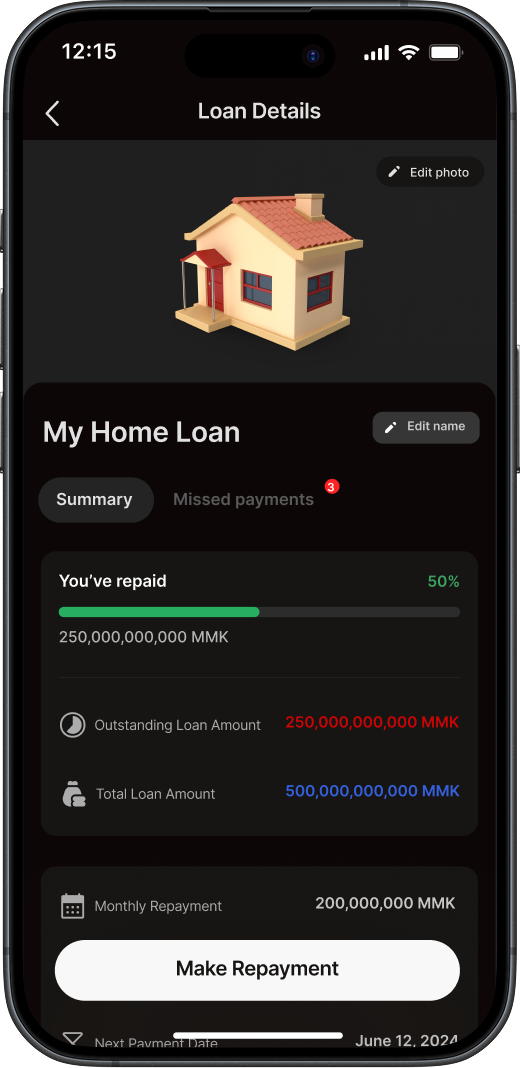

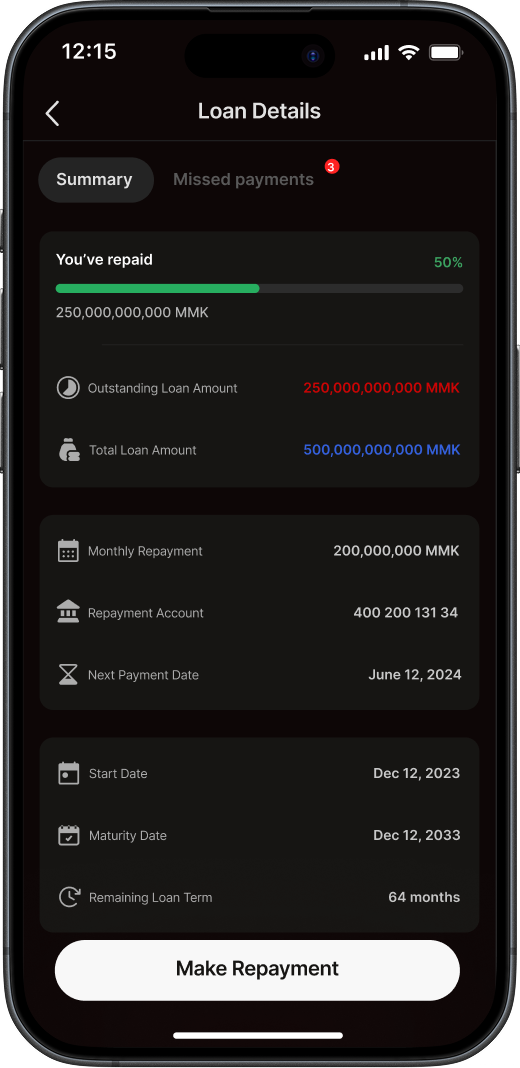

How To Make Loan Repayment

Click on the steps to view screens

-

1A

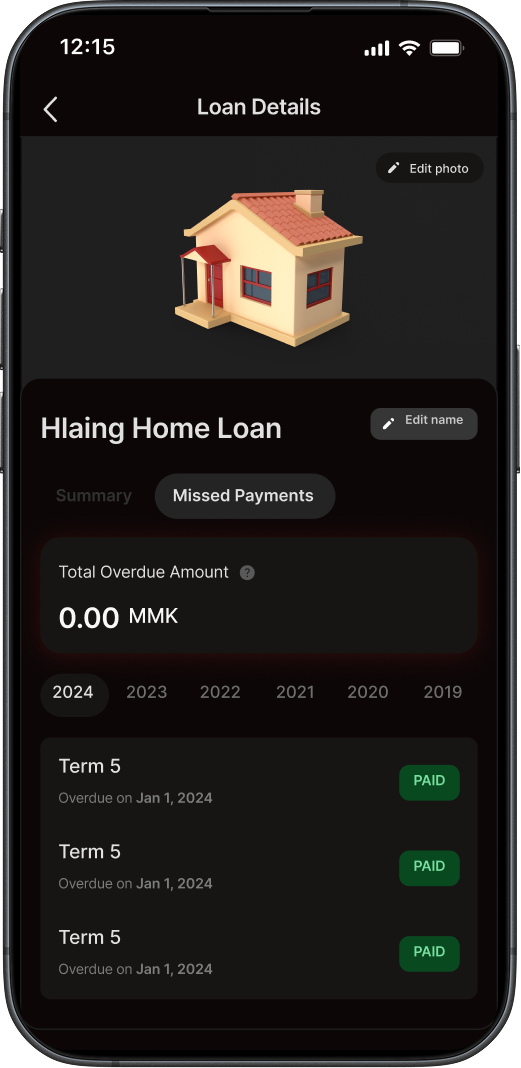

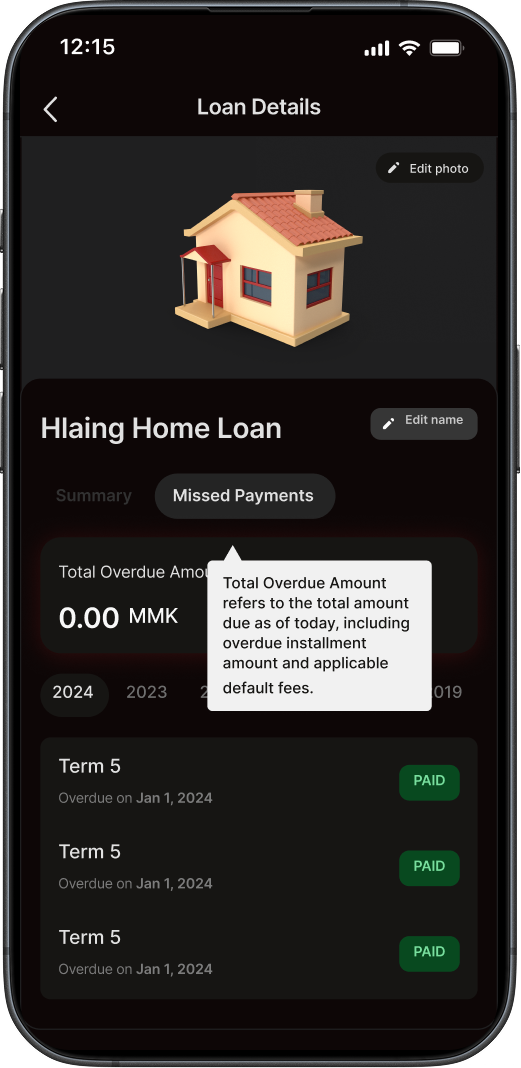

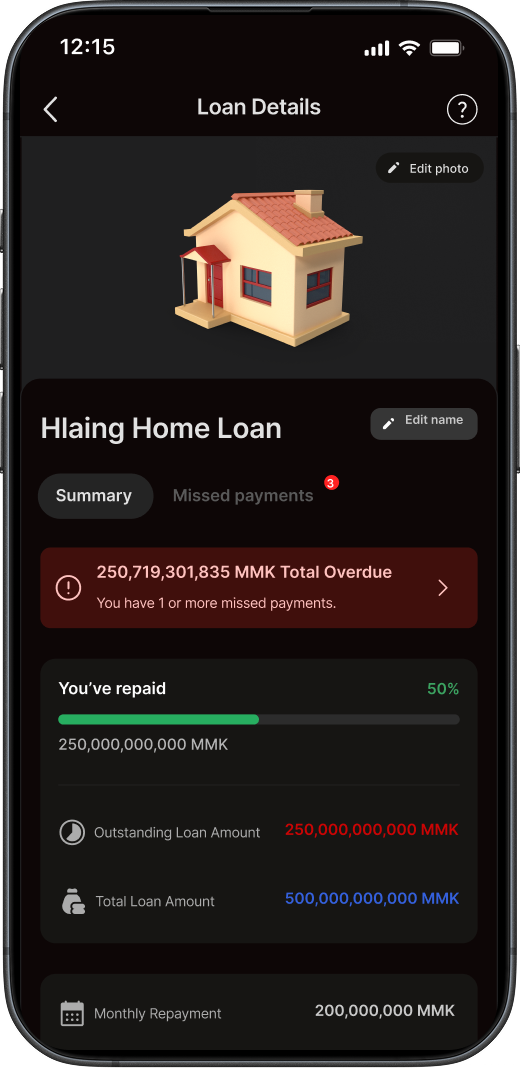

Tap the Summary tab to view your loan progress and details.

1B -

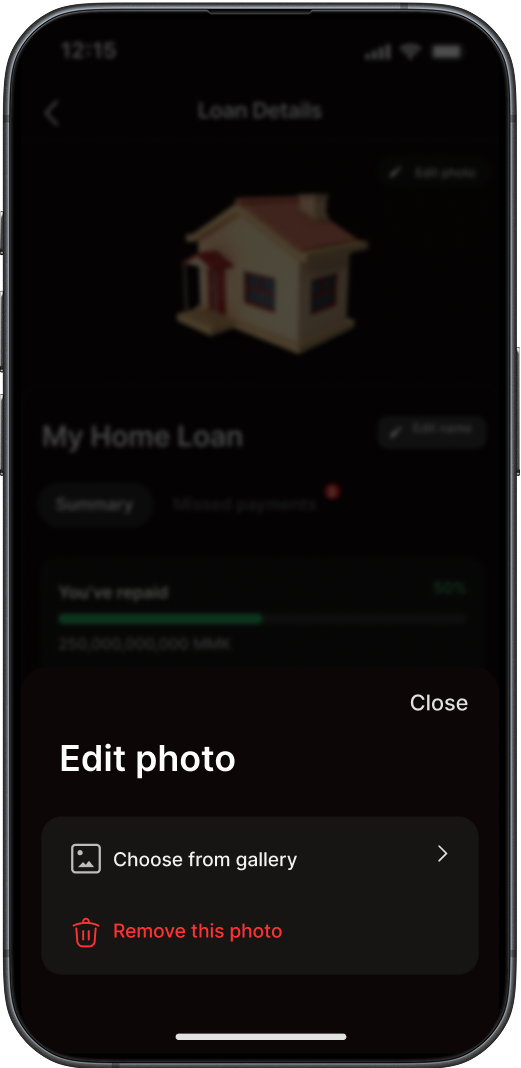

2

Tap Edit Photo to upload your own personalized photo from your gallery.

-

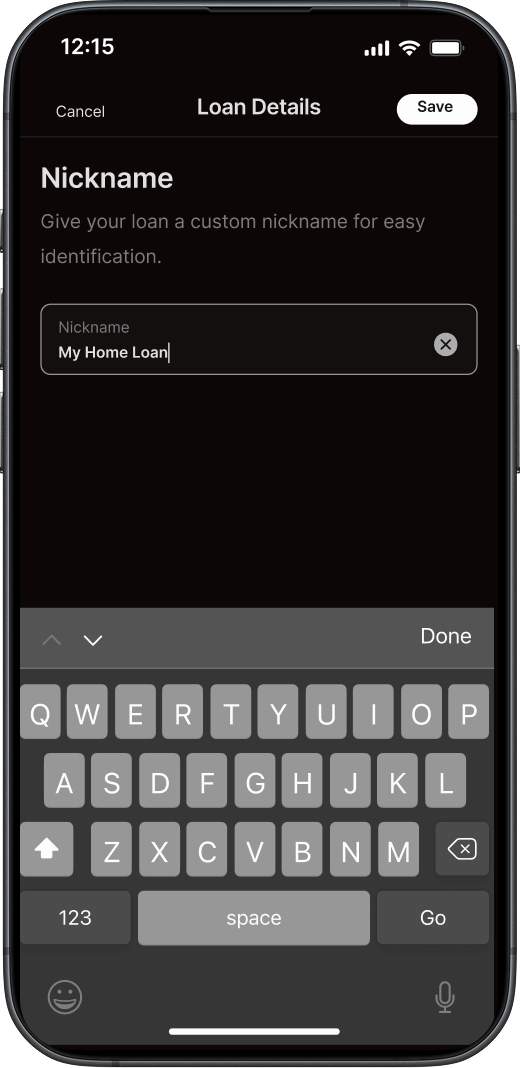

3

Tap Edit Name to update your loan nick name.